If you’ve been following us for a while, you know that we are aspiring minimalists that have decided to sell most of our possessions in 2018 to make the world our home and nomadic travel our new lifestyle. As part of our journey, we became big proponents of the slow movement and have incorporated it into our lives beyond slow travel by embracing slow food and slow living which have made our lives more meaningful and fulfilling.

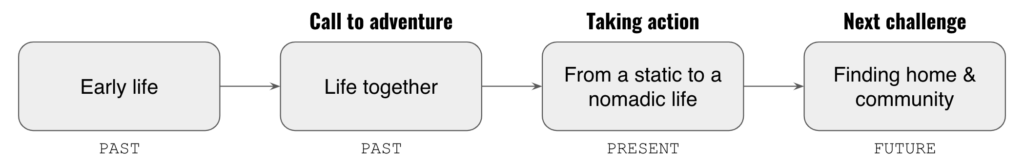

In this article, let’s slow down (pun intended) and take a step back to talk more about our origin story. Where do we come from individually, what brought us together, what led us to decide to leave most of our possessions behind us to become perpetual nomads and where do we see this new lifestyle leading us.

Stage 1: Early life

Before Mrs. Nomad Numbers and I met, we both went to school, graduated from college and got a regular job like many people do. I grew up in France and she grew up in California.

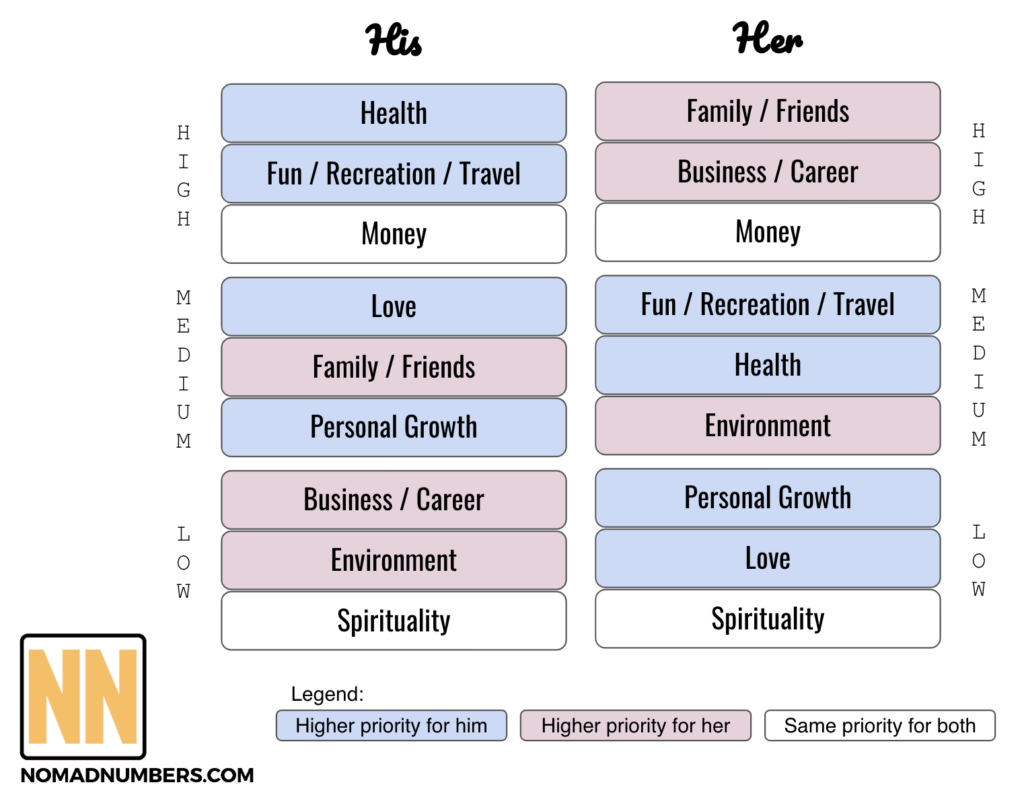

If we look at our priorities of our respectives lives at the time, the two things we had in common were that money felt very important while spirituality did not. The rest was pretty different. My top priorities were staying healthy (because without it the rest doesn’t matter) and travel. For Mrs. NN the top priorities were career and friends + family.

Note: While family & friends were important for me, as I moved away from home to start my career it was hard for me to make it a priority as my closest friends & family where 8,000 miles away from me.

The following illustration compares our priorities before we met and highlights the main differences:

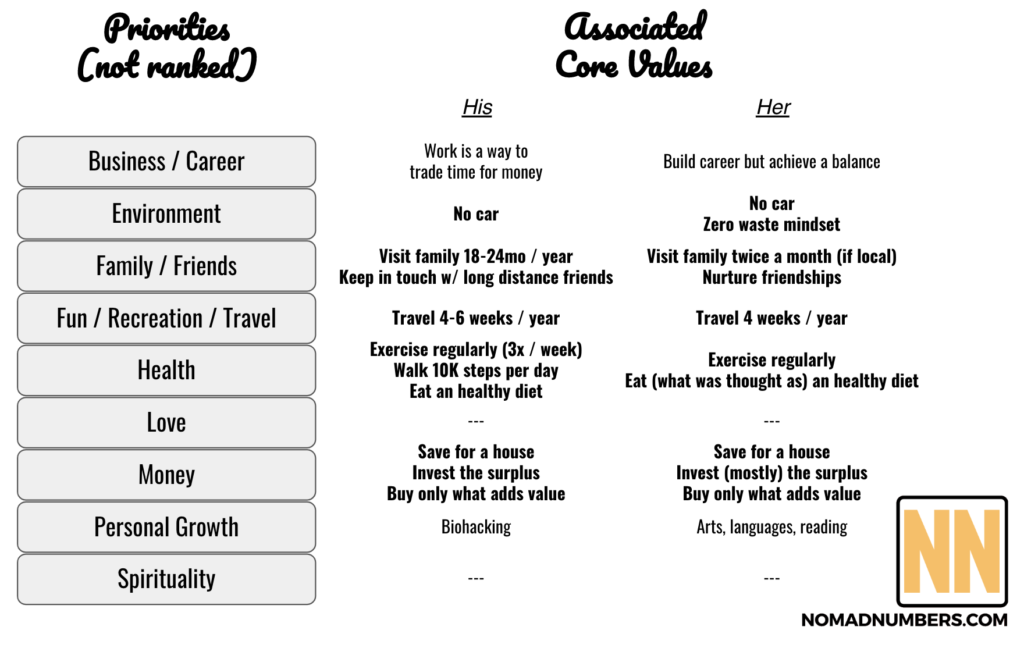

Since life priorities are pretty big items, I asked Mrs. NN to share with me what were the most important values for each of them. It was an interesting exercise to do because even though we ranked our priorities differently, the values we associated to them were pretty similar as you can see in the next illustration:

Stage 2: Life together & call to adventure

When we started dating (back in 2016), we built a strong bond around our common love for travel, which became a key foundation of our relationship. Within a few months of our relationship, we decided to plan a year to travel the world and started to research how much money we would need to save in the bank for what was going to be a trip of a lifetime.

Can long term travel be sustainable?

Through searching the web, we quickly found people reporting budgets for a year long trip around the world anywhere from $20,000 up to $340,000 apparently. Our attention got quickly diverted by two other groups of people that have a lifestyle centered around perpetual travel: digital nomads and early retirees. Let’s take a moment to explain who they are:

- Digital Nomads: these folks, usually in their 20s, have little savings but their jobs are location independent, which means they can work from anywhere as long as they have a solid Internet connection. Thanks to this independence they use what is called geo-arbitrage to adjust their cost of living based on how much money they need to save to sustain their travel. If they can’t find a job for a few weeks or months, they can go to a place where the cost of living is low (Oaxaca would be a good option) and when work is going well they can aim to go to places where the cost of living is higher (Aruba would then be a fantastic option if you want to relax after work). These folks can usually be found hanging out in Digital Nomad hubs such as Chiang Mai (Thailand), Bali (Indonesia), Medellin (Columbia) or Lisbon (Portugal).

- Early Retirees: these folks, usually older than Digital Nomads, have saved enough money upfront that they don’t have to work anymore. They have become financially independent (or FI) before the traditional retirement age which lets them make work optional. While most early retirees don’t travel full time, we stumbled upon couples that are perpetually traveling with pretty successful blogs, like Millennial Revolution (a Canadian couple that left the workplace in their early 30s to travel the world) or Go Curry Cracker (an American/Taiwanese couple that also retired in their 30s to travel and have since had a kid that they have been raising in Taiwan).

From this research, the Early Retirees group was the one that caught our attention the most. Now we wanted to know more about financial independence as well as the term FIRE that they’ve been using pretty often (we quickly found out that FIRE stands for Financial Independence, Retire Early).

Our Aha moment: the more you save the less you have to work

After countless reading of recommended blog posts, personal finance books and listening to hours of podcast episodes about FIRE, we realized that this concept made sense and that we’ve been already following the essence of it. For the readers that don’t know what I am talking about let’s take a moment to explain:

Financial Independence in a nutshell: once you have saved 25 times your projected annual expense post retirement, your wealth can now support your lifestyle (and a W-2 job can become optional).

Corollary: you retirement age is a function of how much you save and NOT how much you earn.

To illustrate this concept let’s take two people: Joe and Claire. Joe is a carpenter and makes $40,000 a year. He can live simply on $20,000 a year (which mean he saves 50% of his income). Claire is a surgeon and makes $300,000 a year. She enjoys a good life and spends $150,000 (which means she saves 50% of her income too). Who will become financially independent first? While some might say Claire because she makes much more, it turns out that they will both reach their Financial Independence after working for 16.6 years!

This blew my mind and we started to think differently about how we were going to trade our time for money in the future.

If you are interested to know more on this topic I suggest the following resources:

- Work Optional (by Tanja Hester) – This recent book is a very practical guide to FIRE with plenty of actionable steps and a checklist to help you along the way.

- The Simple Path to Wealth: Your road map to financial independence and a rich, free life (by JL Collins) – Once you are convinced that you want to pursue FI, you need to read this book. This is the book I always recommend to people that want to get started with investment. It is written by the Godfather of FI, JL Collins that we had the chance to meet in person in Ecuador back in 2017.

And since we’ve been pretty good savers with a saving rate of at least 50%, by the time we met we realized that we have already reached Financial Independence. Of course, like any big Aha moment, we were in denial for a bit, then started to challenge what we learned and it took us about one entire year to get over our fear and probably another year before we decided that we were going to take action and make work optional for us.

Stage 3: Taking action: from a static to a nomadic life

Fast forward to 2018. I gave notice to my job on May 1st while Mrs. Nomad Numbers decided to keep her job as she could work from anywhere. We gave notice to our apartment on June 1st and started aggressively selling/donating/giving away or recycling most of our possessions. On July 1st, we started to make the world our home by becoming full time nomadic. Through this transition, in 2018 we reduced our cost of living expense by nearly 50% and visited more cities in the last half of 2018 than we’ve done over the past few years alone.

We are still at this stage of our lives and could not be happier to have made this decision. Since then Mrs. Nomad Numbers left her job on March 1st, 2019 and we are now roaming the world freely, one location at a time. (We are currently living here).

Stage 4: Our next challenge: community & home

What is next for us? This is the question we started asking ourselves recently as we started to settle down into our new slow travel routing. We think that after slow traveling the world for 5-10 more years, we expect to have visited enough places (anywhere between 50 to 100 cities/places around the world) that should give us a pretty solid list of 1-2 places we would want to make a home base.

We still foresee travel as core to our lives but with one (or two) home bases to start growing a local and close community. Something that I personally thought would be easy to do on the go but is actually very challenging while moving every month or so to a new city/country.

Our bottom line

I am lucky to have met Mrs. Nomad Numbers 3 years ago. Without our common passion for travel, I would probably have totally ignored the Financial Independence concept and would probably still be working a 9-5 to save for an expensive house in an high cost of living area (California). I would have probably kept traveling 4-6 weeks a year and would have never discovered slow travel. I might have also postponed some of the places in my bucket list for a much further future.

As a couple, we are both grateful to have been raised with values that helped us save (more than spend) and make Financial Independence a reality in our 30s.

While slow travel has its advantages, it still has some challenges for us as we move forward with our lives. Our post fulltime nomadic life is not set in stone and what we share with you is just a direction we are setting for ourselves. We will likely make adjustments along the way and we are confident that we will keep embracing change as we’ve done it for the past years. What matters is that you listen to what you are the most passionate about (your call to adventure), keep being open to learning new things and when the time comes, take action to fully embrace your adventure. If you have been reading us for awhile, you probably noticed that we could not have been happier since we decided to live our dream of perpetual travel.

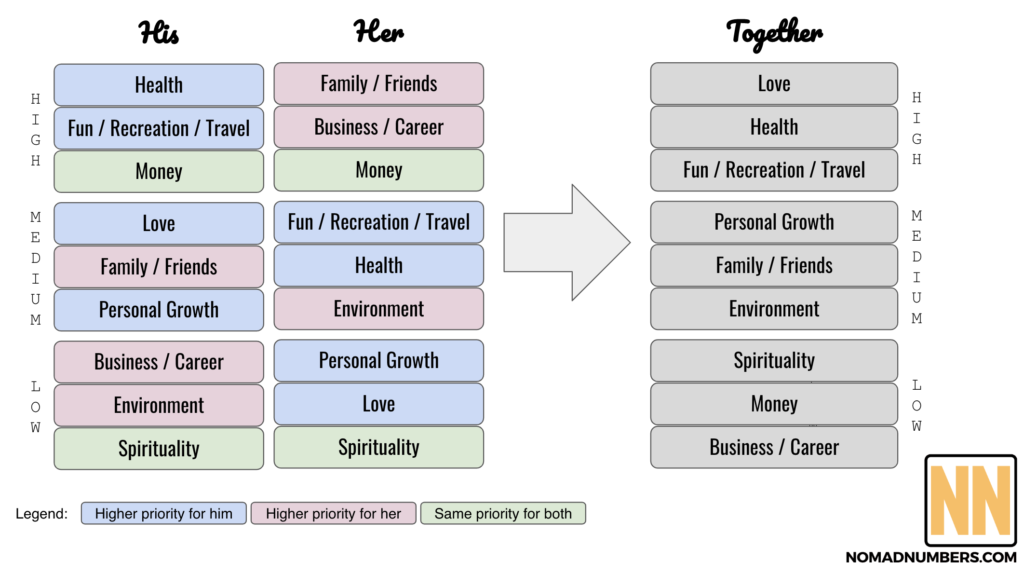

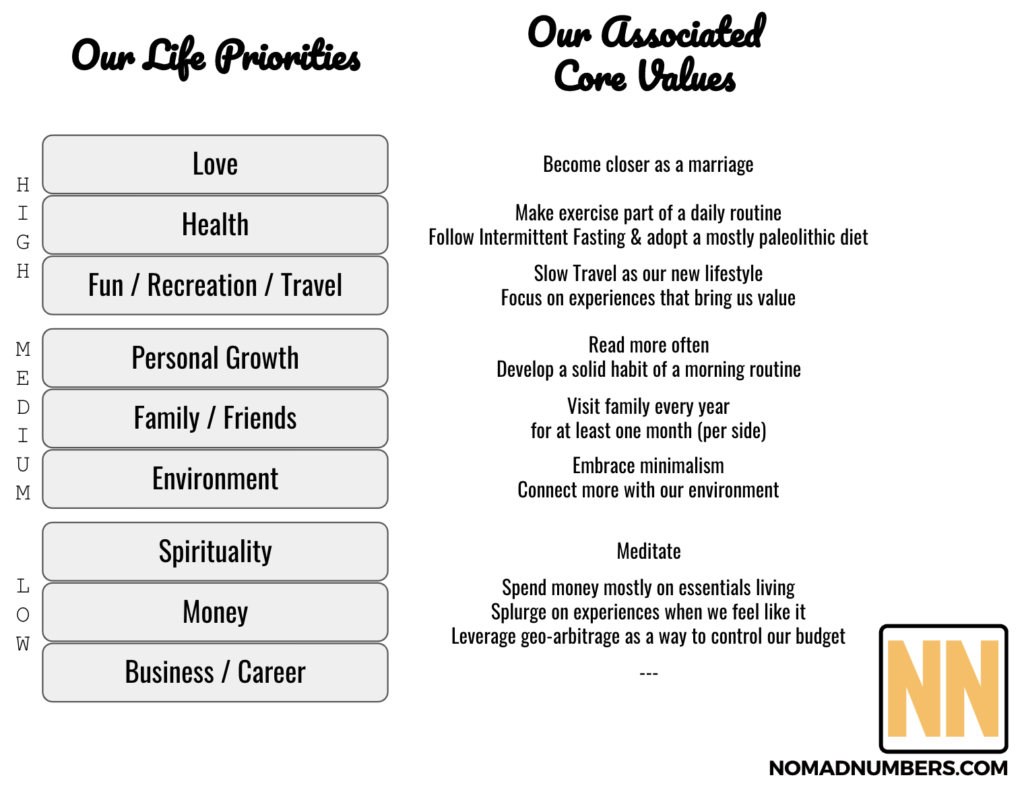

Bonus: since we’ve met and become a married couple, we have aligned both our life priorities.

As well as our core values:

What about you? How has your journey been? Since everyone’s story is different we would love to hear yours, so feel free to leave us a comment in the comment section below.

6 Comments

Have you found your ultimate journey? – Nomad Numbers · May 22, 2019 at 1:47 am

[…] How we decided to become nomads […]

Becoming Nomadic Through Real Estate investment – Nomad Numbers · October 21, 2019 at 4:00 am

[…] How we decided to become nomads […]

Destination Report: Porto - Part One: What to do, eat, see (& avoid) - Nomad Numbers · January 16, 2020 at 7:26 am

[…] save money in Central America or splurge (within reason of course!) in the Caribbean. One of the biggest advantages to us is the ability to spend long periods of time with family and friends that live in different […]

[Interview #006] Semi-nomadic lifestyle through minimalism and house sitting - Nomad Numbers · January 19, 2020 at 7:38 am

[…] but the savings rate.” – This is a great reminder and also a revelation to us when we first heard about it. But how boy what a powerful concept this is especially when you understand the simple math behind […]

What we learned from interviewing 12 nomadic couples and individuals travelers - Nomad Numbers · June 16, 2020 at 7:01 am

[…] Our origin story […]

Financial Independence and Slow Travel with Mr. Nomad Numbers | Episode #21 - Nomad On Fire · July 24, 2021 at 1:05 pm

[…] Their origin story – https://www.nomadnumbers.com/our-life-journey/ […]