If you’ve been following us, you know that Travel Rewards is one of the core strategies we use to travel the world for less than staying at home in the USA.

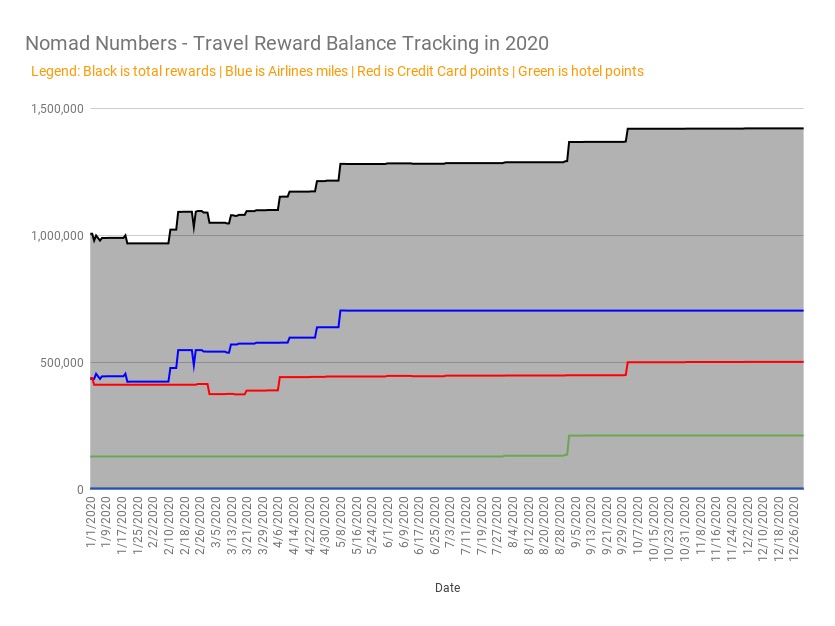

After accumulating more than half a million Travel Rewards points in 2019 (worth about $10,000 in redemption), we accumulated nearly another half-million in 2020 to close the year at an all-time high of 1.5 million Travel Rewards Points!

2020 did not turn out to be a great year for travel as you might have noticed! That being said, there is still tremendous value in Travel Rewards even during a pandemic as we will explain in this article.

In this blog post, we will give you a quick introduction to travel rewards before digging into how many rewards we accumulated in 2020, which credit cards we opened, how much money we saved by redeeming these precious points and what our plans are for 2021!

Are you ready to talk about free travel money and see how much we got in 2020 by using Travel Rewards?

Travel Rewards 101

Travel Rewards (also referred to as “Credit Cards Rewards” or “Travel Hacking”) is where you open targeted credit cards in order to get large sign-up bonuses in the form of travel points or airline miles. You can then later redeem your points or miles to fund your flights or hotel stays. (Such sign-up bonuses mostly benefit residents of the United States of America.)

There are 3 types of travel rewards to be aware of:

- Airline or Hotel rewards – These rewards come from credit cards that are co-branded with either a hotel chain or an airline company.

Example: Delta SkyMiles Credit card, Chase United Explorer Credit card. - Fixed value rewards – These rewards are set in value and can sometimes directly be applied to the money you spend on your credit card to erase it (like the Capital One Venture and their Purchase Eraser)

Example: Capital One Venture Credit card, Barclaycard Arrival Plus Credit card - Transferable rewards – These points are the most flexible (and usually the most valuable) since you can either use the bank’s travel portal or transfer them to many different partner airlines and hotels.

Example: Chase Sapphire Reserve Credit card.

IMPORTANT – Travel rewards only work if you have a good credit score, are able to pay your card in full on time, and are ok to withstand a temporary 3-5 point decrease in your credit score after applying for such cards. If you don’t feel comfortable with any of these, please refrain from opening a new credit card.

THE MOST IMPORTANT RULE OF TRAVEL REWARDS!

How to get the most out of Travel Rewards

Here are our pro tips to maximize your travel rewards:

- Pay your card in full every month. We can’t emphasize this enough! If you can’t pay your card each month, please don’t open a new card. Getting into credit card debt is not what we are discussing here. Please make sure that your financial situation is in order first. Nobody wants to unnecessarily increase their debt and lower their credit score.

- Understand the Chase 5/24 rule. If you open more than 5 credit cards in the past 24 months (across any credit card provider) Chase will not approve you for a new card. Since Chase is known for having the most valuable rewards points(called Ultimate Rewards), you want to prioritize opening your Chase cards first.

- Only aim to get at least $500 worth of total value (after annual fees) when opening a credit card. Don’t open a credit card that will give less than that (like a card with a one-time $50 credit on your next flight or online purchase). The reason for that is that you are limited by the amount of cards you can open with the Chase 5/24 rule.

- Avoid annual fees (unless it is really worth it). Most cards will void the annual fee. After that you can reassess whether or not you still get value by keeping the card open and paying the annual fee.

- Track your rewards in one place. We use a spreadsheet to keep track of every credit card we open. The information that is important to capture are:

- the name of the bank

- the name of the card

- the type of card (personal/business)

- the name and type (transferable. airline miles, hotel points…) of the reward you will be getting

- the day your card will renew (which is usually one year later)

- the bonus you will be getting

- the minimum spend you need to hit

- the date by which you need to hit your minimum spending limit

- whether or your not you have received the bonus

- whether or not you want to keep the card open in future years

- Alternate opening a card for you and your partner (if applicable). This is an easy way to double the benefits. This is especially relevant, when bonuses are part of a limited time offer.

- Open business cards before hitting the Chase 5/24 limit. Business Cards don’t count towards the Chase 5/24 rule. So if you’re trying to stay under 5/24, you can still rack up points and miles bonuses with business cards without affecting your ability to sign up for Chase cards in the future!

For more on this topic, check out our How to fly around the world for (almost) free: our ultimate guide to Travel Hacking.

How much in travel rewards did we earn and redeem in 2020?

Now that we’ve introduced the basic concept of Travel Rewards and how to best use them, let’s look at how much travel rewards we earned and redeemed in 2020 so you can get a sense of how powerful this can be!

What did we earn?

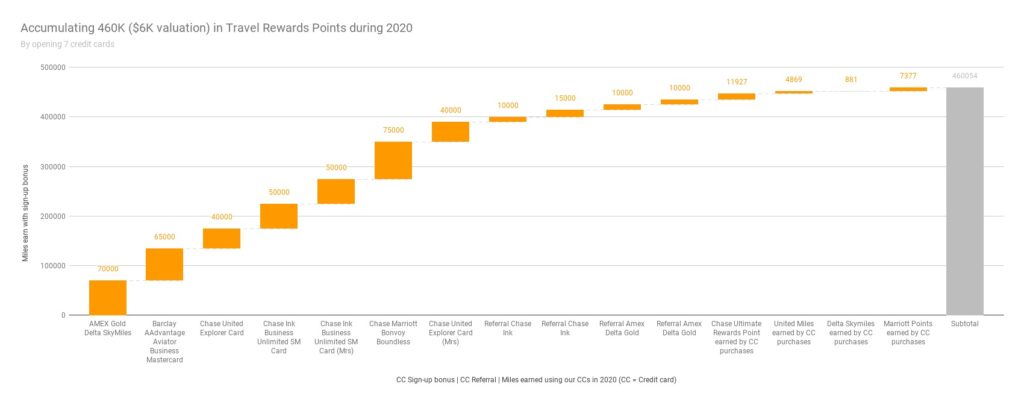

Let’s start with a recap of how much travel rewards we earned from credit cards during the 2020 calendar year (note: we track only the bonus earned in 2020, some of these cards might have been opened in late 2019).

Legend: “Points per $ spent”, is the amount of bonus points you get per dollar spent on the card until you get to the bonus minimum spend limit. “Bonus estimated cash value” is the value of the bonus using the Points Guy valuation’s page (as of February 2021).

As long as you spend money with your credit card, why not apply that money towards credit cards that will provide you with some juicy bonuses as we did in 2020? Here is our breakdown:

| Credit Card | Sign-up bonus / Min Spent / Time to spend minimum spending | Bonus estimated cash value | Points per $ spent |

|---|---|---|---|

| AMEX Gold Delta SkyMiles | 70,000 Delta Skymiles / $2K / 90 days | $770 | 35 |

| Barclay AAdvantage Aviator Business Mastercard | 65,000 American AAdvantage (AA) Points / $1K / 90 days | $840 | 65 |

| Chase United Explorer Card (x2) | 40,000 United miles / $2K / 90 days | $520 x 2 | 20 |

| Chase Ink Business Unlimited SM Card (x2) | 50,000 Ultimate Rewards Points / $3K / 180 days | $1,000 x2 | 16.67 |

| Chase Marriott Bonvoy Boundless | 40,000 Marriott Points / $2K / 90 days | $520 | 20 |

| Credit card purchases | 11,927 Ultimate Rewards Points | $239 | N/A |

| Credit card purchases | 4,869 United Miles | $63 | N/A |

| Credit card purchases | 881 Delta Skymiles | $10 | N/A |

| Referral bonus | 25,000 Ultimate Rewards Points for Mrs. NN for referring Mr. NN to sign-up for the Chase Ink Business card. | $430 | N/A |

| Referral bonus | 20,000 Delta Skymiles for referring people to the Amex Gold Delta Skymiles | $220 | N/A |

| TOTAL | 460,054 Travel Rewards Points | $6,081 |

In summary, for 2020, we accumulated 460K Travel Rewards Points (the equivalent value of $6,081) using the following techniques (listed by order of preference):

- Sign on bonuses: we accumulated 7 sign-on bonuses between the two of us which have an estimated cash value of $5,060.

- Referral bonuses: we scored an easy $650 from referring each other and others to the card we used and recommended.

- Credit card spend: we earned an estimated cash value of $371 from credit card usage.

We could not believe how easy that was, could you?

What did we redeem?

Earning is one thing, but spending is where the savings kick-in. So let’s take a look at our redemption in 2020. In 2020 we had a grand plan to travel all around South east Asia and Europe but the pandemic put this to a halt.

Here are the redemptions we made in 2020.

Note: Due to COVI19, we had to refund 75% of these flights and luckily got most of the points & cashback for later use. For more on what we had to cancel and what we got back read: “We booked $7,300+ in canceled travel in 2020, what was refunded surprised us”

| Airfare description | Travel rewards used | Any additional cash cost to purchase the airfare | Estimated savings |

|---|---|---|---|

| [REFUNDED] 2 one way ticket from Denpasar to Hong Kong | 20,000 Asia Miles | $62.42 | $650 (*) |

| [REFUNDED] 2 one way tickets from Tokyo to San Francisco (USA) | 32,000 Delta Skymiles | $112.61 | $1,000 (*) |

| [REFUNDED] 2 one way tickets from San Francisco (USA) to Florence (Italy) | 60,000 United miles | $89.2 | $1,200 (*) |

| 2 one way tickets from Denpasar (Bali) to Taipei (Taiwan) | 32,000 Ultimate Rewards Points | $0 | $596 |

| 144,000 points (112,000 got refunded) | $264 in fees | $3,445 in estimated savings | |

| Net savings (estimated – fees) | $3,180 |

(*) Estimated savings using Google Flight for a similar flight at the same period this year since we did not record the flight ticket price upon purchase.

In total we purchased 8 one way tickets using 144,000 Travel Rewards in 2020 (+ spent $264.23 on taxes and fees). This represents a net savings (after any cash cost) of about $3,180 which we would have had to pay out of pocket otherwise.

Notice that all of the flights were to cross continents because we tend to book flights through discount airlines for travel within Europe, Asia and Latin America. These discount airlines generally do not accept travel rewards but we will also keep you posted if we discover new hacks for this.

What are our plans for 2021?

Well with the pandemic, we accumulated more than we spent and the trend won’t likely reverse itself in 2021 as the pandemic is still around.

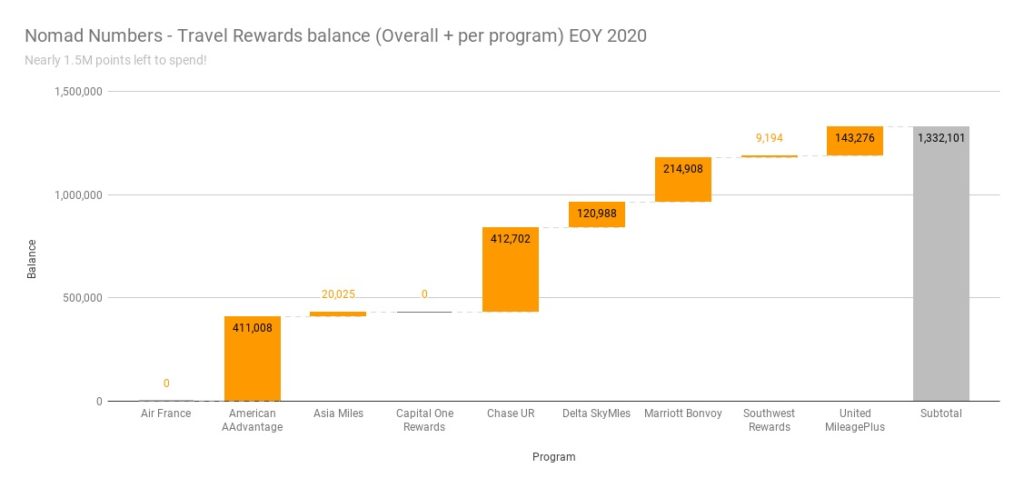

Here are the details of our Travel Rewards balance of nearly 1.5M point at the end of 2020:

| Program | Reward Type | Balance | Estimated value |

|---|---|---|---|

| Air France | Airlines miles | 0 | 0 |

| American AAdvantage | Airlines miles | 411,008 | $5,754 |

| Asia Miles | Airlines miles | 20025 | $260 |

| Capital One Rewards | CC points | 0 | 0 |

| Chase UR | CC points | 412,702 | $8,254 |

| Delta SkyMles | Airlines miles | 120,988 | $1,331 |

| Marriott Bonvoy | CC points | 214,908 | $1,719 |

| Southwest Rewards | Airlines miles | 9,194 | $138 |

| United MileagePlus | Airlines miles | 143,276 | $1,863 |

| TOTAL | 1,332,1010 | $19,319 |

These 1.33M points currently hold a value of $20,000! Not bad, eh?

But I can hear some of you telling us that w/ international travel being on pause for now and the future of the airline industries not looking good, we might never use these points for travel purposes. While this might be the case, most of our portfolio is invested into Credit Card (CC) points, which can be redeemed in various ways including:

- Statement credit: you can wipe out your credit card bill using them

- Cash back: you get a check in the mail

- Gift card: you can buy prepaid gift card we can later use on purchases

- Online purchases: you can shop on places like Amazon or Apple using our points

That being said, we remain optimistic about our ability to travel internationally again where these points will become super-handy. When the day comes that we will fly internationally again, we will be grateful to have points to purchase our flights because the cost in points tends to be more stable.

As for accumulating more, since there isn’t really a cost for us to open new credit cards to get this free money (besides filing an application form and waiting for our card to be electronically delivered to our virtual mailbox), we still plan to open more cards in 2021.

Which cards do we recommend?

We highly recommend that you start with the top Chase cards (Chase Sapphire Reserve or Preferred) to plan against the 5/24 rule.

If you already have those cards and are looking for other suggestions, please check out our Credit Cards page where we put the latest credit cards offers we’ve been using recently.

If you’d like to stay updated on our finds, we suggest that you sign-up for our newsletter where we share the latest offer from the cards we’ve been recently opening.

Our bottom line

Thanks to Travel Rewards we were able to accumulate half a million points (worth $6,000 in redemption) last year. While we could not travel as much as we wanted to in 2020, we are looking forward to being able to use this free money in the future. (hopefully in international travel airfare).

For now, as people that have decided to travel the world for life, we remind ourselves how lucky we are for being able to still freely roam around (the wonderful island of Taiwan) without having to worry about the virus. This is a luxury in 2021 that very few have access to and we are grateful for Taiwan’s amazing effort to keep everyone safe.

What about you? Were you aware of Travel Rewards before and if so, what is the best redemption you’ve made? Did you open credit cards in 2020 (or 2021) and if so how many rewards did you get? Did we overlook something that would help us improve our game even further? Please leave your comment in the comments section below.

10 Comments

Tara Matthews · March 2, 2021 at 4:17 pm

Do you cancel any of your cards as you open new ones?

Mr. Nomad Numbers · March 3, 2021 at 2:47 pm

Hi Tara. Yes we usually close these cards before their first anniversary. And by doing we always make sure manage to keep our sign-up bonuses if we don’t have time to use them before closing the card.

James · March 2, 2021 at 5:05 pm

Thanks NN! This is motivation to build up more points this year. Keep up the great content.

What’s your strategy on closing vs downgrading? Do you lean one way or the other?

Mr. Nomad Numbers · March 3, 2021 at 3:03 pm

Hi James! We always closed every card we open for the purpose of getting a sign-up bonus. In the rare case when closing the account will make us lose our sign-up bonus, we would negotiate to get the renewal fee waived for another year which we have been quite successful doing. We never downgraded any card at this point. (Also closing cards hasn’t negatively affected our credit score over the long term).

Veg · June 14, 2021 at 5:25 pm

Your spending is impressively low, but you still earn many credit card points each year. What strategies do you use to balance the accrual of points with keeping your expenses low?

Mr. Nomad Numbers · June 14, 2021 at 6:14 pm

Hi Veg! It took us a bit of time to adjust to the fact that full-time world travel does not have to be expensive. Our average spending for the past 3 years has been under 30,000 USD and we have not been restricting ourselves if you look at all the places we’ve been, activities we’ve done and the food we like to splurge on 🙂 That being said, when it comes to travel rewards, we mostly use them to cover travel costs (which can add up significantly if you do a couple of international trips each year). They let us save anywhere between 5-10K USD each year. During the pandemic we did not travel, so we mostly accrued these points. We could have used them for cash back but we believe that as travel is resuming, they will still be worth more as airline mile than cash back. Does this answer your question?

Veg · June 14, 2021 at 7:39 pm

I really admire your low cost of living (that supports a thrilling lifestyle).

Of course, low spending each month can make accruing credit card points and sign-up bonuses more difficult. Non-frugal people should have an easier time accruing points. Their lavish spending may ultimately be self-defeating, but they probably don’t stress about earning most sign-up bonuses, for example.

I wonder: Do you have any special strategies that allow you to use your credit cards heavily (so you accrue many points, and earn sign-up bonuses more quickly), even though you keep your overall living expenses very low? I suppose it helps that you can pay for your housing (i.e., Airbnb) with a credit card.

Mr. Nomad Numbers · July 8, 2021 at 4:39 am

Hi Veg. We average a spending of about 30K per year. Knowing that the credit cards we open have a minimum spend between $1,000 and $4,000 we can easily open half a dozen credit card each year without much problem, especially since our major spending expense category is accommodation that we can easily paid through credit card (thanks to Airbnb). In term of strategy, I would recommend to group together your major expenses so you can put all of them on one credit card minimum spend. If you are traveling a lot like us and can’t easily open new credit card while overseas, I suggest using a service like Traveling Mailbox if your are in the USA (our review: https://www.nomadnumbers.com/traveling-mailbox-review/). Traveling Mailbox receive our credit card and scan it for us so we can use it for online purchase. Traveling Mailbox can also forward us our credit card anywhere in the world. Hope this helps!

Veg · July 8, 2021 at 1:43 pm

Your strategies are very wise!

Thanks for your replies, which I think will help many people.

2021 End of Year Travel Rewards Report — Nomad Numbers · February 14, 2022 at 12:31 pm

[…] 2020 Travel Rewards Report […]