As slow travelers, we are constantly moving money between our bank account and the countries we travel to to support our travel. When it comes to day-to-day expenses, we found a great solution that allows us to minimize fees when using an ATM (Read: How to never pay ATM fees while traveling abroad). This works fine for small amounts, but doesn’t work when you need to transfer a large amount of money.

Thankfully, we discovered Wise, a game-changing money transfer service that allowed us to send $120,000 to Taiwan at an unbelievably low cost of only $7! In this review, we will delve into our experience using Wise, examining its features, fees, and overall performance, and explain why it has become an essential tool in our financial arsenal for hassle-free international money transfers.

Some links to the product(s) mentioned below are affiliate links, meaning that if you click and make a purchase, Nomad Numbers may receive a commission at no additional cost to you. For more information please review our disclaimer page.

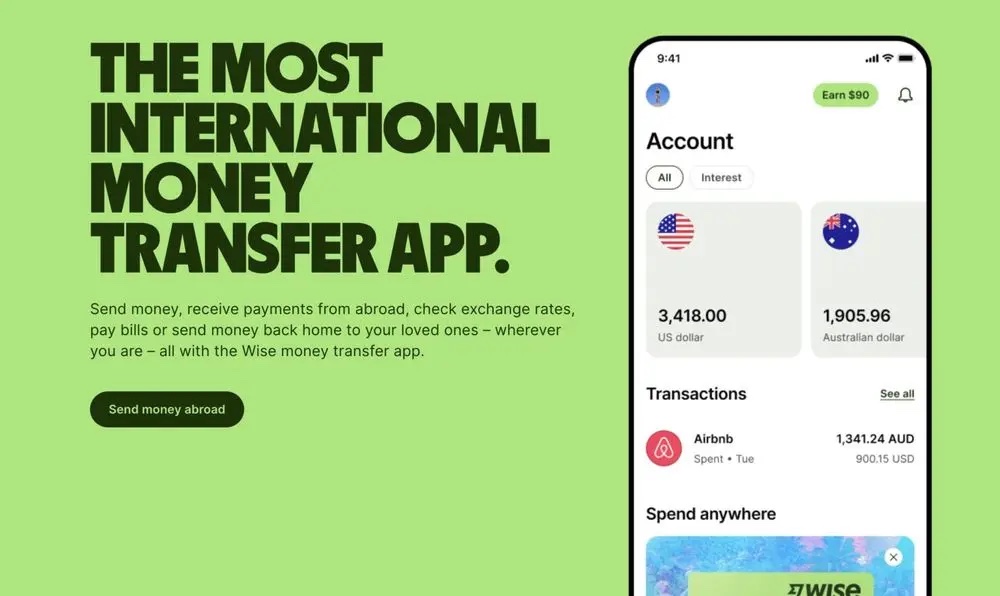

User-friendly Interface

One of the standout features of Wise is its user-friendly interface. The website and mobile app are intuitive, making the entire process of transferring money abroad seamless and straightforward. From the registration process to initiating transfers, Wise ensures a hassle-free experience even for first-time users.

Transparent Fees

One of the primary concerns while using any money transfer service is hidden fees and unfavorable exchange rates. With Wise, transparency is at the core of their business model. They offer the real mid-market exchange rate with a small, upfront fee. This level of transparency is truly commendable and sets Wise apart from traditional banks and many other money transfer services.

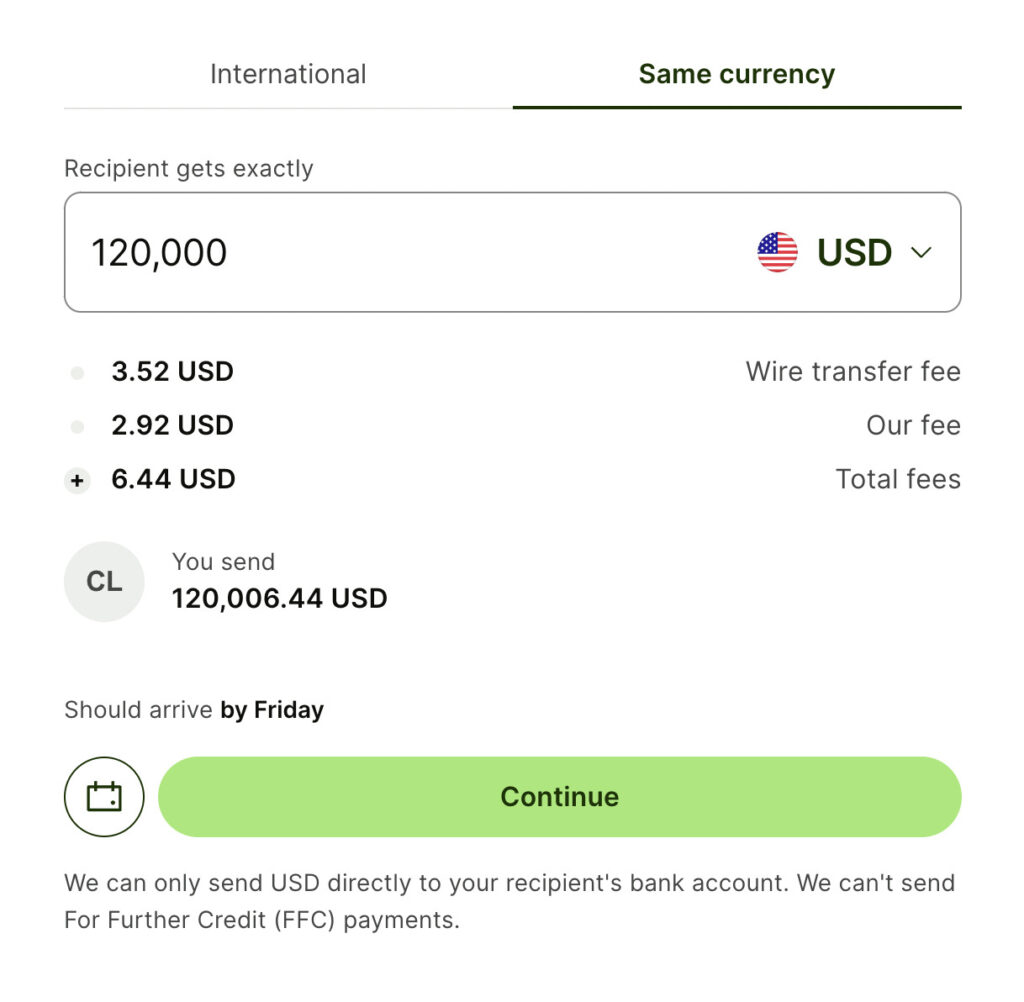

Sending the same currency

Here is a screenshot from the app, when transferring 120,000 USD between the USA and Taiwan. The fee is only $6.44 USD. As you can see the fees are really minimum, accounting for only 0.0075% of the total amount!

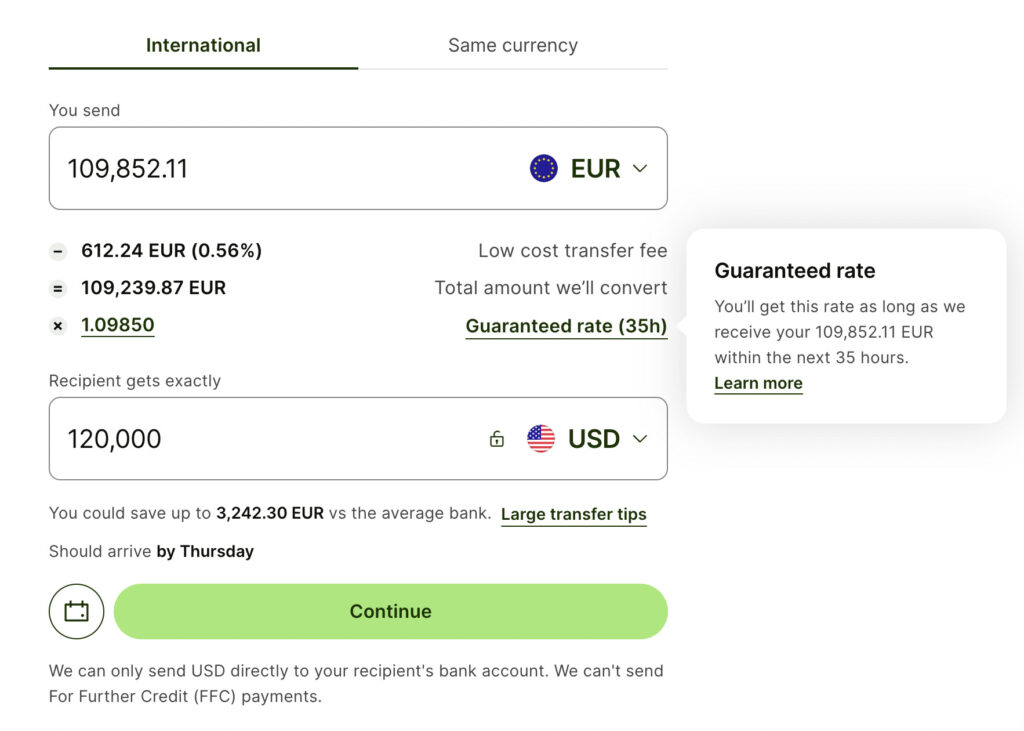

Transferring currency

Here is a screenshot from the app, when transferring 120,000 USD in EUR.

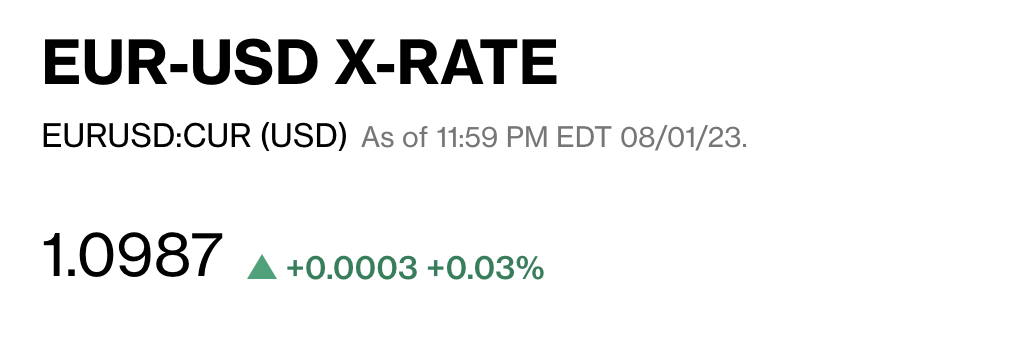

The fee is 0.56% of the total amount (or 612.24 EUR). This is much lower than our local bank that would charge much more. Also the conversion rate is pretty much inline with the conversion rate from the market. (1.09852 vs 1.09870 – the difference is 0.0163 % which is pretty negligible)

Speed of Transfers

In my experience, Wise has consistently delivered prompt and efficient money transfers. While transfer times may vary depending on the recipient’s location and currency. In our recent experience, the transaction was completed within one business day. This is a significant improvement over the often lengthy processing times associated with traditional banking channels. The longer part of the process was actually to send money domestically from our bank to Wise’s bank account which took 3 business days!

No amount limit

When it comes to sending money from your bank account, certain banks, such as CapitalOne, may impose a daily limit of $50,000 USD. However, with Wise, you can bypass this restriction as they do not have any such limits, allowing you to transfer large amounts of money in a single transaction. It is important to note that, initially, you will need to send the funds to Wise from your bank account.

For a smooth and cost-effective experience, we recommend using an online bank like Ally, which does not enforce daily limits on outgoing transfers. Additionally, Ally charges a flat $20 wire fee for any amount being wired, making it a more economical choice compared to banks like CapitalOne, which levy a flat $30 fee but restrict it to a maximum amount of $50,000 USD. By utilizing Wise in combination with an online bank like Ally, you can streamline your international money transfers and avoid unnecessary fees and limitations.

Security and Regulation

Wise is authorized and regulated by multiple financial authorities in various jurisdictions. This regulatory oversight ensures that customer funds are held securely and that Wise follows strict compliance guidelines. Additionally, they implement robust security measures to safeguard user data and prevent unauthorized access, providing peace of mind for users concerned about their financial security. (You can read more about how Wise is regulated in each country/region they operate on their official page here.)

Customer Support

Throughout my usage of Wise, I have found their customer support to be responsive and helpful. Whenever I had a query or encountered an issue, the support team promptly addressed my concerns, ensuring a positive experience with the service.

I made a mistake on the bank account by swapping two numbers. The receiving bank had to return the money to Wise which immediately notified me through their app and offered me to update the bank account for no additional fee.

Multi-Currency Account & Debit Card

Wise also offers a multi-currency account that allows users to hold and manage funds in multiple currencies. This feature is useful if you are conducting frequent transactions in different currencies. We personally have not used it so can’t say much about it.

Wise also offers a debit card that lets you take money at ATMs. However there is a $1.50 USD flat fee coupled with a 2% fee on the amount being withdrawn (after 2 free withdrawals of up to 100 USD each). This is not as competitive as the credit card we are using to withdraw money from ATMs. (Read: How to never pay ATM fees while traveling abroad)

Our Bottom Line

Wise is undoubtedly a reliable and transparent money transfer service that we have been using for many years and seven thousands of dollars in fee. Wise caters to the needs of people who frequently send or receive money internationally. With its user-friendly platform, upfront fee structure, and commitment to transparency, we believe that Wise has changed the way we handle cross-border transactions. Whether you are a slow travel, digital nomad, expat or just someone who needs to transfer money abroad occasionally, we highly encourage you to check out Wise.

Did you know about Wise (formerly TransferWise)? Have you found a service that offers a lower rate? Please let us know by leaving a comment in the comments section below.

5 Comments

Darrell · August 2, 2023 at 12:41 pm

I have been using Wise/Transferwise since 2018 and have found them to be the best method of transferring money. Occasionally I have found a slightly (pennies) cheaper transfer when all the elements line up just right, but overall it has always been the cheapest and fastest. As for speed, I think you undersold them. I have had transactions take less than a minute all the way up to a day. I have never had it go longer than that. I wonder if yours was due to being a bank transfer and if a weekend or holiday interfered.

Also, the “multiple currency” system is far more useful than it just holding your money in different currencies. It one of those currencies can act as a “local” bank. This came in very handy for me when traveling in England. The train system offers refunds if they are late, but they will only send the money to a British bank or otherwise will send you a check. Cashing an international check is time consuming and hardly worth the effort when talking about a 10 GBP refund. Wise, however, is my British bank and then the process is just one of filling out the paperwork and waiting for the money to show up.

I also use Wise as a direct pay system when credit and debit cards are not allowed and it would be too much cash to be carrying around. If both parties are on WIse, the transfer is near seamless.

Mr. Nomad Numbers · August 4, 2023 at 8:18 am

Thank you so much Darrell for adding these important comments to the Wise experience. We always send money from our bank to Wise which is taking definitely the longest on the overall transaction. We had the impression that the transaction was taking about a day (which for us was already really good) but after looking at the timestamp, you are right that is is more a matter of hours, which is incredible and make the traditional financial system finally catching up with the era of digital currencies. Also it looks like you’ve been using them much more that we’ve done it from reading your experience. Sincerely appreciate that. This is great to see that Wise can do so much more!

J · February 20, 2024 at 11:49 am

hmm, when I use Wise to send USD to my Taiwan account, it costs much more than shown here. About $31 sending from my Wise balance. About the same doing a wire transfer. Maybe they’ve changed things.

Mr. Nomad Numbers · February 25, 2024 at 1:13 am

Hi J. Do you mind sharing the amount your are trying to send? I can double check the fee on our end and see if things have indeed changed…

How to Open a Bank Account in Taiwan as A Foreigner — Nomad Numbers · February 19, 2024 at 2:35 pm

[…] When it comes to transferring money in and out of Taiwan, we highly recommend using Wise. This platform offers some of the lowest fees in the industry. To get started, you can create an account by signing up here. Additionally, feel free to read our detailed review: “A Reliable & Transparent Money Transfer Service: Wise (formerly TransferWise) Review“ […]