It’s been a remarkable five years since we took the plunge, sold everything and left San Francisco to slow travel the world full-time. Since 2018, we’ve clocked over 100,000 miles and touched down in nearly 50 destinations across 20 countries (across 4 continents), our adventures have unfolded in ways we never imagined. We love numbers and have been tracking all of our spend in great detail. If you are planning and budgeting to slow travel the world or become a nomad, this detailed report will give you the insight into the cost to travel the world for one year including flights, accommodation, food, activities and insurance.

How Much Does it Cost to Travel the World for One Year?

Everyone’s travel style and budget is different so you will have to account for the differences based on your personal preference. We are a couple in our early 40s, we travel to a mix of high and low cost of living countries, stay at least one month per location and are value conscious but are not budget travelers. We also save a lot of money on flights by using travel rewards from credit cards. Keep in mind, traveling as a couple versus traveling solo does save on accommodation on a per person basis. Staying longer in one location is also less expensive because there’s less transportation cost and usually a big discount on long-term accommodation.

Now with that background, our cost to travel the world for one year in 2023 as a couple was $34K(way less than what we used to spend back in pricey San Francisco). In fact, this annual cost of full-time travel has been very consistent for the past 5 years since we have been nomadic. We will take you through the highlights of the past year, sharing not only the places we explored in 2023 but also the detailed expenses of our unforgettable travels. If numbers are your cup of tea, you’re in for a treat – let’s dive in!

Some links to the products mentioned below are affiliate links, meaning that if you click and make a purchase, Nomad Numbers may receive a commission at no additional cost to you. For more information please review our disclaimer page.

Which countries did we travel to in 2023?

In 2023 we went to Thailand, Cambodia, Vietnam, Taiwan and California. The map below shows all the countries and cities we traveled to:

The table below provides details about how long we spent in each location along with our spending for the two of us.

| Location | Total cost (for 2) | Living cost only (for 2) |

|---|---|---|

| Chiang Mai | Thailand (Jan-Feb) – 37 days | $1,695 | $1,510 |

| Mae Hong Song Loop | Thailand (Feb) – 5 days | $413 | $413 |

| Koh Samui | Thailand (Feb) – 29 days | $1,702 | $1,464 |

| Koh Tao | Thailand (Feb) – 3 days | $348 | $348 |

| Siem Reap | Cambodia (Mar) – 29 days | $1,474 | $1,173 |

| Hanoi | Vietnam (Apr) – 22 days | $1,208 | $1,008 |

| Nihn Binh | Vietnam (May-Aug) – 3 days | $135 | $135 |

| Taipei | Taiwan (Apr-Oct) – 186 days | $15,413 | $14,918 |

| Taiwan travel with fam (Sept) – 22 days | $1,451 | $1,449 |

| Mrs. NN’s Home | California (Nov) – 35 days | $2,146 | $2,126 |

| Ho Chi Minh City | Vietnam (Dec) – 5 days | $496 | $464 |

| Chiang Mai | Thailand (Dec) – 27 days | $1,663 | $1,520 |

| 2023 One Time Expenses | $6,234 | $0 |

| Total – 365 days | $34,473 | $26,532 |

Our total spend for 2023 was $34,473 USD (or $94.45 / day) and our living cost was $26,534 USD (or $72.69 / day).

Mr. & Mrs. Nomad Numbers

2023 Spending

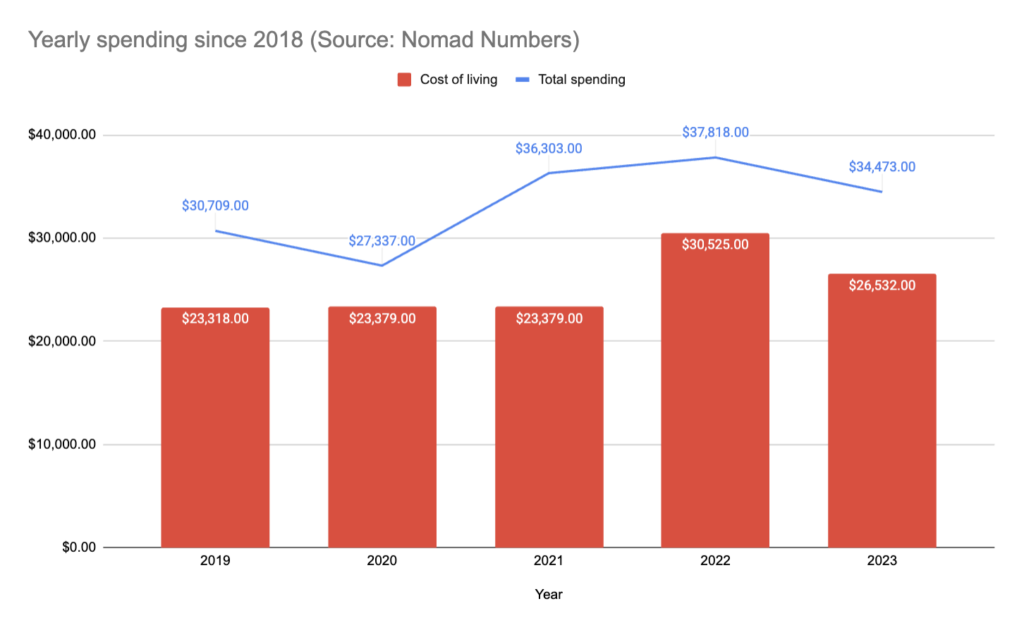

$34K is a ~10% increase from last year but this is still about half of our spend when we were back in our static life in San Francisco. (Read: for reference about our spending in California, pre-nomadic life, check out our 2018 Year End spending report).

If you are interested to get more details on the budget related to each place we’ve visited, please take a look at both our destination reports, getaway guides or day trip guides.

Detailed Breakdown of Cost of Travel for One Year

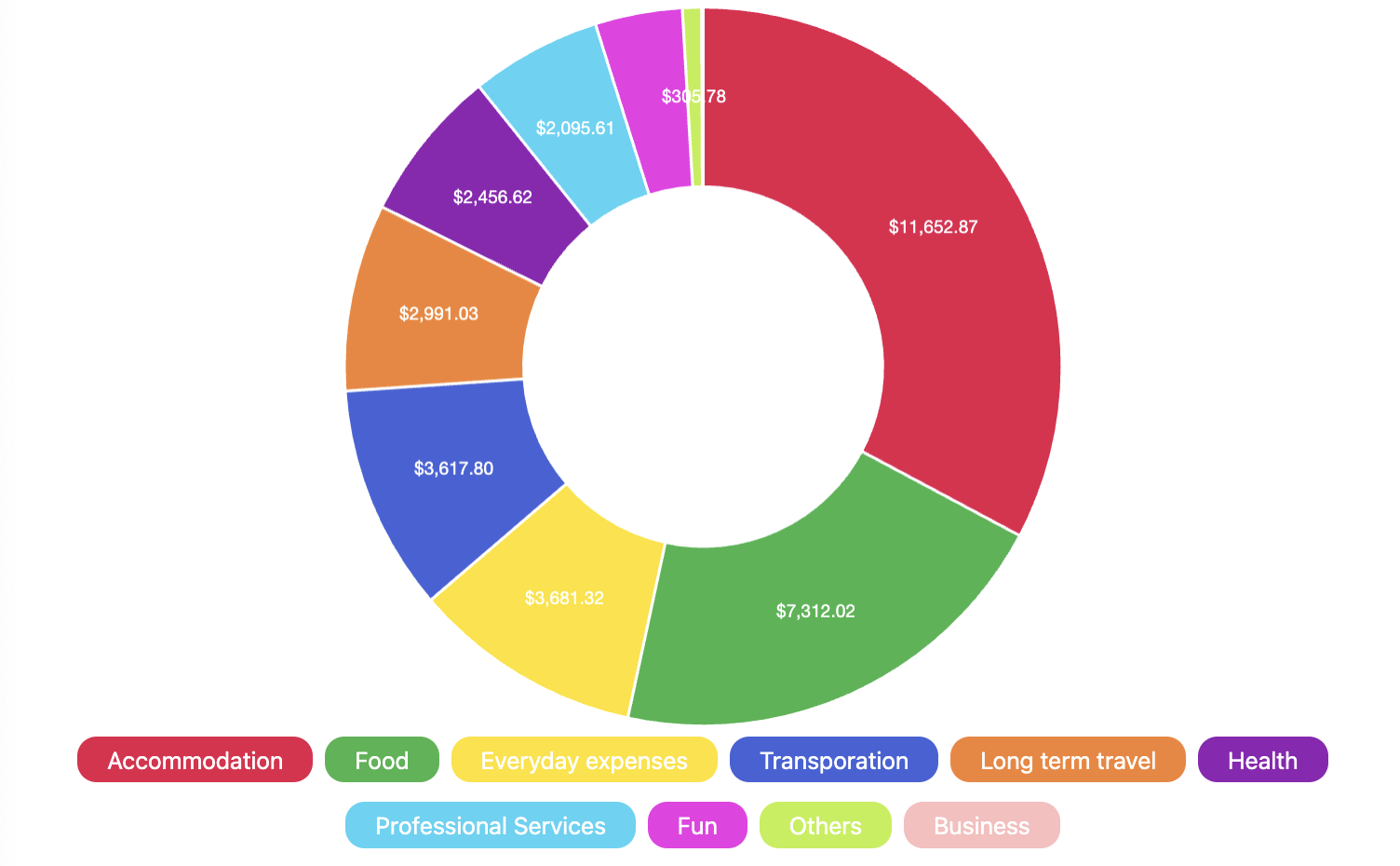

Let’s look at our spending per category to see where our money went in the table below:

| Category | Total | % of Grand Total | Monthly equivalent (for 2 ppl) |

|---|---|---|---|

| Accommodation | $11,403 | 33.07% | $950 |

| Food | $7,044 | 20.43% | $587 |

| – Groceries | $3,422 | 9.93% | $285 |

| – Dining out | $2,969 | 8.61% | $247 |

| – Cafe, Coffee shops, Sweets & Snacks | $524 | 1.52% | $44 |

| – Food Delivery, Take out, Street food | $128 | 0.37% | $11 |

| Everyday expenses | 3,569 | 10.35% | $298 |

| – Gifts | $1,158 | 3.36% | $97 |

| – Subscription (recurring) | $542 | 1.57% | $45 |

| – Personal Care | $537 | 1.56% | $45 |

| – Self Improvement, Education | $478 | 1.39% | $40 |

| – Clothing | $405 | 1.18% | $34 |

| – Fitness, Gym, Workout | $207 | 0.60% | $17 |

| – Data | $143 | 0.42% | $12 |

| – Living Expenses | $75 | 0.22% | $6 |

| – Home furnishing | $21 | 0.06% | $2 |

| Transportation | $3,483 | 10.10% | $291 |

| – Local Transportation | $1,678 | 4.87% | $140 |

| – International Transportation | $1,381 | 4.01% | $115 |

| – Travel Rewards, Travel Miles | $285 | 0.83% | $24 |

| – Intercity Transportation | $138 | 0.40% | $12 |

| Long term travel | $2,932 | 8.51% | $244 |

| – Travel Gear | $2,421 | 7.02% | $202 |

| – Visas | $385 | 1.12% | $32 |

| – Cancelation | $65 | 0.19% | $5 |

| – Personal Equipment, Electronics | $38 | 0.11% | $3 |

| – Scam | $22 | 0.06% | $2 |

| Health | $2,273 | 6.59% | $189 |

| – Health Care | $1,116 | 3.24% | $93 |

| – International Health Insurance | $832 | 2.41% | $69 |

| – Local Health Insurance | $325 | 0.94% | $27 |

| Professional Services | $2,095 | 6.08% | $175 |

| – Residency Application & French Citizenship | $2,095 | 6.08% | $175 |

| Fun | $1,355 | 6.59% | $189 |

| – Recreation, Museums, Sightseeing, Tours | $1,107 | 3.21% | $92 |

| – Entertainment (Book, Games, Hobbies) | $248 | 0.72% | $21 |

| Others | $299 | 0.87% | $25 |

| – Donation, Charitable Giving | $181 | 0.52% | $15 |

| – Non-Living Expenses | $118 | 0.34% | $10 |

| Business | $18 | 0.18% | $1 |

| TOTAL | $34,473 | 100% | $2,923 |

Here are the major highlights of our spending:

- Our top 3 spending categories were housing (33.08%), Food (20.43%) and then Everyday expenses (10.36%).

- Our International transportation spending (mostly international flights) was only $1,381 because we love using travel rewards to get free flights and you should as well!

- Our Local Health Insurance spending was only $325 to cover us while in Taiwan since we became permanent Taiwanese residents, we are now utilizing Taiwan’s very affordable healthcare at about $30 USD / month and per person. (Note: for accounting purposes, we’ve moved under the ‘international health insurance spending’ the portion of the Taiwan National Health Insurance that we pay while we are outside of Taiwan so we can keep our coverage when we return).

- We had a large expense of $2,100 as we are applying for different residencies and citizenships that you will likely not have.

What did we exclude from our budget?

The only expenses we aren’t tracking are the one related to our income and investments (like Property Taxes, Repairs and so on). We also exclude the taxes we paid as they are pretty much related to our real estate or some side projects we work on.

Are we missing an important category though? Please let us know by leaving your feedback in the comments section below.

For reference, here are our spending reports:

– 2019: Total spending: $30,709.19 (including living cost of: $23,318.00)

– 2020: Total spending: $27,337 (including living cost of: $23,980)

– 2021: Total spending: $36,303 (including living cost of: $23,379)

– 2022: Total spending: $37,818 (including living cost of: $30,525)

– 2023: Total spending: $34,473 (including living cost of: $26,532)

Our bottom line

We hope this detailed report has given you helpful insights into the cost to travel the world. It is not as expensive as most people think because full-time travel is not the same intensity as a 2 week vacation. Our hope is that this transparency into the costs gives you the inspiration and courage to start your travel adventure. Full-time travel is very attainable and with the necessary planning and budgeting, you can do it too!

What about you? How much did you end up spending in 2023? Were you able to spend less or more than the previous year? How did you feel about it? Please feel free to share your numbers or your biggest surprises!

Since we are beginning a new year, we encourage you to take a few hours in your life to think about the life you want to design for yourself (check out our tips to get started on the life design process & get yourself a Remarkable II).

10 Comments

Margot H Knight · January 9, 2024 at 12:53 am

I so appreciate your granular posts! While we admire your frugal travel, we are on a die with zero itinerary. And suspect we have fewer years left on the planet. But still managed to increase our net worth by 6.8% (I turned 70 and started Social Security which helped). We are still spending out of our cash bucket and don’t plan to tap investments until 2025. This was our 3rd year of nomaddery.

We ended up spending $145,504 in 2023 BUT that included a car for $13K and a World Cruise we’ll take this year ($38,000) and we have prepaid ALL our accommodations for the 154 days we won’t be on cruise ships in 2024. I expect our 2024 “out of pocket” costs to be less than $50K, getting us back to our $100K annual spending goal.

We slept in 43 beds in 8 countries and took care of some great dogs and cats. And we only had one fall (damn cobblestones) and no illnesses that required quarantining.

Our biggest line-item at $71,541 was “travel,” a catchall for current and future cruises, rental cars, etc. I know many split cruising into accommodations/food/travel but we just lump it into one line-item. And here’s the rest:

Rent—$20,811 (includes 2024 pre-paid rents)

Restaurants—$8.942 (we do enjoy a Michelin restaurant every now and then)

Groceries—$5,438

Entertainment—$13,130 (opera, Broadway, West End and Bruce Springsteen are expensive!)

Merchandise/Mail—$6,312

Insurance/Taxes—$6,372

Phone $2,943 (we like our ancient all-data, free-roaming plan from T-Mobile)

Public transportation $3,331

Charitable Giving—$6,683

Live Your Life. Live Your Life.

Mr. Nomad Numbers · January 13, 2024 at 1:42 am

Hi Margot. Thank you so much to taking the time to share your budget.

We love the Die with Zero book and it looks like you are living by it. I’m hoping you have at least 2 more decade to live but we never know and better to have no regret in life when you get to your senior years, right?

We are still relatively young on our end (just cross the 40 years mark recently) and while we can definitely spend much more than what we are currently spending we realized that we do enjoy a lot of “free activites” hence why our entertainment budget is quite low. That being said we have been considering having one honeymoon like experience once a year that would be in the 5-10K budget where we would book a really luxurious destination for 1-2 weeks. Mrs. NN is still but hesitant on it so I’m trying to remind her that life is short and that we definitely have the money for it. We did a wonderful week in Fiji in 2022 but we entirely use credit card miles and hotel points for it so this costed us nothing (a 4-5K saving as we stayed at a 5 start beach resort). This is progress though

Do you have any suggestion when it comes to spending in a way that is adding value to your life? Did you change your spending now than before reading the die with zero book (or while you where in your 40s like us)?

Margot · January 13, 2024 at 4:26 pm

Interesting question. We are 70 and 75–and I only read Die With Zero a few years ago—it helped me put together my financial plan on NewRetirement. So, no, the book did not have an effect on me in the years before I quit working. But it has given me permission to spend more freely than I might have (it is definitely more than 4% of our investments!).

To add value to our lives, we are intentional about spending money on experiences, rather than stuff. That plays itself out in the choices we make about the quality of the experience, e.g. I will pay for GOOD seats for concerts and plays. We book smaller or even private tours of places. I’ll pay extra for an apartment with a view of the water. We book at nicer hotels. We book balcony cabins rather than interiors when we can. I was surprised how this has blown our entertainment budget but I am compensating by doing more pet-sitting and saving on rents when I can.

I love the idea of splurging for a completely luxurious 1-2 weeks. Though, at some price points, the law of diminishing returns kicks in, e.g. the perks of a $600 a night hotel room are probably not much different than a $1200 a night stay!. I, too, am now using points for all hotels and airfares and just booked two weeks on Batam Island off the coast of Singapore. Live your life. Live your life.

Mr. Nomad Numbers · January 14, 2024 at 5:49 am

Thanks a lot, Margot, for sharing your thoughts. I totally agree with you about the law of diminishing returns. It’s kind of like buying expensive French wine. For most people, there’s not much difference between a $100 bottle and a $1,000 bottle (or even a $5,000 bottle if you’re lucky enough to try one). We’ll remember your advice for the future. Cheers!

Kklope · January 10, 2024 at 12:36 am

Where do you stay in Taiwan? Taipei ? Heard rental is expensive there? Can you share your monthly accommodation cost , room type and size (1 or 2 bedder?) and how far by local mrt to city Center?

I am thinking of moving to Taipei in a year’s time and like to know what’s the rental market there like. If you can refer me to an earlier blog post, that works too.Thanks

Mr. Nomad Numbers · January 13, 2024 at 1:32 am

Rent on short term (<4 weeks) in Taipei has significantly increased since we first arrived in 2020 during the pandemic. Though on long term rental 3+ month you can get good deals especially if you negotiate like we always do. Read:

Check out our post that capture all the places we’ve stayed at to get an idea of where we stayed in Taipei. (Read: https://www.nomadnumbers.com/5-years-of-slow-travel-and-70-airbnbs/)

We are coming back in April to the last place we stayed in Taipei last year and will be paying 38K NTD a month for a long term 1 BR 1 BA with a kitchen that is really bright in the Shilin area.

Most of the places we stayed at were either centrally located or a 15 minutes MRT ride away from the city center so quite convenient.

Kk trine · January 17, 2024 at 12:14 am

What’s the local house rental website you use in Taiwan? 38k NTD sounds pricey which is 1.3k usd per month. Of course also depends on location, convenience and amenities , state of the apartment…

What about Airbnbs for short term stay (1~3months)?

Mr. Nomad Numbers · January 24, 2024 at 5:01 am

Hi KK trine,

For Airbnb on short term rental, we’ve shared them all in our 5 years to slow travel post: https://www.nomadnumbers.com/5-years-of-slow-travel-and-70-airbnbs/#Airbnbs

For long term stay, we also like to start with Airbnb and then negociate with the landlord once we met with them in person (this mean you need to be in the country first). There are also offers on Facebook groups. The best platform is https://rent.591.com.tw/ but it is not super English friendly.

Hope this helps!

Kk trine · January 28, 2024 at 2:39 pm

Question about opening a bank account and getting a local drivers license … can you share how this is one or maybe point me to an earlier blog post?

I reckon you need a proper rental address (rental agreement) to even open a bank account or take up a mobile plan? I don’t think banks would allow Airbnb addresses to be used to open bank accounts right?

Mr. Nomad Numbers · February 4, 2024 at 2:17 am

We will need to write a post about bank account. It is a bit of a hassle but doable. Basically you need to have first a residency visa (gold card, arc…). Then you need to make an appointment with the bank and meet someone in person. This can take anywhere between 2-5 hrs. You can’t open joint account in Taiwan so if you are coming with your spouse you will need to repeat that process.

As for document required, they will ask for the reason why you want to open a bank account. You can say to pay your rent and you will be fine. On one account they only ask us for our residential address but on the other one they ask for a copy of our rental agreement.

As for SIM card, we suggest that you switch to e-Sim if you phone allow it. Unless you need a local phone number. e-Sim are so easier to setup and we use one that works in multiple countries: Check this post: https://www.nomadnumbers.com/best-international-phone-plan-without-roaming-2023/

If you still need a SIM card, you can get some at the airport upon arrival. If you have an ARC card (ie. not coming on a tourist visa), you can apply for longer plans which are much cheaper. Still more expensive than the e-Sim options we use nowadays.