This interview is part of our interview series, where we curate stories of regular people that decided to design a life they love. (click here to learn more).

Steven and Lauren from Tripofalifestyle.com

Some links to the products mentioned below are affiliate links, meaning that if you click and make a purchase, we (Nomad Numbers) may receive a commission at no additional cost to you. For more information please review our disclaimer page.

- Can you introduce yourself?

Steven & Lauren (S&L): We’re Steven and Lauren from Trip Of A Lifestyle, ages 29 and 30. We were born and raised near Tampa, Florida, and we currently live in Gainesville, Florida — although we also lived in California for 9 months, Hawaii for 6 months, and the back of an ever-moving van for 7 months! Beginning shortly after college graduation, we saved and invested anywhere from 50-90% of our middle-class salaries with a goal of reaching financial independence at a young age.

Life design journey

2. What does a typical day in your life look like for you today? How does it differ from your life before?

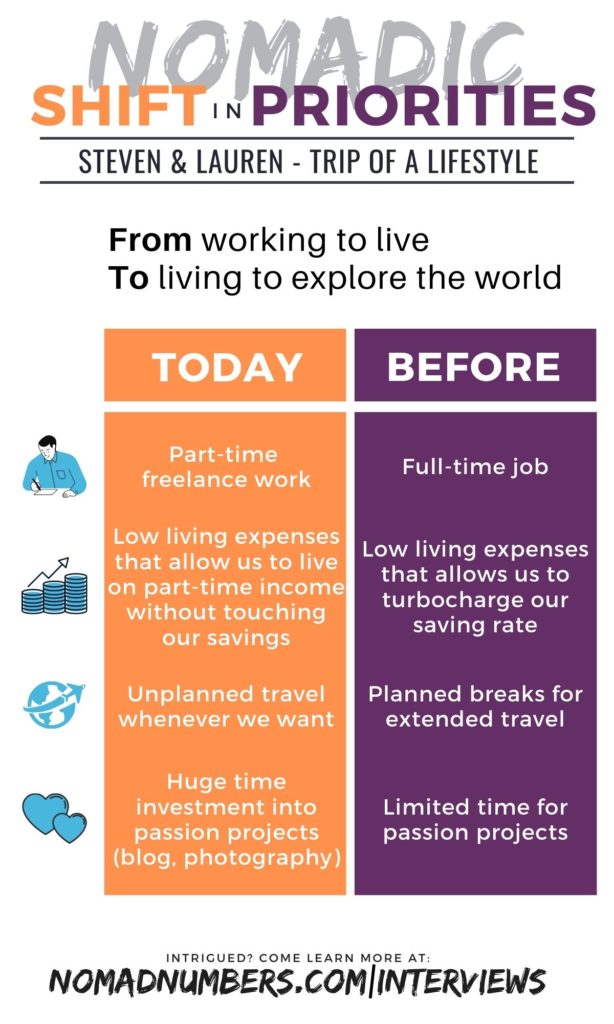

S&L: For the majority of our 20s, we worked full-time jobs and focused on saving money. We took some big, fun, and exciting breaks along the way, but for the most part, we stayed focused, keeping our living expenses low and building wealth. By age 29, we had accumulated enough money in investments to feel comfortable retiring from full-time work indefinitely. Now, we work a little on freelance gigs that can mostly be done remotely, and we spend the rest of our time relaxing, spending time with friends and family, and exploring the world (although some of that has been put on hold for the moment because of the COVID-19 pandemic).

3. What inflection point led you to decide to change your life trajectory?

S&L: In 2012, soon after college graduation, we got curious about investing money. This led us to discover Mr. Money Mustache and the FIRE (financial independence / retire early) movement. Once we understood that saving money could lead to freedom from mandatory work, our interest in spending money on possessions and luxuries disappeared.

4. What were some of the limiting beliefs that hold you back initially?

S&L: Initially, we were making about $38k per year per person, and we were able to save at least 60% of our take-home pay on those salaries. So, we knew our goals were totally within reach, but we didn’t expect to be able to permanently quit our jobs until at least age 40. We both underestimated our ability to make more money at more lucrative jobs, which is what eventually happened, accelerating us toward financial independence much faster.

5. What did you do to prepare the transition to this new destination and how did you do it?

S&L: Discovering the concept of financial independence (#fire) straight out of college made our journey surprisingly painless. Instead of trying to “undo” a high-spending lifestyle later in life, we really just had to maintain our college lifestyle for as long as possible. After graduation, we watched friends finance $25,000 cars and $250,000 houses with their newfound incomes, while we just kept sharing one decade-old Honda Civic and renting one-bedroom apartments for a while. These few initial decisions can make a massive impact, which is why we are really passionate about helping younger people find financial education resources (like our blog) as early in life as possible.

6. Once on the journey, what were some of the biggest wins you realized? What were the challenges you had to face along the way?

S&L: Right at the beginning, when we successfully saved $100,000 in 2 years on public school teacher-level salaries, we realized that our plan was definitely going to work no matter what. It actually gave us so much confidence and made us feel so free that it launched us into a 6-month honeymoon in Hawaii, after which we were able to purchase a modest home for cash.

7. How long did/will it take to reach the destination? Any advice to make the journey as enjoyable as possible?

S&L: We went from broke college kids to semi-retired 29-year-olds in under 8 years. For us, the key to making it enjoyable was taking big breaks as necessary. For us, that came in the form of travel, first to Hawaii, and later on a journey to all 62 US National Parks. Long-term travel doesn’t have to disrupt your savings goals. By setting up remote work opportunities and keeping our expenses super low by leasing apartments instead of using hotels, and living in the back of a converted camper van, our travel experiences didn’t decrease our net worth at all.

Cost of living

8. How much yearly expense did you have before and after this change in lifestyle?

S&L: Here’s an example of the costs of “lifestyle travel,” done our way. During our six-month honeymoon in Hawaii, we leased an apartment rather than staying hotels, bought a cheap used car instead of renting one, and used nature as our playground instead of paying for expensive tours and entertainment. At the bottom, an annual figure is extrapolated. Long-term travel doesn’t have to cost a fortune!

| Category | Description | Cost per month for two people combined |

| Accommodation | Anything you pay toward keeping a roof over your head (ie. rent, internet, water, utilities…) | $965 (rent for beachside 2/1 apartment) |

| Alcohol | Anything related to alcohol you purchase | $0 |

| Groceries | Anything related to the groceries you get to cook at home | $375 (Walmart and Costco!) |

| Dining out / Take-out | Anything related to what you spend when dining outside of your home. | $75 |

| Activities / Entertainment | Anything you pay related to ‘fun money’ (ie. park fees, outdoor activity, AirBnB experience…) | $40 (almost all free/nature-based) |

| Health Care | Any cost related to treatment you are receiving on a given location. | $0 (on parents’ plans under age 26 per ACA) |

| International Health / Travel Insurance | This is health.travel insurance that your purchase to get you covered outside of your home country | $0 |

| Local Transportation | Anything related to transportation within the boundary of the location you are staying at. | $185 (gas + insurance + maintenance for the used car we bought) |

| International Transportation | Anything related to transportation to go from one location to another. | $0 |

| Visa | Any cost related to a visa to stay in a given country. | $0 |

| Living expenses | Anything else that you are spending money on to live in a specific location that can’t fit anywhere else (ie. Haircut, Netflix, cell phone…) | $240 (electricity, Internet, cell phone) |

| Monthly total | $1,880 per month for two people | |

| Yearly total | $22,560 per year for two people |

9. What strategies have you used to reduce your expenses? And what strategies have you used to fund your lifestyle?

S&L: Reducing our expenses has been the single most important factor for our success. The two largest factors, by far, have always been housing and transportation. To reduce our housing costs, we initially rented small apartments nearby at least one of our workplaces, so that one of us could ride a bike to work every day, and the other could drive the car. After just a couple of years, we had enough money to buy a $71,000 condo for cash, eliminating rent altogether. Since it had 3 bedrooms (too much space for us), we rented out one of the rooms to friends on two separate occasions, netting us some extra cash along the way. As for cars, we’ve always shared just one between the two of us (even now), and it’s always been purchased significantly used. We think that $2,000 – $6,000 is the sweet spot for buying a reliable, used car in cash.

Lessons, tips & advice

10. If you had to do it again, what would you do differently?

S&L: We could say we would have invested more aggressively (100% stocks, for example), but hindsight is always 20/20, and performance has been very good. If the past 8 years had been a bear market instead, we wouldn’t be saying that.

11. What advice do you have for others who are considering going through a life design exercise?

S&L: Honestly, we could write a hundred pages on this topic. We follow a 6 steps process to go from zero to financial independence that we encourage others to consider. In a nutshell, these steps are:

- Step 1: Level yourself up

- Step 2: Build a surplus & safety net

- Step 3: Create a wealth explosion

- Step 4: Take a BIG break

- Step 5: Accelerate toward your destination

- Step 6: Ride off into the sunset

If you would like to learn more about these steps, check out their Financial Roadmap article.

12. What is one resource (blog, podcast, book beside your own) you recommend for those that want to design their own life?

S&L: Our favorite blog is Mr. Money Mustache.

Looking ahead

13. What is next for you?

S&L: Our life was so dramatically improved by all of this financial information. Our biggest passion right now is to reach young people with the same info, so that we can help others experience the same thing. We’re still putting a lot of time into our blog. But there are lots of fun travel adventures on the horizon, too!

Rapid-fire questions

We like ending every interview asking some fun rapid-fire questions to our guests

| What is your superpower & why? | Dirt cheap travel is our superpower since you can spend way less on travel per unit time if you’re willing to stay gone a little longer. |

| What is your favorite travel destination & why? | We love Death Valley National Park — in fact, we ranked it the best National Park in the United States. |

| What’s something you can never live without? | Air conditioning in Florida. |

| What’s the best piece of advice you’ve received? | When you’re not 100% sure of what you want to do in the future, just take the tougher path anyway and work really hard now, because it’ll leave you with the maximum number of options available later on (from Steven’s dad). |

Thank you so much Steven and Lauren for sharing your transformational life design journey with us. It is quite remarkable (& inspiring) to see this young couple – who started on regular teacher salaries – managed to get from a place with no savings in the bank to a place where they have saved enough to define work on their own terms/schedule and shift from a place where they had to work to live a life of exploration while they were still in their 20s! They haven’t stopped here since they are now using all the extra time they recoup from working part-time to spread what they have learned with people that could follow a similar path! We can’t wait to see what the next 10 years will bring them to!

If you want to know more about Steven and Lauren, you can find them on the following platforms:

- Blog: Trip Of A Lifestyle

- Facebook: @tripofalifestyle

- Twitter: @TOALifestyle

- Youtube: Trip Of A Lifestyle

- Instagram: @tripofalifestyle

Also don’t forget to check out these posts from their blog relevant to this interview:

- Their 6 steps financial roadmap

- How they successfully saved $100,000 in 2 years

- Their 6-month honeymoon in Hawaii

- How they purchased a modest home for cash

- Their journey to all 62 US National Parks

- Setting up remote work opportunities

- Living in the back of a converted camper van

- How they reduce their housing costs

- How to buy a reliable, used car in cash

Our Bottom Line

Here are the main lessons we took away from this interview with Steven and Lauren:

- Lesson 1 – It is never too late to start but starting early is better! – When Steven and Lauren discovered Financial Independence at age 22 they accomplished two things. First, they saw how consumerism would affect their path to financial freedom and subsequently decided to not spend their money on luxuries or unnecessary possessions. Second, by starting early they avoid making mistakes that some of their peers made (like getting a big mortgage on a house or purchasing an expensive car) which would have slow them significantly on their own journey.

- Lesson 2 – Dry-run your ideal lifestyle – Steven and Lauren wanted to reach early retirement but weren’t sure if they would enjoy the destination. Rather than chugging along a 10 years path, they were able to dry-run this lifestyle by taking a 6 months honeymoon. By shifting how they would approach this honeymoon (from a vacation mindset to a new lifestyle mindset) they were able to look at the pros/cons of this new life and confirm that they were on the right path early on, so they could make adjustment early on if necessary.

- Lesson 3 – You are worth much more than you think! – While Steven and Lauren started their career on modest teacher-level salaries (earning $38K a year each), they could not think they could supercharge their ability to earn more. But by developing new skills on the road and taking mini-retirement breaks they realized they could design a work schedule on their own which later led them to become both part-time employees.

- Lesson 4 – Reduce your expense – This has been Steven and Lauren’s biggest strategy to reach semi-retirement while still in their 20s. Similar to us they have been using various strategies to reduce their major expenses (like housing and transportation).

Sometimes we need to hear about others making unconventional decisions before we can have the confidence to make our own. If you have (or are on a path to) an unconventional journey to improve your life that has a nomadic component to it and is interested to share it, please reach out to us as we would love to consider your story for our blog.

2 Comments

Michelle C · July 27, 2020 at 10:03 pm

Another wonderful post as always. Thanks SO much for sharing these, Mr. and Mrs. Nomad Numbers! I love learning about the journey of others and seeing detailed breakdowns of their lives.

Mr. Nomad Numbers · July 28, 2020 at 1:04 am

It takes us time to put these interviews together so your comment means a lot to us as it is another validation that we make good use of our time by sharing such unique stories. We love finding people (like Steven and Lauren) that have designed truly beautiful and wonderful lives for them and we hope people will get inspired to rethink about their own! (Btw, if you do know people that you want us to interview, please feel free to send us an email and we will definitely consider them!).