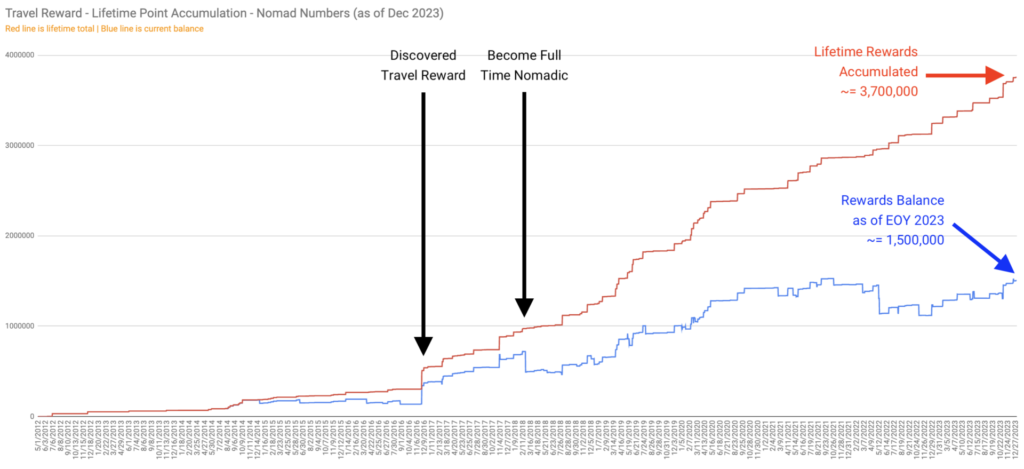

If you’ve been following us, you know that redeeming Travel Rewards is one of the core strategies we use to travel the world for less than staying at home in the US. In this blog post, we will give you a quick introduction to travel rewards before digging into our travel rewards earnings and travel rewards redemptions. We will also share which credit cards we opened, how much money we saved by redeeming these valuable points and what our plans are for 2024.

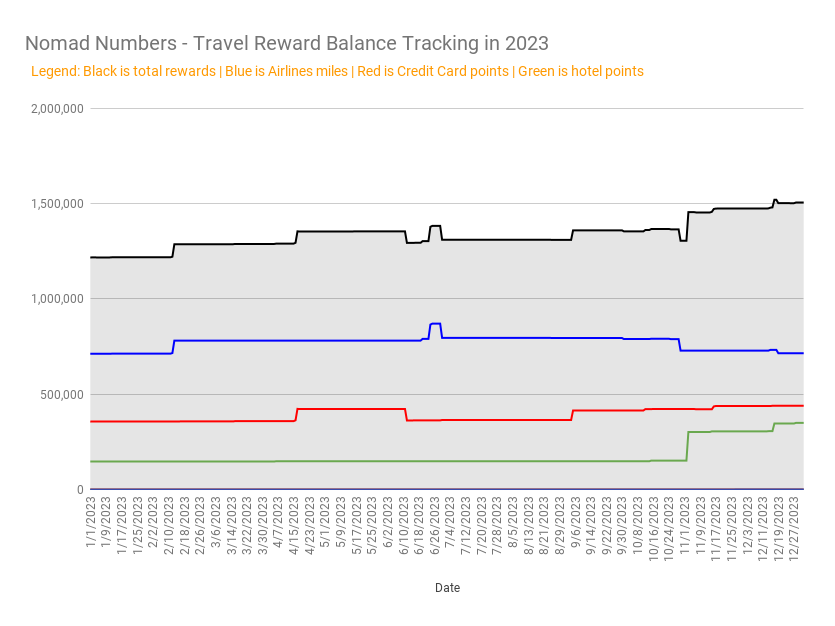

In 2023, our one year of travel rewards earnings was 513K points (worth ~$7,500 USD) and our travel rewards redemptions were 251K points. This leaves us with an extra balance of 262K points that we will be rolling over for the following year. Our current Travel Rewards balance is 1.5M points that we are saving for future international flights and hotel rewards redemptions.

Introduction to Travel Rewards

Travel Rewards (also referred to as “Credit Cards Rewards” or “Travel Hacking”) is where you open targeted credit cards in order to get large sign-up bonuses in the form of travel points, hotel miles or airline miles. You can then later redeem your points or miles to fund your flights or hotel stays. (Note: Such sign-up bonuses mostly benefit residents of the USA)

There are 3 types of travel rewards to be aware of:

- Airline or Hotel rewards – These rewards come from credit cards that are co-branded with either a hotel chain or an airline company.

Example: Delta SkyMiles Credit card, Chase United Explorer Credit card. - Fixed value rewards – These rewards are set in value and can sometimes directly be applied to the money you spend on your credit card to erase

- Transferable rewards – These points are the most flexible (and usually the most valuable) since you can either use the bank’s travel portal or transfer them to many different partner airlines and hotels.

Example: Chase Sapphire Preferred Credit card, Capital One Spark Business Credit card

IMPORTANT – Travel rewards only work if you have a good credit score, are able to pay your card in full on time and are ok to withstand a temporary 3-5 point decrease in your credit score after applying for such cards. If you don’t feel comfortable with any of these, please refrain from opening a new credit card.

THE MOST IMPORTANT RULE OF TRAVEL REWARDS!

How to Maximize Travel Rewards

Here are our pro tips to maximize your travel rewards:

- Pay your card in full every month. We can’t emphasize this enough! If you can’t pay your card each month, please don’t open a new card. Getting into credit card debt is not what we are discussing here. Please make sure that your financial situation is in order first. Nobody wants to unnecessarily increase their debt and lower their credit score.

- Understand the Chase 5/24 rule. If you open more than 5 credit cards in the past 24 months (across any credit card provider) Chase will not approve you for a new card. Since Chase is known for having the most valuable rewards points(called Ultimate Rewards), you want to prioritize opening your Chase cards first.

- Only aim to get at least $500 worth of total value (after annual fees) when opening a credit card. Don’t open a credit card that will give less than that (like a card with a one-time $50 credit on your next flight or online purchase). The reason for that is that you are limited by the amount of cards you can open with the Chase 5/24 rule.

- Avoid annual fees (unless it is really worth it). Most cards will void the annual fee. After that you can reassess whether or not you still get value by keeping the card open and paying the annual fee.

- Track your rewards in one place. We use a spreadsheet to keep track of every credit card we open. The information that is important to capture are:

- the name of the bank

- the name of the card

- the type of card (personal/business)

- the name and type (transferable. airline miles, hotel points…) of the reward you will be getting

- the day your card will renew (which is usually one year later)

- the bonus you will be getting

- the minimum spend you need to hit

- the date by which you need to hit your minimum spending limit

- whether or your not you have received the bonus

- whether or not you want to keep the card open in future years

- Alternate opening a card for you and your partner (if applicable). This is an easy way to double the benefits. This is especially relevant when bonuses are part of a limited time offer.

- Open business cards before hitting the Chase 5/24 limit. Business Cards don’t count towards the Chase 5/24 rule. So if you’re trying to stay under 5/24, you can still rack up points and miles bonuses with business cards without affecting your ability to sign up for Chase cards in the future!

For more on this topic, check out our How to fly around the world for (almost) free: our ultimate guide to Travel Hacking.

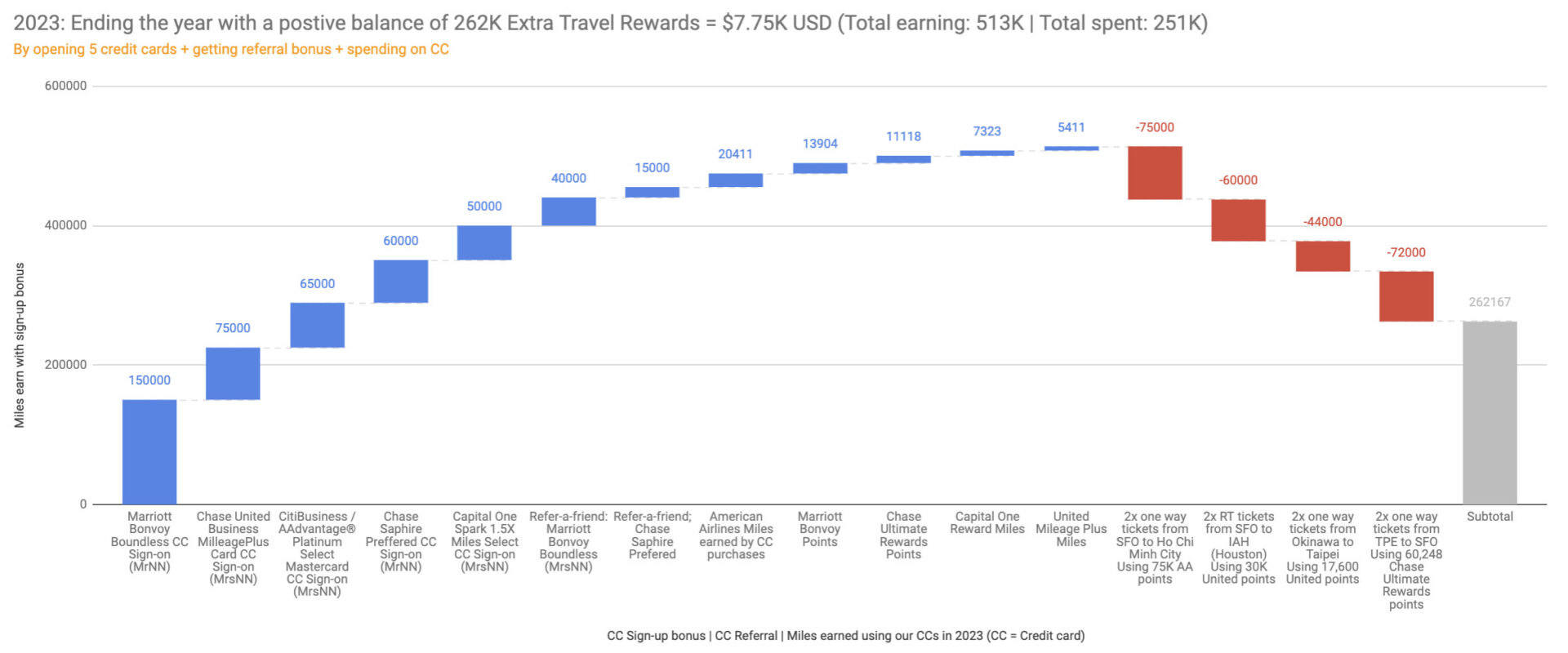

Detailed List of Travel Rewards Earning and Redemptions 2023

Now that we’ve introduced the basic concept of Travel Rewards and how to best use them, let’s look at how much travel rewards we earned and redeemed in 2023 so you can get a sense of how powerful this can be.

One Year Travel Rewards Earnings

Let’s start with a recap of how much travel rewards we earned from credit cards during the 2023 calendar year (note: we track only the bonus earned in 2023, some of these cards might have been opened the previous year).

Legend: “Points per $ spent”, is the amount of bonus points you get per dollar spent on the card until you get to the bonus minimum spend limit. “Bonus estimated cash value” is the value of the bonus using the Points Guy valuation’s page (as of December 2023).

As long as you spend money with your credit card, why not apply that money towards credit cards that will provide you with some juicy bonuses as we did in 2023?

Here is our breakdown:

| Credit Card | Sign-up bonus / Min Spent / Time to spend minimum spending | Bonus estimated cash value | Points per$ spent |

| Marriott Bonvoy Boundless | Up to 150,000 Marriott Bonvoy Points (3 free night) / $3K / 90 days | $1,200 | 50 |

| Chase United Business MilleagePlus | 75,000 United Mileage Points / $5K / 90 days | $1,538 | 15 |

| American Airlines AAdvantage Points | 65,000 American Airlines AADvantage Points / $5K / 180 days | $975 | 13 |

| Chase Sapphire Preferred | 60,000 Chase Ultimate Rewards Points / $5K / 90 days | $1,230 | 12 |

| Capital One Spark Business | 50,000 Capital One Points / $4.5K / 90 days | $925 | 11 |

| Credit card purchases | 20,411 American Airlines AAdvantage Points | $306 | N/A |

| Credit card purchases | 13,904 Marriott Bonvoy Points | $111 | N/A |

| Credit card purchases | 7,323 Capital One Points | $135 | N/A |

| Credit card purchases | 5,411 United MilleagePlus Points | $78 | N/A |

| Referral bonus | 40,000 Capital One Points using our Marriott Bonvoy referral link | $320 | N/A |

| Referral bonus | 15,000 Chase Ultimate Rewards Points using our Chase Sapphire Preffered referral link | $308 | |

| NET BALANCE (Earning – Spending) | 513,167Travel Rewards Points | $7,354 |

In summary, for 2023, we earned 513K Travel Rewards Points (the equivalent value of $7,354) using the following techniques (listed by order of preference):

- Sign on bonuses: we accumulated 5 sign-on bonuses between the two of us which have an estimated cash value of $5,867.

- Referral bonuses: we scored an easy $628 thanks to two CC referral

- Credit card spend: we earned an estimated cash value of $860 from using our credit cards.

One Year Travel Rewards Redemptions

Earning is one thing, but redeeming is where the savings kick-in. So let’s take a look at our travel rewards redemptions in 2023. In 2023 our primary goal was to spend time in Taiwan to become Permanent Resident, explore a bit of Asia and then visit our family and friends in the US.

In total, our one year travel redemption was 251K points.

Here are the redemptions we made in 2023.

| Airfare description | Travel rewards redeemed | Any additional cash cost to purchase the airfare | Estimated savings |

| [2023] 2x one way tickets from SFO (SF) to SGN (Ho Chi Minh City) | 75,000 American Airlines AADvantage Points | $32 | $1,125 (*) |

| [2023] 2x one way tickets from TPE (Taipei) to SFO (SF) | 72,000 Chase Ultimate Rewards Points | $0 | $864 (*) |

| [2023] 2x return tickets from SFO (SF) to IAH (Houston) | 60,000 United MileagePlus Points | $22 | $870 (*) |

| [2024] 2x one way tickets from OKA (Okinawa) to TPE (Taipei) | 44,000 United MilleagePlus Points | $28 | $484 (*) |

| 251,000 points | $82 in fees | $3,343 in estimated savings | |

| Net savings (estimated – fees) | $3,261 |

(*) Estimated savings using reward point valuation since we did not record the flight ticket price upon purchase which was likely much higher.

In total, we purchased 8 one way tickets by redeeming 251,000 points in Travel Rewards in 2023 (+ spent $82 on taxes and fees). This represents a net savings (after cash spent) of at least $3,261 which we would have had to pay out of pocket otherwise.

Notice that all of the flights were to cross continents because we tend to book flights through discount airlines for travel within Europe, Asia and Latin America. These discount airlines generally do not accept travel rewards but we will also keep you posted if we discover new hacks for this.

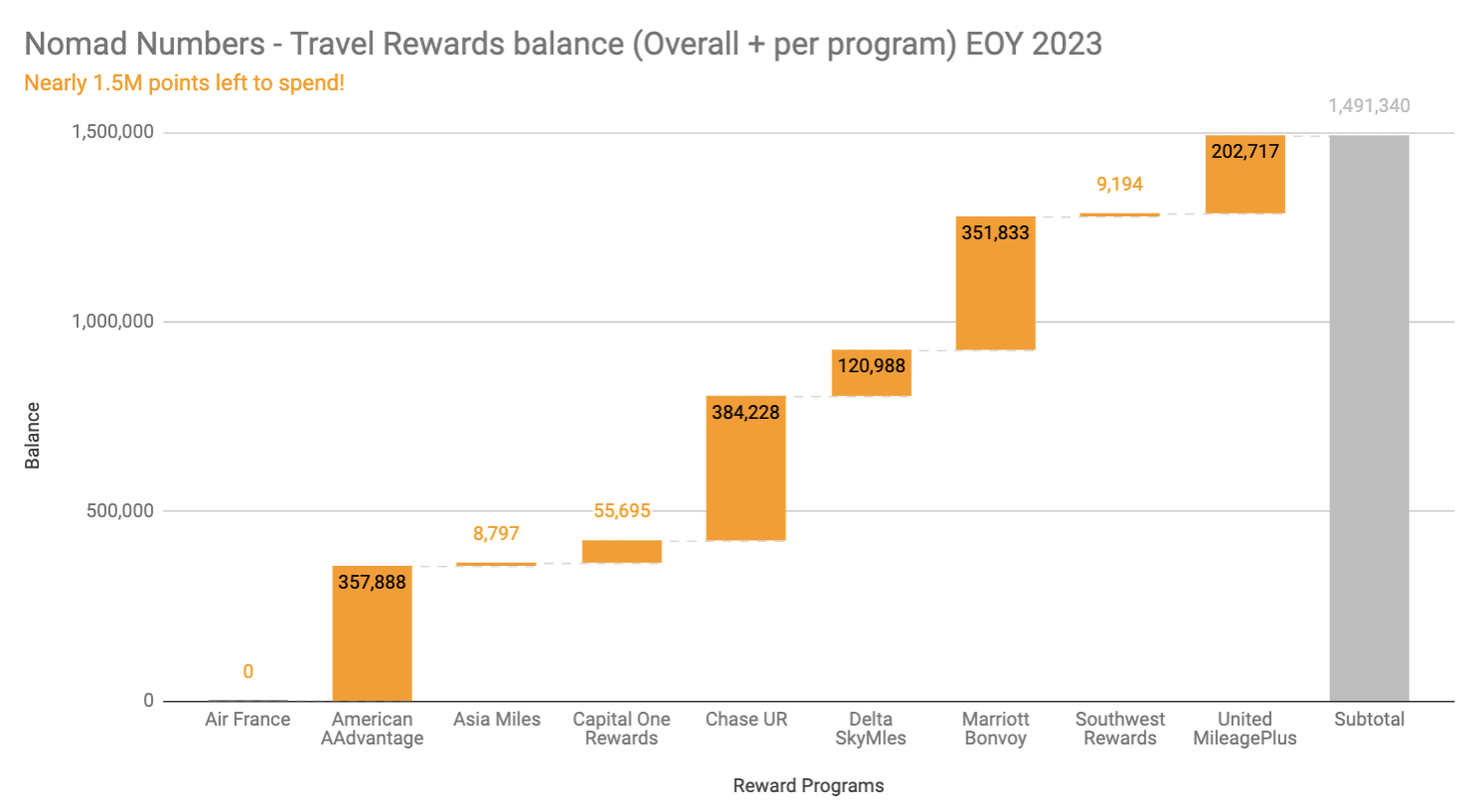

What are our Travel Rewards Plans for 2024?

Let’s start by looking at the details of our Travel Rewards balance of nearly 1.5M point at the end of 2023:

| Program | Type | Balance |

| Air France | Airlines miles | 0 |

| American Airlines AAdvantage | Airlines miles | 357,888 |

| Asia Miles | Airlines miles | 8,797 |

| Capital One Rewards | CC points | 55,695 |

| Chase Ultimate Rewards | CC points | 384,228 |

| Delta SkyMles | Airlines miles | 120,988 |

| Marriott Bonvoy | CC points | 351,883 |

| Southwest Rewards | Airlines miles | 9,194 |

| United MileagePlus | Airlines miles | 202,717 |

| TOTAL | 1,491,340 |

As for accumulating more, since there isn’t really a cost for us to open new credit cards to get this free money (beside filing an application form and waiting for our card to be electronically delivered to our virtual mailbox) , we still plan to open more cards in 2024.

Recommended Credit Cards for Earning Travel Rewards

We highly recommend that you start with the top Chase cards (Chase Sapphire Reserve or Preferred) to plan against the 5/24 rule.

If you already have those cards and are looking for other suggestions, please check out Credit Cards page where we put the latest credit card offers we’ve been using recently.

And if you’d like to stay updated on our finds, we suggest that you sign-up to our newsletter where we share the latest offer from the cards we’ve been recently opening.

Our bottom line

Thanks to Travel Rewards, we were able to earn 500K points (worth ~$7,500 in redemption) in 2023. We are excited to be able to put these points to good use and redeem travel in the upcoming year to keep enjoying the beauty of international travel.

What about you? Were you aware of Travel Rewards before and if so, what is the best redemption you’ve made? Did you open credit cards in 2023 and if so how much rewards did you get? Did we overlook something that would help us improve our game even further? Please leave your comment in the comments section below.

1 Comment

How to Travel for Free: Introduction to Credit Card Travel Rewards · June 7, 2024 at 11:15 am

[…] One Year of Travel Rewards Earnings & Redemptions 2023 […]