This is the second post in a two-part series where we recap our firth year of nomadic travel.

Our fifth year of nomadic travel was full of exploration! We discovered new places, try new food, met new people and created wonderful memories(read: Year 5 Nomad Travel – Back to Slow Travel: Part I – The highlights). In this second part of this two-part series we are now looking into our budget and how much we ended up spending.

Are you ready to know whether or not we break the bank in our Year 5 of nomadic travel? Where did we splurge the most and how did this year compare to year 4?

Some links to the products mentioned below are affiliate links, meaning that if you click and make a purchase, Nomad Numbers may receive a commission at no additional cost to you. For more information please review our disclaimer page.

How much did we spend in Year 5 of nomadic travel?

(Note: if you are new to this blog and want more context about our spending as nomads, check out our previous reports including our 1st year of nomadic travel, our 2nd year of nomadic travel and our 3rd year of nomadic travel)

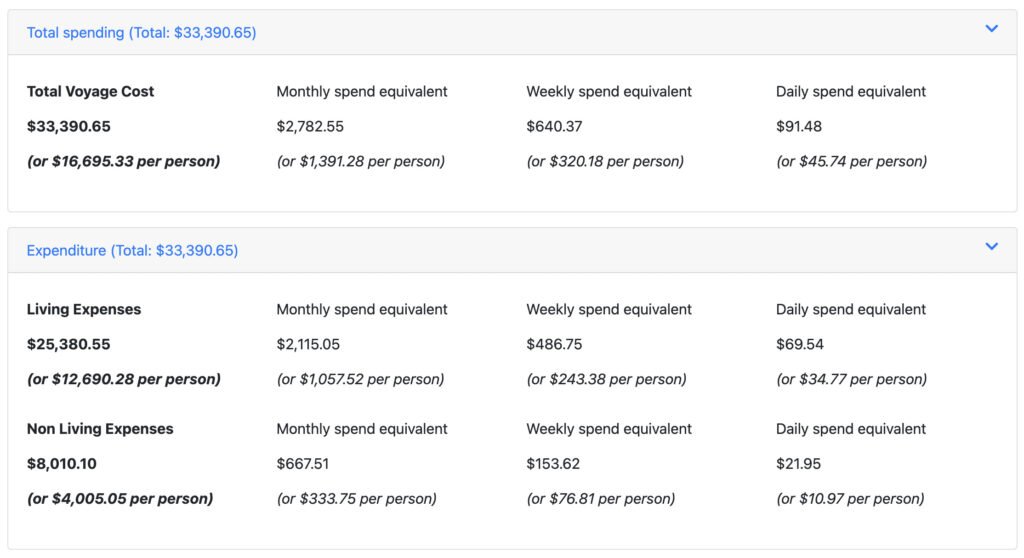

Let’s get into the meat of this post: for our Year 5 of nomad travel, we spent about $33K USD! (or $33,390.65 USD to be exact).

Here are details about this total cost with a breakdown between living and non-living expenses:

(Note: Non-living expenses are everything that we spent that is not specific to the location we are staying at. We exclude these from our living cost, so our living cost could really reflect the true cost of living on such location)

This is an average of $2,782 USD per month for the two of us. Back in California, this would barely cover our rent and utilities!

Note: We like to track living and non-living expenses as we are building a public cost of living index for each country we visit so we have an idea of what our budget would be if we would like to spend an extended period of time in a city we fall in love with).

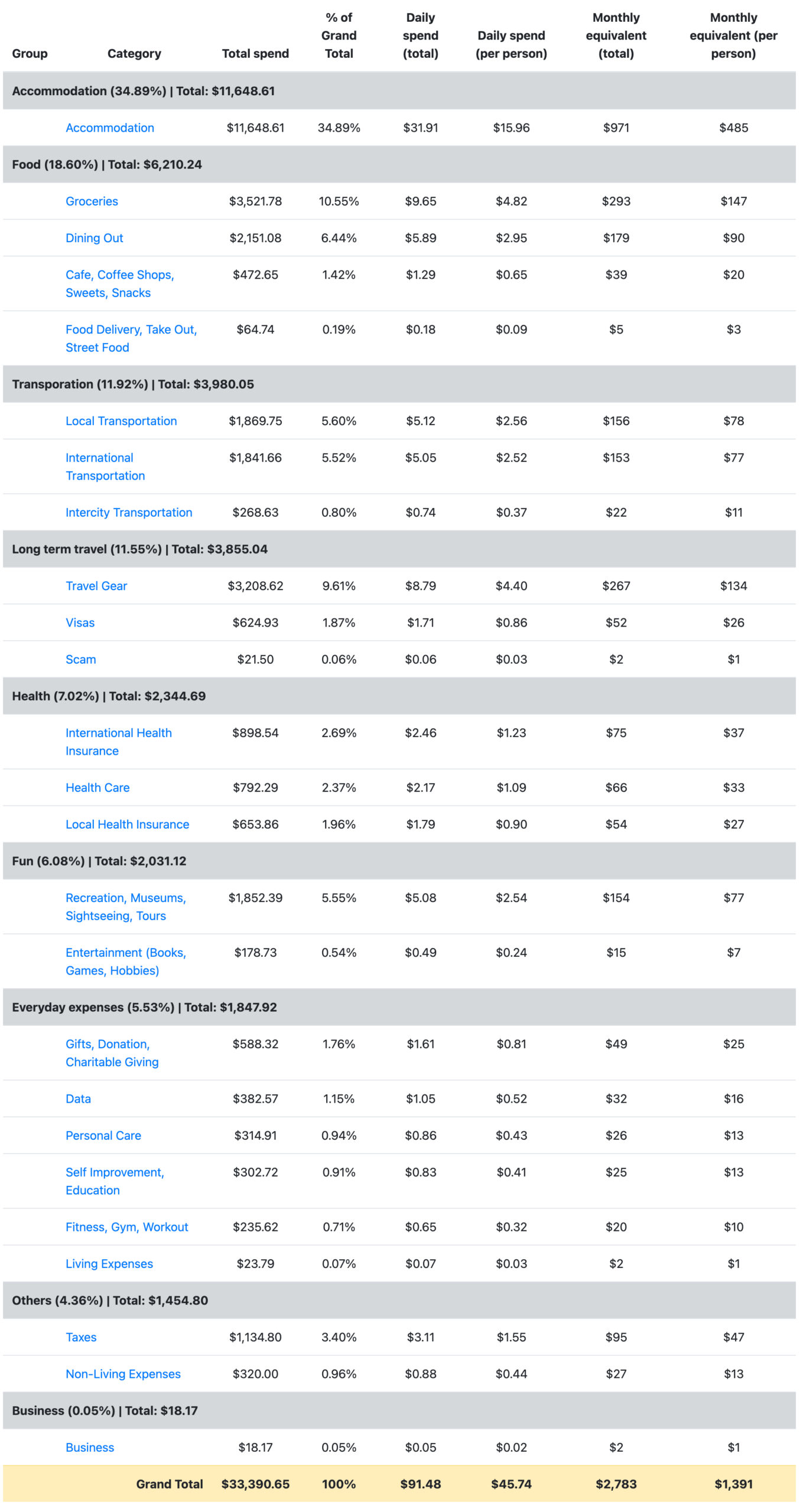

Spending per category

Let’s look how we spent this money by going over each of our spending categories. Let’s start by taking a look at our spending per category grouped into major buckets (ordered from the biggest ones to the smallest one):

The first thing to notice is that out of the 9 groups & 25 categories we used to track our spending, 65+% of our spending fit only into the 3 major buckets we are all familiar with:

- Accommodation (with $11,648 or 35%)

- Food (with $6,210 or 19%)

- Transportation ($3,920 or 12%)

Let’s dig into each major bucket:

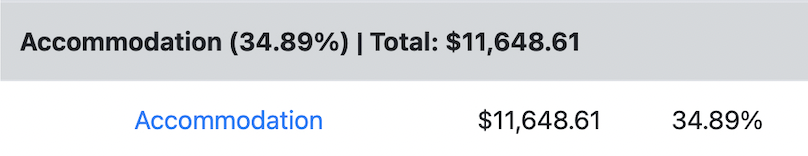

Accommodation: $11,684 / year (or ~$971 / month)

We rented 10 monthly rental (4+ weeks) Airbnb during this 12 months period. Since we spend some time with our respective family, we only have to cover 10 out of 12 months of the year. This average out about $19 per night and per person (or $1,200 per month as a couple). Knowing that we got to spent time in 8 countries (excluding our 2 home countries) this is pretty good!

Cambodia was by far our cheapest monthly Airbnb rental with this great 2BR appartment!

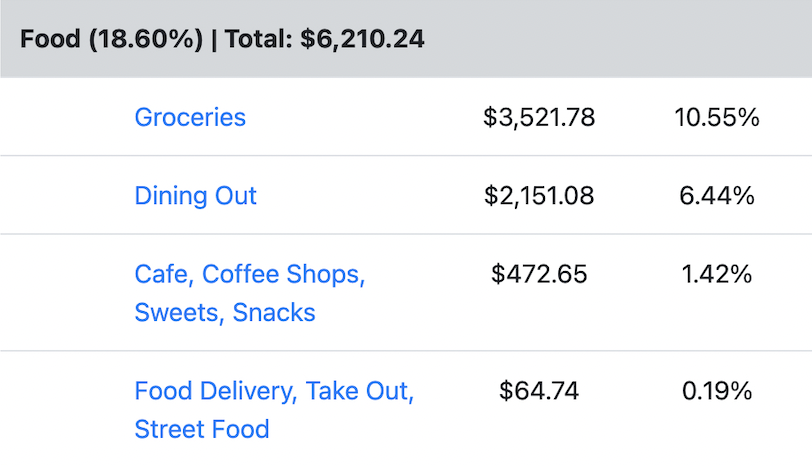

Food: $6,210 / year (or $516 / month)

Note: As a couple who follow a 16:8 intermittent fasting schedule we usually skip breakfast and only eat lunch and dinner w/ a snack in between.

This year we enjoyed 64 dinners and 156 lunches at sit down restaurants, 15 meals ordered via food delivery services (like UberEats). On top of that, we might have a sweet tooth problem as we apparently purchased 217 snacks or sweet items. (including ~40 ice creams thanks to places like Lake Como, Italy and ~30 boba pearl teas)

Looking at averages, this mean we spent about $16 on dinning out per couple and $2 on a snack (some shared, some not :D).

The food is so affordable and delicious in South East Asia (as well as in Australia due to a strong US dollar) that we definitely enjoyed a LOT of food outside. However, we like to prioritize our health and we know it isn’t very healthy to consume all of our food outside since you have limited control on the ingredients and cooking methods (like refined oils). So we don’t mind prioritizing an Airbnb with a functional and well equipped kitchen to cook and spend the time to go grocery shopping (we did 300+ grocery runs during that year and spent $2,151 eating delicious food at home.

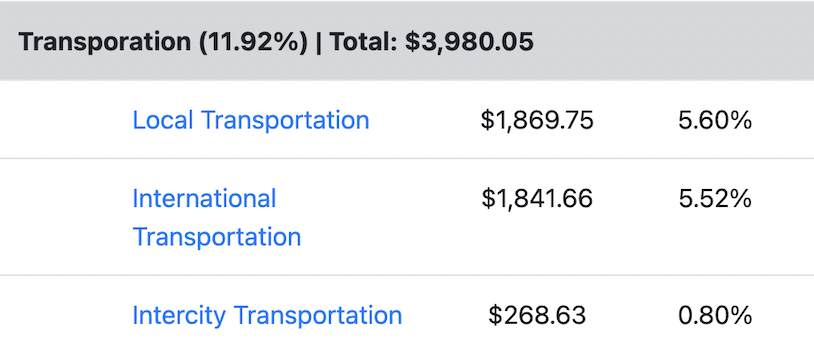

Transportation: $3,980 / year (or $331 / month)

With an average on $150 / month in Local Transportation, we’ve been mostly taping into public transportation to move around. We did rent a car for 2 weeks while visiting Australia ($270 + gas) as well as a motor bike for a month is Koh Samui ($103 + gas). We even rented 2x mountain bikes in Cambodia for a month ($88).

We also has a bit of Intercity transportation, which were local buses or semi-private vans to commute from one place to the next when that option was available. (like to visit Ninh Binh in Vietnam from Hanoi, Vietnam).

Our International Transportation is low even-though we did flew from Europe to the USA to Australia and the South East Asia. We managed to achieve low spending on air fare this thanks to travel rewards redemption (aka travel hacking) that lets us book most of our international flights with points instead of cash.

New to travel rewards? Check out our 2021 End of Year Travel Rewards Report to see how we accumulated 300,000 + travel rewards miles in that year alone! If you want to start earning free travel money, do not miss our travel rewards article where we share our strategy and help you get started within minutes ).

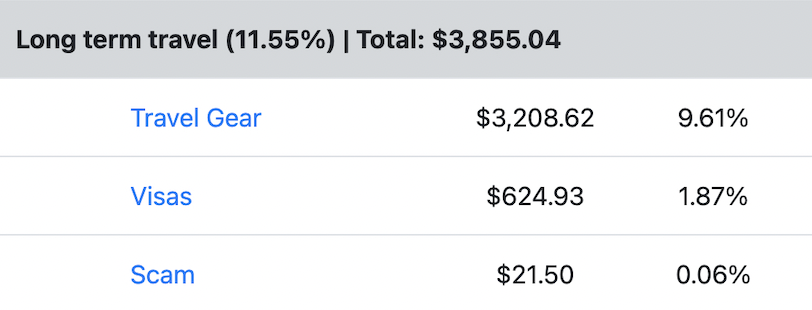

Long term travel: $3,855 / year (or ~$321 / month)

This represents our spending related to our long-term travel items, which are mostly our travel gear and our visas.

Travel Gear this year included some clothing we had to replace as well as some electronics, with the most expensive items being the following:

- iPhone 12 Pro – Upgrading my 2018 iPhone X to get a better camera and much more storage to keep all the wonderful pictures we are taking through our slow travel journey.

- Oura Ring – Upgrading my own ring to the latest version (v3) that provide greater insights (Read: Making sleep a top priority – Oura ring review)

- Beats Fit Pro – I personally decided to acquire these great wireless headphone mostly for exercising (but also to provide decent level of noise cancelation while on a plane).

- Apple Magic TrackPad – We broke one so had to replace it.

- Hardshell Expandable Suitcase – Mrs. NN decided to upgrade from her bag pack to this hardshell suitcase. It turns out that most of our commute between location are from airport to Airbnb via Uber or public transportation, in which case a suitcase is perfectly fine. I still carry my Tortuga backpack (Read: Men’s carry on packing list for nomadic long-term travels)

- Drone batteries – Need some new batteries for my Mavic drone I bought back in 2016!

- Patagonia Rain Jacket – Mrs. NN’s love her so much that she used it all the time and unfortunately it was time to get a new one after many years of good use!

- Xero shoe – We were these pretty much everyday so needed to replace them as well.

Pro-tip: To save money on electronic we like to use BackMarket, a global marketplace for refurbished devices. You can get $10 by using our code dfb74549aaacdc13 when signing up here).

We also spent $625 on Visas as most countries required one and we are also applying for perminent residency here in Taiwan which occurs costs. Here are a breakdown of visa costs during that year:

- Taiwan PR: $100 each (partial fees)

- 1 month in Vietnam: $25

- 1 month in Cambodia: $60 each

- 3 months in Thailand: $100 each (including renewal)

- 1 month in Bali: $33

- 3 month in Australia: $20

- 1 month in Fiji: free

Health: $2,344 / year (or ~$195 / month)

For our fifth year of nomadic travel, we used our IMG Global expat health insurance plan as part of our health insurance strategy as nomads while we were outside of Taiwan. We spent $898 on International Health Insurance. For the time we were in Taiwan we were covered by the National Health Insurance (NHI) which costed us $28 / month and per person. We kept coverage for the entire year and spent $653 on Local Health Insurance.

Note: If you are based in the USA, you will be surprise to see how affordable health care is outside of the country which is a big reason why were are looking at establishing residency in the long term outside of the USA.

We also spent $792 on Health Care related expenses. These include weekly Chinese Medicine consultation for myself in Taiwan between May & June for $10 (Read: Experiencing Chinese Medicine in Taiwan) as well as yearly extensive physical exam & blood panel (Read: Blood tests – a starter guide to understand them and order your own!). These are preventive, so not covered by the NHI.

Note on the Taiwan National Health Insurance (NHI): The Taiwan National Health Care is REALLY GOOD! (Read: The true cost of healthcare as nomads). We pay a few dollars to get a cleaning, a doctor consultation at a really nice hospital will cost about $12 and any additional prescription from the consultation are usually entirely covered. I had to do a CT Scan that the hospital billed $200 entirely to the NHI. Can someone remind us how much cost a CT Scan in the USA? 😀

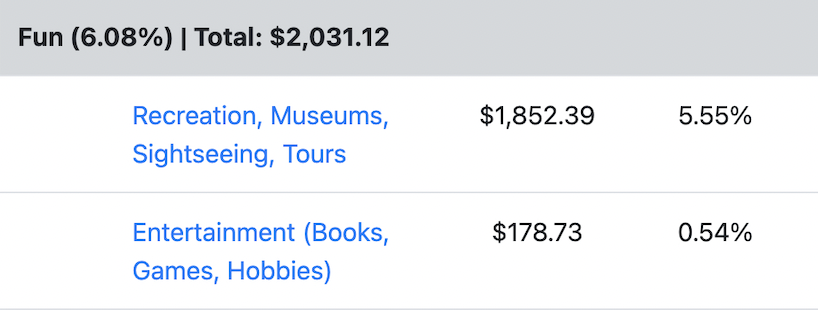

Fun: $2,031 / year (or $169 / month)

These are all expenses related to the fun activities we like to engage with. Olive oil tasting, hiking permit, whale watching, boat cruises, sailing trips, play at the Sydney Opera, scuba diving, etc… This obviously does not include a lot of other activity we do (like regular hiking) that is pretty much free.

Everyday expenses: $1,847 / year (or ~$154 / month)

Last but not least, this bucket include pretty much every other expenses we had:

- Gift, Donation, Charitable giving: pretty self-explanatory

- Data: This includes our Google FI phone plan + Google Drive subscription. This year we started taping more into local Sim cards as we’ve been staying in places for extended period of time as well as the fact that Google has been picky when it come to people using their plans overseas for extended period of time.

Pro-tip: If you can have e-Sim added to your smartphone a great alternative to Google FI is Airalo. Airalo is an eSIM Store that offers travel data packs at truly local rates to over 200+ countries and regions globally. We like this alternative because you can purchase a data pack before you enter the country and get connectivity as soon as you disembark! Use our Airalo referal link to get a few dollars credited to your account

- Personal care: Massage, Massage and a lot of Massage thanks to SEA’s affordable cost (We booked 32 of them!)

- Self Improvement, Education: Mrs. NN is took French lessons in Taipei and I took some surfing lesson in Australia. Plus a couple of spiritual workshops in Bali.

- Fitness, Gym. Workout: Lots of time spent at the local swimming pool for myself as well as 40 yoga class in Bali to keep both our mind and body in great shape!

- Living Expenses: a bunch of misc everyday expenses that could not fit anywhere else

Spending per destination (living cost only!)

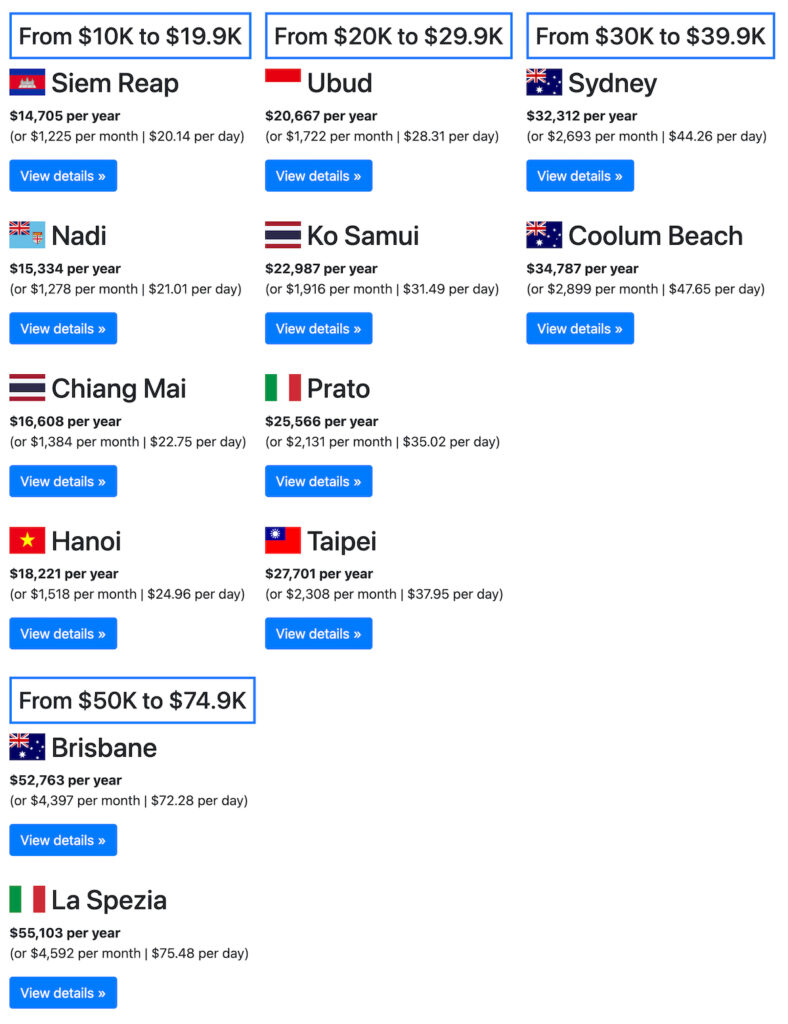

Let’s now take a look at all the destinations we’ve visited during Year 5. We’ve put together the cost of living for each of the places with the daily budget extrapolated over an entire year.

Note: To stay consistent in our reporting, we only include the living cost in these estimates. Keep in mind that during Year 5, we spent about $8,000 in non-living expenses.

Without much surprise, South East Asia has some of the cheapest places to stay on the planet with wonderful location like Chiang Mai (Read: Chiang Mai – Cost of Nomad Living), Hanoi (Read: Hanoi (Vietnam) – Cost of Nomad Living) or Siem Reap (Read: Siem Reap (Cambodia) – Cost of Nomad Living) that fit below a $20,000 budget for a year.

In the $20K-$30K range we found a few other SEA’s countries like Ubud that we love (Read: Ubud (Bali) – Cost of Nomad Living), Koh Samui (Read: Koh Samui (Thailand) – Cost of Nomad Living) and Taipei.

In the $30K-$40K range we found Australia (with Sydney, followed by Column beach). Though these countries could be much expensive, thanks to a strong USD during our visit this was a pretty good deal!

Brisbane and La Spezia (Cinque Terre region) are in the 50K or above range for a year. This is exaggerated since we only spend a few days in these places so that spending adjusted for a year is far from being correct and will likely be much cheaper.

A reminder about the power of geo-arbitrage! While we only spent $33K this year, we can see that thanks to geo-arbitrage we can decide to leave in many countries, even countries that would more than our average for a year. We did spent 3 months in Australia as still did not manage to break the bank!

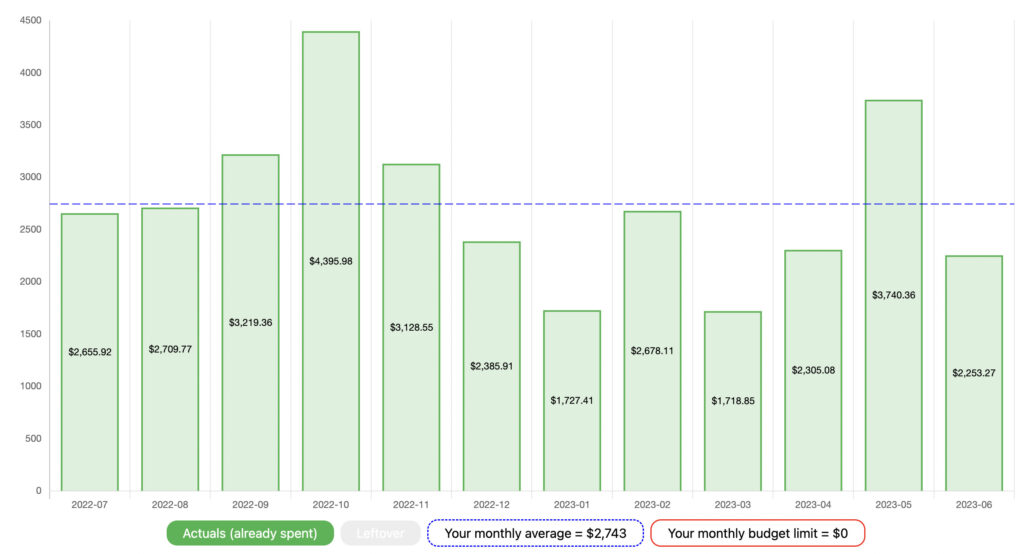

Spending per month

Looking at our expenses on a monthly basis, we can definitely notice geo-arbitrage in action. In the fall were we were in Australia, are monthly spending was pretty much at its highest while during the Winter and early Spring where we were in SEA it was at its lowest!

The high month of May was due mostly to taxes (~$1,000) we had to pay in Taiwan.

Spending Year 5 vs Year 4

Let’s look at a side-by-side comparison to see the major differences between Year 5 and Year 4.

Notable categories where we spent more money than during Year 4:

- Travel gear: $3,208 vs $540 (a 6X increase!) – We had to replace a bunch of stuff this past year that were not cheap. Mostly electronic.

Then a bunch of increase were related to us getting back to slow travel mode:

- Recreation, Museum, Sightseeing, Tours: $1,852 vs $312 (a 6X increase!) – Since we started traveling 2 years post the COVID-19 pandemic we had more freedom to explore the world! We also felt more comfortable booking tours or 1:1 experience now than the year prior.

- Intercity Transportation: $268 vs $53 (a ~5X increase) – We also got more option to travel on the road vs via air.

- Entertainment : $178 vs $35 (a ~5X increase) – This is more of a catch up than an increase since the pandemic did not gave us as many ‘entertainment’ options available.

- International Transportation: $2003 vs $510 (a ~4X increase) – Our cost of airfare is now back to our average.

- Visas: $624 vs $237 (a 2.6X increase)

Notable categories where we spent less money than during Year 4:

- Self Improvement, Education: $374 vs $703 (a ~2X decrease) – On Year 4 Mrs. NN spent money on some Chinese online classes and I took some free diving certification that were not cheap 😉

- Food Delivery: $59 vs 284 (a ~5X decrease) – Well while ordering food when we can go out and explore many restaurants again?

What do we expect to spend for Year 6 of our nomadic life?

From a budget standpoint, we are still targeting $40,000 budget for the upcoming year. Our investment strategy has sustained both the pandemic and the mini recession of 2022 so we feel good about being about to spent that amount. Let’s see how we do!

Want more details?

All of the images in this article came from Nomad Purse, the FREE travel tool that we launched in 2019. If you sign-up you will gain full access to all of our expenses. You will also be able to use the tool to track all of your travel expenses and we now have an Android mobile companion application to make it even easier to capture your expenses while on the go (even if you are in the middle of nowhere with no data!).

Our bottom line

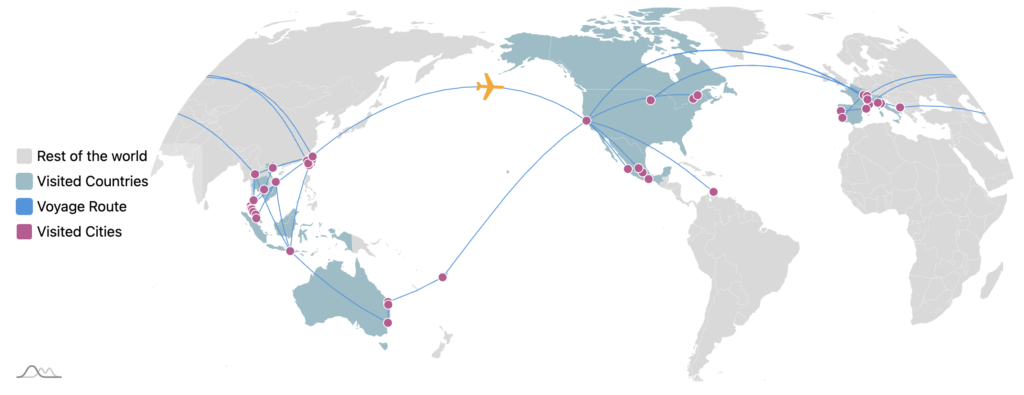

Since we started our nomadic lifestyle, we’ve explored much more than we’ve done the prior 10+ years but at the same time, there’s still so much to explore as you can see in the places we’ve been to since July 2018.

Besides exploring, we are less stressed and having a lot of fun roaming the planet, one city at a time. We’ve also adopted some new routines (like journaling)

This lifestyle also gives us the freedom to spend our time on the things we care about like reading some life-changing books, learning new skills, starting projects we are excited about (like this blog, our free travel-app, sharing stories on social media, creating some cool drone footage video on our Youtube channel and even being featured in some pretty cool podcasts or websites).

And as you’ve just seen, slow and nomadic travel can be much cheaper than staying at home!

Want to get started on slow travel? We have plenty of resources for you. First, start by reading our destination reports, getaway guides or day trip guides. If you like what you are reading and want to prepare for it, learn our tactics (like how we handle our physical mail while being away from home for so long, how we got a very affordable phone plan anywhere we go, what we have in our carry-on packing list for long-term travel. And don’t forget to review our previous spending reports to show that this life can be more affordable than most people think!

If you have been traveling long-term or plan on doing so, definitely let us know what you think about our numbers. Do they align with your expectations? We would love to hear from you, so please leave us a comment in the comment section below.

Live the moment & never stop exploring!

Mr. & Mrs. Nomad Numbers

8 Comments

Margot · July 18, 2023 at 12:04 pm

So fascinated to see how the numbers express our respective desires and values. Thanks for the details. They give me a lot to think about as I analyze our spending (and spending categories).

Mr. Nomad Numbers · July 18, 2023 at 11:32 pm

Hi Margot. Glad to hear that you are enjoying these detailed spending reports. If you need help to analyze your spending, feel free to give our free budget app a try (https://www.nomadpurse.com)

Christine · July 18, 2023 at 7:51 pm

I enjoy the nitty gritty details. I am weird that way. I would love to do something similar but my partner would find in controlling and unpleasant so I will have to be happy with less granular data.

I am not sure I think upgrade from an iPhone X represents a travel related expense. I know lots of people that don’t hardly go anywhere that have iPhones 14s.

Mr. Nomad Numbers · July 18, 2023 at 11:56 pm

Hello Christine! It seems that we share a common interest in digging into the intricate details of our spending 😉 When it comes to our expenses, we tend to rely significantly on cash, particularly in South East Asia. Therefore, checking our credit card statements on Personal Capital doesn’t provide us with much insight, especially regarding our day-to-day spending. However, now that we have diligently tracked our expenses for five years, if it weren’t for writing these blog posts, we would likely be content with ensuring that we don’t exhaust the funds we allocate each year while planning for the upcoming year.

Regarding iPhone replacement or upgrades, which category would you suggest we track them under? Currently, we include all our travel-related purchases under “Travel Gear,” but should electronics be a separate category?

Christine · July 19, 2023 at 1:05 am

I wouldn’t change or add categories. I was just saying most of the world has a cellphone. A nicer one certainly facilitates your travel blogging and life but not strictly necessary. A smartphone is a tool and a toy for all sorts of activities including but not limited to travel.

Mr. Nomad Numbers · July 19, 2023 at 6:18 am

Gotcha! Thanks for replying back 🙂

Katie · July 24, 2023 at 12:25 pm

Your captivating blog on nomadic life truly inspires wanderlust! From the vivid descriptions to the practical tips and figures, I’m ready to embark on my own adventurous journey. Thank you!

Is it too difficult to live that way?

Mr. Nomad Numbers · July 24, 2023 at 11:21 pm

Many thanks, Katie, for your comment. Is living this way too challenging? Well, every lifestyle has its advantages and disadvantages, and we’ve discussed some of them on our blog regarding full-time nomadic living (https://www.nomadnumbers.com/pros-cons-of-a-nomadic-lifestyle/). Nevertheless, we firmly believe that opting for a life we love far outweighs the alternative we once embraced.