If you’ve been following us, you know that Travel Rewards is one of the core strategies we use to travel the world for less than staying at home in the USA.

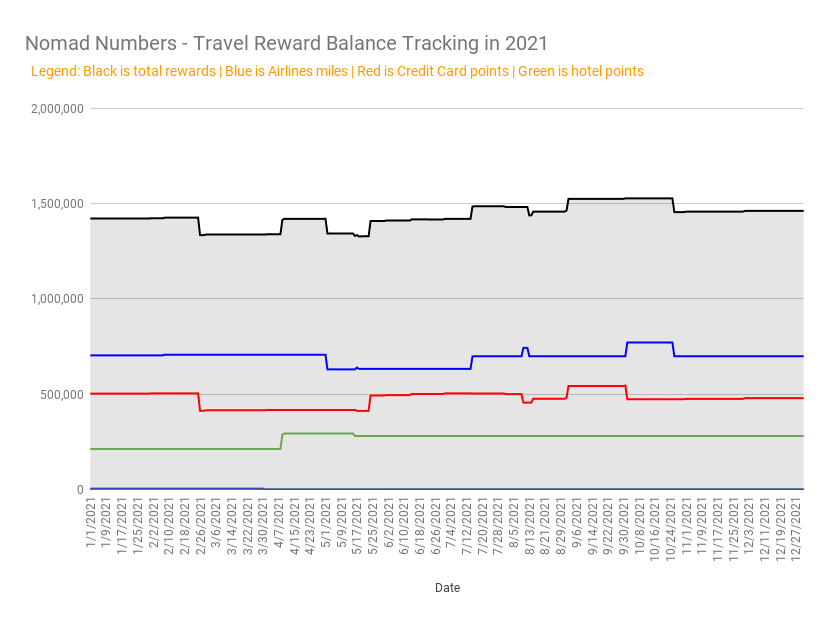

After accumulating about 1.5 million of Travel Rewards points in 2020 (worth about $25,000 in redemption at current valuation), we managed to accumulate some more and was also able to spend them again to enjoy some free international flights.

In this blog post, we will give you a quick introduction to travel rewards before digging into how many rewards we accumulated in 2021, which credit cards we opened, how much money we saved by redeeming these precious points and what our plans are for 2022!

Are you ready to talk about free travel money and see how much we got in 2021 by using Travel Rewards?

Travel Rewards 101

Travel Rewards (also referred to as “Credit Cards Rewards” or “Travel Hacking”) is where you open targeted credit cards in order to get large sign-up bonuses in the form of travel points or airline miles. You can then later redeem your points or miles to fund your flights or hotel stays. (Such sign-up bonuses mostly benefit residents of the US.)

There are 3 types of travel rewards to be aware of:

- Airline or Hotel rewards – These rewards come from credit cards that are co-branded with either a hotel chain or an airline company.

Example: Delta SkyMiles Credit card, Chase United Explorer Credit card. - Fixed value rewards – These rewards are set in value and can sometimes directly be applied to the money you spend on your credit card to erase(like the Capital One Venture and their Purchase Eraser)

Example: Capital One Venture Credit card, Barclaycard Arrival Plus Credit card - Transferable rewards – These points are the most flexible (and usually the most valuable) since you can either use the bank’s travel portal or transfer them to many different partner airlines and hotels.

Example: Chase Sapphire Reserve Credit card.

IMPORTANT – Travel rewards only work if you have a good credit score, are able to pay your card in full on time and are ok to withstand a temporary 3-5 point decrease in your credit score after applying for such cards. If you don’t feel comfortable with any of these, please refrain from opening a new credit card.

THE MOST IMPORTANT RULE OF TRAVEL REWARDS!

How to get the most out of Travel Rewards

Here are our pro tips to maximize your travel rewards:

- Pay your card in full every month. We can’t emphasize this enough! If you can’t pay your card each month, please don’t open a new card. Getting into credit card debt is not what we are discussing here. Please make sure that your financial situation is in order first. Nobody wants to unnecessarily increase their debt and lower their credit score.

- Understand the Chase 5/24 rule. If you open more than 5 credit cards in the past 24 months (across any credit card provider) Chase will not approve you for a new card. Since Chase is known for having the most valuable rewards points(called Ultimate Rewards), you want to prioritize opening your Chase cards first.

- Only aim to get at least $500 worth of total value (after annual fees) when opening a credit card. Don’t open a credit card that will give less than that (like a card with a one-time $50 credit on your next flight or online purchase). The reason for that is that you are limited by the amount of cards you can open with the Chase 5/24 rule.

- Avoid annual fees (unless it is really worth it). Most cards will void the annual fee. After that you can reassess whether or not you still get value by keeping the card open and paying the annual fee.

- Track your rewards in one place. We use a spreadsheet to keep track of every credit card we open. The information that is important to capture are:

- the name of the bank

- the name of the card

- the type of card (personal/business)

- the name and type (transferable. airline miles, hotel points…) of the reward you will be getting

- the day your card will renew (which is usually one year later)

- the bonus you will be getting

- the minimum spend you need to hit

- the date by which you need to hit your minimum spending limit

- whether or your not you have received the bonus

- whether or not you want to keep the card open in future years

- Alternate opening a card for you and your partner (if applicable). This is an easy way to double the benefits. This is especially relevant when bonuses are part of a limited time offer.

- Open business cards before hitting the Chase 5/24 limit. Business Cards don’t count towards the Chase 5/24 rule. So if you’re trying to stay under 5/24, you can still rack up points and miles bonuses with business cards without affecting your ability to sign up for Chase cards in the future!

For more on this topic, check out our How to fly around the world for (almost) free: our ultimate guide to Travel Hacking.

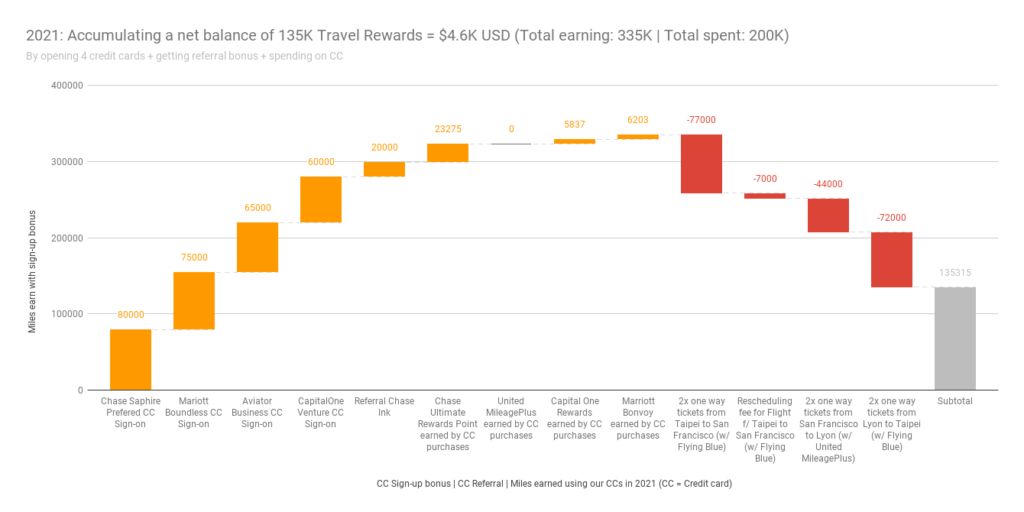

How much in travel rewards did we earn and redeem in 2021?

Now that we’ve introduced the basic concept of Travel Rewards and how to best use them, let’s look at how much travel rewards we earned and redeemed in 2021 so you can get a sense of how powerful this can be!

What did we earn?

Let’s start with a recap of how much travel rewards we earned from credit cards during the 2021 calendar year (note: we track only the bonus earned in 2021, some of these cards might have been opened in late 2020).

Legend: “Points per $ spent”, is the amount of bonus points you get per dollar spent on the card until you get to the bonus minimum spend limit. “Bonus estimated cash value” is the value of the bonus using the Points Guy valuation’s page (as of February 2022).

As long as you spend money with your credit card, why not apply that money towards credit cards that will provide you with some juicy bonuses as we did in 2021? Here is the breakdown

| Credit Card | Sign-up bonus / Min Spent / Time to spend minimum spending | Bonus estimated cash value | Points per$ spent |

| Chase Sapphire Prefered | 80,000 Chase Ultimate Rewards / $4K / 90 days | $1,200 | 20 |

| Chase Marriott Bonvoy Boundless | 75,000 Bonvoy Points / $3K / 90 days | $600 | 25 |

| Barclay Aviator Business | 65,000 United miles / $1K / 90 days | $910 | 65 |

| Capital One Venture | 60,000 Capital One Rewards / $3K / 90 days | $1,020 | 20 |

| Credit card purchases | 23,275 Ultimate Rewards Points | $466 | N/A |

| Credit card purchases | 5,837 Capital One Rewards | $108 | N/A |

| Credit card purchases | 6,203 Marriott Bonvoy | $50 | N/A |

| Referral bonus | 20,000 Ultimate Rewards Points using our referral bonus for the Chase Sapphire Preferred | $300 | N/A |

| NET BALANCE (Earning – Spending) | 160,756Travel Rewards Points | $2,243 |

In summary, for 2021, we accumulated 336K Travel Rewards Points (the equivalent value of $4,653) using the following techniques (listed by order of preference):

- Sign on bonuses: we accumulated 4 sign-on bonuses between the two of us which have an estimated cash value of $3,730.

- Referral bonuses: we scored an easy $300 thanks to a single CC referral

- Credit card spend: we earned an estimated cash value of $623 from using our credit cards.

We could not believe how easy that was, could you?

What did we redeem?

Earning is one thing, but spending is where the savings kick-in. So let’s take a look at our redemption in 2021. In 2021 our primary goal was to visit family in the USA + France before heading back to Taipei.

We spent 175K Travel Rewards (saving us about $2,400). Here are the redemptions we made in 2021.

| Airfare description | Travel rewards used | Any additional cash cost to purchase the airfare | Estimated savings |

| 2 one way tickets from Taipei to San Francisco | 84,000 Flying Blue | $69.7 | $1,008 (*) |

| 2 one way tickets from San Francisco to Lyon (France) | 44,000 United Mileage Plus | $172.78 | $484 (*) |

| 2 one way tickets from Lyon (France) to Taipei (Taiwan) | 72,000 Flying Blue | $220.90 | $884 (*) |

| 200,000 points | $463 in fees | $2,356 in estimated savings | |

| Net savings (estimated – fees) | $2,297 |

(*) Estimated savings using reward point valuation since we did not record the flight ticket price upon purchase but the market flight prices were likely closer to $5K.

In total we purchased 6 one way tickets using 200,000 Travel Rewards in 2021 (+ spent $463 on taxes and fees). This represents a net savings (after any cash cost) of at least $2,256 (up to $5K) which we would have had to pay out of pocket otherwise.

Notice that all of the flights were to cross continents because we tend to book flights through discount airlines for travel within Europe, Asia and Latin America. These discount airlines generally do not accept travel rewards but we will also keep you posted if we discover new hacks for this.

What are our plans for 2022?

Let’s start by looking at the details of our Travel Rewards balance of nearly 1.5M point at the end of 2021:

| Program | Type | Balance |

| Air France | Airlines miles | 0 |

| American AAdvantage | Airlines miles | 411,008 |

| Asia Miles | Airlines miles | 20025 |

| Capital One Rewards | CC points | 0 |

| Chase UR | CC points | 412,702 |

| Delta SkyMles | Airlines miles | 120,988 |

| Marriott Bonvoy | CC points | 214,908 |

| Southwest Rewards | Airlines miles | 9,194 |

| United MileagePlus | Airlines miles | 143,276 |

| TOTAL | 1,332,1010 |

Thanks to the efficacy of the vaccine, we feel comfortable traveling again outside of Taiwan in 2022.

As for accumulating more, since there isn’t really a cost for us to open new credit cards to get this free money (beside filing an application form and waiting for our card to be electronically delivered to our virtual mailbox) , we still plan to open more cards in 2022.

Which cards do we recommend?

We highly recommend that you start with the top Chase cards (Chase Sapphire Reserve or Preferred) to plan against the 5/24 rule.

If you already have those cards and are looking for other suggestions, please check out Credit Cards page where we put the latest credit card offers we’ve been using recently.

And if you’d like to stay updated on our finds, we suggest that you sign-up to our newsletter where we share the latest offer from the cards we’ve been recently opening.

Our bottom line

Thanks to Travel Rewards we were able to accumulate half a million points (worth $6,000 in redemption) in 2021. We are excited to be able to put these points to good use in the months to come and keep enjoying the beauty of international travel. Some of the destinations we are currently contemplating include Europe (Portugal? Spain?), America and eventually Australia. Let’s see how this plays out!

What about you? Were you aware of Travel Rewards before and if so, what is the best redemption you’ve made? Did you open credit cards in 2021 and if so how much rewards did you get? Did we overlook something that would help us improve our game even further? Please leave your comment in the comments section below.

0 Comments