Investing is crucial knowledge whether for traditional retirement, early retirement or simply to have more financial freedom. Unfortunately, investing for retirement is a skill that is not taught in school and a topic that a lot of people struggle with. In this detailed guide on how to invest for retirement, you’ll learn the rules and tactics so that you can get started on your investment journey.

This guide will demystify the 4% rule, the cornerstone in retirement planning that ensures your savings last a lifetime. You’ll learn some common risks when it come to the literal definition of this rule. If you are outside of the US, this covers how the 4% rules can be adapted for you. It also includes tactics to put this plan into action. Whether you aspire to retire in your 30s, 40s, 50s, or 60s and beyond you need to educate yourself on investing for retirement.

Note: This post has been revised as of 12/6/2023 with the addition of 3 How To Sections

Disclaimer: The content of this blog post is for informational purposes only and should not be construed as financial or legal advice. The information presented here is based on personal experiences and research, and individual circumstances may vary. Readers are encouraged to consult with qualified professionals, such as financial advisors or legal experts, to obtain advice tailored to their specific situations. The authors of this blog post are not responsible for any actions taken based on the information presented, and readers should use their discretion and seek professional guidance before making financial or legal decisions.

Invest for Retirement: Understanding the 4% Rule

Definition of the 4% Rule

The 4% rule serves as the keystone for retirement planning, offering a practical framework backed by research and market data that ensure financial security in your post-work years.

The concept is straightforward yet powerful: it suggests that retirees can withdraw 4% of their savings annually to maintain a balance and never run out of money while enjoying their retirement years.

The 4% rule aims to provide a steady income stream while minimizing the risk of running out of money during retirement

This rule gained prominence through the Trinity Study, conducted by 3 researchers in 1998, which analyzed historical market data to determine sustainable withdrawal rates over different time periods. The 4% rule aims to provide a steady income stream while minimizing the risk of running out of money during retirement. It’s based on the historical performance of diversified investment portfolios, considering various market conditions.

Portfolio Mix

For the 4% rule to work, you need to invest your portfolio (ie. your savings that will be used to fund your retirement) in the financial market using a mix of:

- Stocks (Equities):

- Allocate a significant portion to stocks for potential long-term growth. A common recommendation is around 50-75% of the portfolio.

- Bonds:

- Include bonds to provide stability and income. A typical allocation might range from 25-50%. Bonds can serve as a counterbalance to the volatility of stocks.

The 4% rule is a guideline

The 4% rule is a guideline rather than an absolute guarantee. Factors like life expectancy, unexpected expenses, and market fluctuations can influence its effectiveness. As such, it is important to reassess and adjust your retirement plans based on the evolving economic landscape and your personal situation.

Calculating Your Retirement Number

Determining your retirement fund requirements begins with establishing your desired retirement spending. This figure may differ from your current expenses, particularly if you anticipate retiring in a new location or aspiring to increase your current lifestyle once you retire to do all the things you’ve been dreaming about.

Once you’ve identified this yearly target spending amount, multiply it by 25 to obtain the fully invested portfolio required to adhere to the 4% rule.

Let’s explore a few examples:

| Annual Spending (in USD) | Size of your portfolio (in USD) |

|---|---|

| $20,000 | $500,000 |

| $40,000 | $1,000,000 |

| $60,000 | $1,500,000 |

| $80,000 | $2,000,000 |

| $120,000 | $3,000,000 |

| $200,000 | $5,000,000 |

You also want to update this number by taking into account the inflation between today and your retirement year. It seems that 3% yearly inflation is a safe CPI according to « The Global Expatriate Guide to Investing » by Andrew Hallam. SO unless your retire tomorrow, we need to revisit our example based on a 10, 20, 30 or 40 retirement time horizon.

| Annual Spending | 10 years retirement horizon | 20 years retirement horizon | 30 years retirement horizon | 40 years retirement horizon |

|---|---|---|---|---|

| $20,000 | $24,627 | $30,389 | $37,379 | $45,888 |

| $40,000 | $49,254 | $60,779 | $74,758 | $91,777 |

| $60,000 | $73,882 | $91,168 | $112,137 | $137,665 |

| $80,000 | $98,509 | $121,558 | $149,517 | $183,554 |

| $120,000 | $147,764 | $182,337 | $224,276 | $275,331 |

| $200,000 | $246,273 | $303,895 | $373,792 | $459,443 |

Understanding the Risks of the 4% Rule

As we said earlier, the 4% rule is a guideline and like with any guideline, it needs to be adjusted. Here are a few risks to keep in mind when using the 4% rules that people often overlook:

- Reliance of historical returns

- Retirement horizon of 30 years

- Absence of fees

- Failure to diversify

- Fixed percentage withdrawal

Let’s review each of these risks and provide tactics to mitigate them

1 – Reliance on historical returns

The Trinity Study is based on historical data of the stock market from 1925-2009. As the common adage says: “Past performance is no guarantee of future results” so people should keep in mind that we don’t know what will happen in the future. That being said, between 1925 and 2009, there has been one world war, a global financial crisis, and a pandemic. So the market has been through a lot already.

Mr & Mrs Nomad Numbers’ portfolio insights – Since our retirement in 2018, our portfolio has seen a 30% increase.

2 – Assumes a retirement horizon of 30 years

The Trinity Study data is geared towards a conventional 30 year retirement, typically suitable for those retiring in their mid 60s. However, for early retirees planning a lengthier 50 year retirement span, the fit isn’t as seamless.

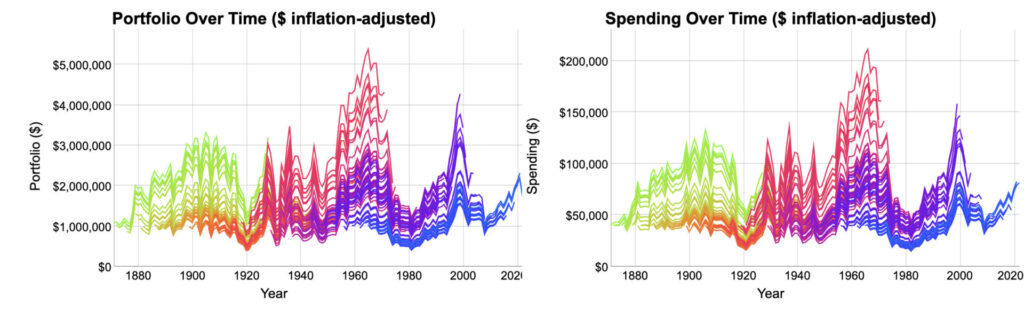

Enter cFIREsim, a tool born out of the Trinity Study data. This tool allows customization to align with individual preferences. cFIREsim can be used to ensure that your investment strategy stands the test of the retirement horizon you are planning.

In the simulation below (check the entire simulation data here), you’ll observe the performance of a $1,000,000 USD portfolio with 4% withdrawals over a 50 year period. According to the data, the strategy works as the portfolio never fails in the simulations.

3 – Absence of the consideration of taxes

In life, two inevitables stand out: “Death and Taxes.” Surprisingly, the Trinity Study doesn’t quite dive into the complexities of taxes. Taxes are especially a significant consideration for non-Americans where the tax rates after retirement can be quite high.

The US has a fairly favorable stance on long-term capital gains. However, tax codes are far from universal, subject to change, and vary significantly across countries. Overlooking this could be a common pitfall in retirement planning.

On the table below, we are estimating the potential tax implications when withdrawing from your portfolio, focusing on a few countries outside of the US.

| Country | Tax on Long Term Capital Gain (LTCG) as of 2022 |

|---|---|

| USA | 0% for individuals in the 10% and 12% tax brackets (to qualify your ordinary income has to be between $0 to $83,550 for an individual, twice as much for a couple filing jointly – source) 15% for individuals in the 22%, 24%, 32%, and 35% tax brackets (to qualify your ordinary income has to be between $41,775 to $215,950 for an individual, twice as much for a couple filing jointly – source) 20% for individuals in the 37% tax bracket (to qualify your ordinary income has to be between $539,900 or more for an individual, $647,850 or more for a couple filing jointly – source) |

| Taiwan | A flat tax rate of 15% |

| Italy | A flat tax rate of 26% |

| Spain | A flat tax rate of 27% |

| Portugal | A flat tax rate of 28% |

| France | A flat tax rate of 30% |

Let’s break it down with a practical example: If your retirement budget is $40,000 USD, you might need to set aside an extra $6,000 (15% more) for retirement in Taiwan or a whopping extra $12,000 for a retirement stint in France. So instead of savings $40,000 you need to save respectively $46,000 or $52,000!

Now, if you’re a US citizen looking to retire in another country, the complexity level kicks up a notch.

Mr & Mrs Nomad Numbers’ portfolio insights – As permanent citizens of Taiwan (Read: How we become a Permanent Resident in Taiwan), our US-sourced capital gain income isn’t taxed locally since it’s not generated through a Taiwanese bank/investment firm and Taiwan doesn’t tax overseas capital gains. However, we still owe taxes in the US. Fortunately, as a married couple and filing jointly generating less than $83,550 from long term capital gains per year, our Federal tax bill stands at a cool $0.

The Consideration of Expense Ratios and Investment fees

Whether you manage your investments or have someone manage it for you, this is not free.

We encourage you to learn the basics of personal finance through The Simple Path to Wealth: Your road map to financial independence and a rich, free life and manage your portfolio yourself. If you want to use a financial advisor to invest your own money, make sure they take a very reasonable flat fee (and not a fix % of the portfolio under management as this will become very expensive over decades).

For our U.S. readers, we’d like to spotlight Wealthfront. Acting as a robo-advisor, Wealthfront simplifies investing in low-cost index funds for a reasonable 0.25% fee. What’s more, they can assist in trimming your tax burden through Long-Term Capital Gain Harvesting (and other cool features). It’s a win-win for investors aiming for efficiency in both cost and tax strategy without having to get their hands dirty managing their portfolio themselves.

We are using Wealthfront and wrote a detailed review that you can read here.

If you would like to sign-up, you will get your first $5,000 managed for free by signing up using our Wealthfront referal link.

4 – Failure to diversify

Another concern associated with the Trinity Study is the reliance on a portfolio fully invested in the US stock market. While some argue that investing in the US market provides exposure to the entire world, others advocate for more diversification.

Individuals can consider investments not only in the US stock market but also in international markets. Diversifying in this manner can potentially enhance risk management and optimize investment opportunities.

For US residents, opening a Vanguard account and investing into these low cost index funds:

– VTI – Vanguard Total Stock Market ETF (or VTSAX for the mutual fund equivalent)

– VSUX – Vanguard Total International Stock ETF (or VTIAX for the mutual fund equivalent)

– BND – Vanguard Total Bond Market ETF (or VBTLX for the mutual fund equivalent)

VTI + VSUX will represent your equities allocation, while BND will represent your bonds allocation

Another diversification strategy could be investing in real estate This additional layer of diversification helps spread risk across different asset classes and can contribute to a more resilient and balanced investment portfolio.

Mr & Mrs Nomad Numbers’ portfolio insights – Currently, about 20% of our portfolio is allocated to real estate, with the remaining portion invested in the stock market.

5 – Fixed percentage withdrawal

While the Trinity Study advocates for a fixed 4% withdrawal over a 30 year span, this approach can be rigid and prone to early failure, especially during significant market downturns (like the 2008 Financial Crisis where the market drop where the S&P 500 lost ~57% of its value from its peak in 2007 to the bottom in 2009). Instead, we suggest to a more adaptable strategy: withdraw based on your portfolio’s current value when you need the funds. This means adjusting your spending, potentially receiving less during market downturns and more during upswings.

Flexibility is key, allowing you to adjust with market fluctuations. For enthusiasts of geo-arbitrage, living in Thailand (Read: Living comfortably on 15K USD in Chiang Mai) could cost about 50% less than in France and even less than in California.

Alternatively, consider building a robust emergency fund equivalent to 6-12 months of living expenses. This fund will act as a financial buffer during years when your portfolio will yield less so you can still get the full amount your need each year without affecting your portfolio. On the flip side, during prosperous years, you can replenish your emergency fund with the surplus from your portfolio. This dynamic approach provides a practical way to navigate the unpredictability of the market and ensure financial resilience.

Mr & Mrs Nomad Numbers’ portfolio insights – We started our retirement in 2018 with an Emergency fund worth about 36 months worth of spending to be extremely conservative.

How to Start Deploying Your Capital

Depending on your stage in the accumulation phase, you may find yourself either in the early or late stages of wealth building. Let’s explore the optimal strategies for deploying your capital in each scenario.

Early Stage of Accumulation (Early 20s)

If you’re reading this in your early 20s, kudos to you! You’re ahead of the game, set to benefit from the magic of compound interest. In this phase, the Dollar Cost Averaging (DCA) strategy reigns supreme. DCA involves consistently investing a portion of your savings each month (typically a percentage of your paycheck) into your chosen investment funds. This method helps you navigate market fluctuations by providing multiple entry points. For those looking to save over the next 15-30 years, DCA is likely to yield the best results.

Late Stage of Accumulation Phase (Somewhere in Your 40s or 50s)

By this point, you’ve (hopefully) amassed a substantial savings nest, but it may be sitting idle or invested in suboptimal assets. The task now is to redeploy this capital. If the funds are in a taxable account, you’ll also need to consider the tax consequences associated with realizing long-term capital gains.

We actually found ourselves in a similar situation in 2017 when we recognized the need to rebalance our portfolio, heavily weighted (95%) in 2-3 tech stocks, posing unnecessary risk of major overnight losses. Here’s how we tackled it:

- Sold Tech Stocks: Liquidated all tech stocks, incurring a substantial capital gains tax in FY 2017 (held these investments for 10+ years).

- Reinvested in Low-Cost ETFs: Immediately reinvested the entire amount back into low-cost ETFs after selling.

- Maintained Emergency Fund: Kept a robust ~3 years worth of emergency funds to navigate market downturns and re-enter at lower prices.

A more conservative approach could be splitting your entire savings into five chunks and DCAing into your target funds on a monthly basis, totaling 60 entry points. The non-invested portion would then serve as a comfortable emergency fund.

How to withdraw from your portfolio

Following the 4% rule, you need to sell 4% of your portfolio every year. For those preferring a Dollar Cost Averaging (DCA) approach to withdrawals, a monthly or quarterly schedule is an alternative.

Given the yearly fluctuations in your portfolio, the 4% value may deviate from your target spending for the year.

- If it falls below, tapping into your emergency fund becomes crucial to prevent erosion of your portfolio.

- If it exceeds, you can allocate the surplus back into your emergency fund or opt to withdraw less than 4%, leaving the remainder invested.

While the latter may be tempting, it is recommended to maintain a robust emergency fund of 6-12 months (or more if you want to be very conservative like us).

In less fortunate scenarios involving multiple years of negative returns that would empty your emergency fund, geo-arbitrage can be a good option. Temporarily relocating to a lower cost-of-living country, such as Thailand (Read: Our COL in Chiang Mai in 2019), Malaysia (Read: Our COL in Penang in 2019), Bali (Read: Our COL in Ubud in 2022) or Taiwan (Read: Our COL in Taiwan during the pandemic), can offer financial relief compared to many other countries worldwide.

How to rebalance your portfolio

As the market evolve, you would need to rebalance your portfolio on a yearly basis to make sure you still target the same percentage of equity vs bonds. For example if you were targeting a 60% stocks and 40% bonds portfolio mix, you would sell stocks when the stock market is up and rebalance by reinvesting into bonds. So if your portfolio shifted to 65% stocks / 35% bonds, you would sell stocks to rebalance back to 60% stocks / 40% bonds.

Also, besides rebalancing your portfolio, you should remember that your retirement plan isn’t set in stone. It is important to regularly review and adjust as needed. Life changes, and so should your plan. Whether it’s adjusting for changes in expenses, health, or market conditions, staying flexible is key.

Final Thoughts on How to Invest for Retirement

To sum it up, crafting your retirement plan need not be a daunting task. While the 4% rule offers a solid foundation, it’s essential to view it as a flexible guide rather than a strict rule. Dive into personal finance (Read: The Simple Path to Wealth), seek counsel from financial experts (opting for an advisor only if they propose a fair and transparent flat management fee or sign-up for Wealthfront), factor in taxes and fees, and be prepared to adjust your plan as life unfolds. We hope that this guide gave you a good understanding of investing for retirement so that you can get started on your journey.

How about your own retirement strategy? Have you initiated the planning process? Are you familiar with the 4% rule, and has it sparked the realization that you might already have sufficient savings to retire? Share your thoughts with us by dropping a comment in the section below!

5 Comments

Eileen Chu · December 6, 2023 at 10:12 pm

Your portfolio dip that low in 10/2022? This might be a little blunt…are you guys FI under $1M? Just curious 🙂

Mr. Nomad Numbers · December 7, 2023 at 1:11 am

Hi Eileen! Well we are still above our 2018 investment value so we’ve been fine. 🙂

Having a comfortable emergency fund can definitely help in that situation. Our combine portfolio is above $1M but we’ve been living so far like we had only a $1M portfolio (since our yearly spending has always been below $40K – much closer to $30-$35K actually if you read our past yearly spending reports)

#kojet · December 6, 2023 at 10:59 pm

Great additions Mr and Mrs Nomad!

A great introduction to the overall FIRE concept and how to do implement it. You faced quite impressive downturns which and proves and reinsures that sitting tight works!

Mr. Nomad Numbers · December 7, 2023 at 1:17 am

Thank you!

Yes so far we are above water even after everything that happen with the financial markets and the overall economy since 2018. Pretty incredible!

The more we enjoy the freedom and quality of life this “early retirement” lifestyle gave us, the more we think we might end up with more money that what we started with as the nomadic life definitely turns out to be cheaper than our previous 9-5 life which could seems counter intuitive to many 🤷🏻♂️

We might need to more aggressively apply the concepts from the “Die With Zero” book!

Maybe we should give ourself another 5 years to confirm that we are golden before spending like there would be no tomorrow?

Unlock Financial Freedom with Wealthfront: A Comprehensive Guide — Nomad Numbers · December 10, 2023 at 2:31 pm

[…] week we shared a comprehensive guide on how we’ve invested our money to retire early (Read: How to Invest for Retirement – A Guide to the 4% Rule). Some of our readers have been reaching out to us asking how they can get started in the simplest […]