This interview is part of our interview series, where we curate stories of regular people that decided to design a life they love. (click here to learn more).

Scott & Caroline from CostaRicaFire.com

Some links to the products mentioned below are affiliate links, meaning that if you click and make a purchase, we (Nomad Numbers) may receive a commission at no additional cost to you. For more information please review our disclaimer page.

- Can you introduce yourself?

Scott & Caroline (S&C): We are both 49 and have been married for 26 years! We met in high school in New York City, dated throughout college (we went to different colleges but both in New York State) and married a year after college, settling into a tiny apartment in Manhattan. We had our first child a year after we married and our second child five years after that. So, by age 30, we already had 2 kids and were well into our corporate careers. We focused early on saving, career, and raising a family, and saving early definitely gave us a jump start towards financial independence. With that said though, we were your typical dual-income in a High Cost Of Living (HCOL) city – making six-figures but still feeling like we were just getting by and watching every penny, as we tried to prioritize saving.

We focused early on saving, career, and raising a family, and saving early definitely gave us a jump start towards financial independence

Scott & Caroline

Life design journey

2. What does a typical day in your life look like for you today? How does it differ from your life before?

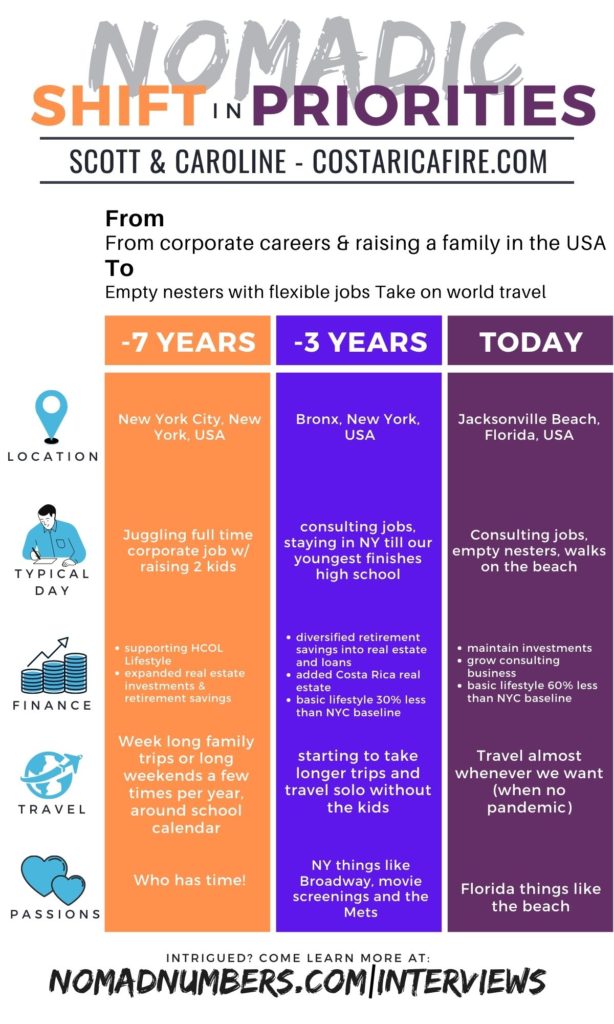

S&C: Our typical day starts with an hour-long walk on the beach around 6:30 am for sunrise, then a hot breakfast, and then we start our workday. We work for ourselves – Caroline as a career coach, Scott doing all the IT for Caroline’s business, and both of us working on the Costa Rica FIRE website. Our days are dictated by meetings or other events, but we often break up the day with afternoon naps, exercise, and sit-down meals. If you have space in your life for an afternoon siesta, we highly recommend it!

Our day is very different from even just last year, and unrecognizable compared to most of our adult life.

Compared to last year, the big change is that we now primarily live in Jacksonville Beach, Fl. Our youngest child started college last year (fall 2019), so being empty nesters, we didn’t feel like we needed to be in New York City full time. In fact, moving away from that HCOL city is strategically part of our financial independence journey.

Moving away from that HCOL city is strategically part of our financial independence journey.

Scott & Caroline

As an aside, we chose Jacksonville as our place to live because we started investing in rental property there in 2013, and fell in love during the many visits we’ve made. In Jax, we rent out several properties: a single-family home, both sides of a duplex and 2 condos. We are living in another condo that we used to rent out.

Compared to 5 years back and further, the changes have been enormous. When raising kids, some of the particulars depended on their life stage (preschool age, primary school age, teen years, etc) but the constants were that we were always both working and had to juggle busy careers and raising 2 kids: getting up early, getting kids up and out to school, working all day, and then juggling their activities, household chores, exercise, church, family events, etc. in the evenings and weekends. Like many working families, we would take a weeklong trip or long weekend a few times per year, but always around school holidays. Now that our kids are older, we have the flexibility to travel almost whenever we want.

3. What inflection point led you to decide to change your life trajectory?

S&C: We each had our own Aha moments, and as probably typical when dealing with couples, one person takes the lead, and the other has to be brought along! Caroline was first, and her Aha moment was around 2011-2012 when she turned 40. It wasn’t a mid-life crisis but a professional crisis. She had been working for herself as a career coach and business was booming but she felt topped out. She wanted to figure out how to untether our income from our time, and after some experimenting with growing her business via products, hiring subcontractors and the other obvious ways of growing a business, it occurred to her that we didn’t need the additional income to necessarily come from one of our jobs. We had started investing in rental real estate in 2005 in Asheville, NC, and we had done well with the properties and enjoyed the process. We decided to expand our real estate portfolio as a way to turn our active income into more passive income.

Caroline [had] her Aha moment was around 2011-2012 when she turned 40. It wasn’t a mid-life crisis but a professional crisis

Scott & Caroline

Caroline continued working on her business, but with a different mindset, as we used the next several years to add to our real estate portfolio, expanding our net worth and monthly passive income. Scott continued at his job, and his Aha moment didn’t come until around 2015. Scott was leading the IT department for a non-profit, so had a decent weekly schedule but never could take a long vacation or really unplug because technology was the backbone for the entire organization That was when our youngest child started high school, and he realized that in a few short years, she would be on her own and that we no longer needed to be tethered to New York City, especially with Caroline working to create a business for herself that could operate from anywhere. He wouldn’t leave his job until the end of 2016, but in that intervening time, we were able to use his job status to take out several more conventional loans to help expand our real estate portfolio and use his income to fund those additional purchases. When he finally left his job at the end of 2016, we were able to use that pivot to travel more, which led us to spend time in Costa Rica and then buying 3 properties there.

The biggest thing that enabled our transformation journey was our early focus on our professional career, saving, and getting our financial lives in order. Since we had kids shortly after graduating from college, the savings habit was started while our kids were young and growing up. Once that foundation was laid, it gave us the flexibility and courage to act on our Aha moments when they occurred – we were on solid footing to make significant changes as our kids got older and more self-sufficient. Our ‘how’ has changed over the years, but our ‘why’ was also about getting our financial selves in order to support a comfortable retirement. We just didn’t know till our 40’s that it could happen much earlier than age 65.

4. What were some of the limiting beliefs that hold you back initially?

S&C: We were narrow-mindedly fixated on growing our income around what we were already doing. We also had been raised around the traditional two-step strategy of 1) get a job and 2) save in the company retirement plan. Real estate was seen as something other people did – the rentals we started within Asheville in 2006 were a supplement for our traditional retirement plan, but that was all they were meant to be. It took a few more investments before we saw ourselves as “real estate investors” and before we realized that we could actually retire earlier than planned with our real estate and consulting in projects we love.

5. What did you do to prepare the transition to this new destination and how did you do it?

S&C: It wasn’t necessarily an orderly transition to a new destination according to a plan. The steps we took along the way were a combination of doing things that were financially sound but also things we enjoyed. And eventually, we realized those activities put us in a position to live differently.

It started with Caroline building her own business, slowly creating a professional career that could be done from anywhere. It continued with us using the spare money we had to expand our real estate portfolio, an activity we both enjoyed, and with the added benefit of diversifying our financial savings and adding a new source of passive income. Finally, we also moved to a cheaper neighborhood in New York City, transitioning from renting an apartment to owning. We bought so we could lock in our monthly housing expenses as well as lower our housing expenses (by over 30%). All these moves made it easier for Scott to eventually leave his corporate job, as we would be down one paycheck. Caroline also dove head-first into education around retiring abroad (favorite resource here: International Living Magazine) and thinking differently about money (favorite resource here: Financial Mentor).

All these key activities took place over multiple years, but eventually, when Scott left his job, he had much more flexibility in his time. Within a year after he left his job, we purchased 3 vacation rental properties in Costa Rica, which entailed several trips back and forth, something that could never have been done while working a tradition 9-5. Costa Rica had been on our radar for years as a possible international destination – we wanted international diversification for our portfolio in a place we like to travel to. It also represented a minimum FIRE level for us – we knew we could live there on our paper and real estate investments as they were, without us working at all. While we intended to keep working on our businesses, we wanted the peace of mind that if our business completely dried up or if we wanted to step away from it and try something else, we would still be OK.

6. Once on the journey, what were some of the biggest wins you realized? What were the challenges you had to face along the way?

S&C: The biggest reward has been the greater flexibility with our time. In the last 6 months, we have been to the beach over 50 times. We exercise more. We take naps in the afternoon. We cook at home and can eat a hot breakfast, lunch, and dinner (Caroline hates sandwiches and other cold meals.) Travel is a big part of the changes we’ve experienced – in just the last 3 years, we traveled to the Philippines several times, India, England, France, various road trips around the US, and many trips to Costa Rica. With the pandemic, we have put travel plans on hold, but we know we will start traveling again when it’s safe and responsible to do so.

While probably not what you would typically hear from married couples, it has been really rewarding for us to spend more time together the past few years. While we have very different professional interests as well as casual interests (for example, Caroline likes Broadway and Scott likes baseball games), our most common interests are the ones we enjoy now — traveling, eating meals at home, going to the beach for sunrise, and discovering new hiking trails.

Of course, there are challenges too when you don’t have a steady paycheck. We were on Scott’s employer’s insurance and while we were able to continue coverage with COBRA for 3 years, it cost over $3,000 per month to maintain the same coverage! The biggest challenge was getting used to not having a steady paycheck and living entirely on consulting income which is lumpy. It also has been challenging to work together since we have different workstyles and keep different schedules. The solution has been to divide responsibilities very clearly. Luckily, we enjoy spending time together personally so flexing our professional routine is a small price to pay to spend all day together.

7. How long did/will it take to reach the destination? Any advice to make the journey as enjoyable as possible?

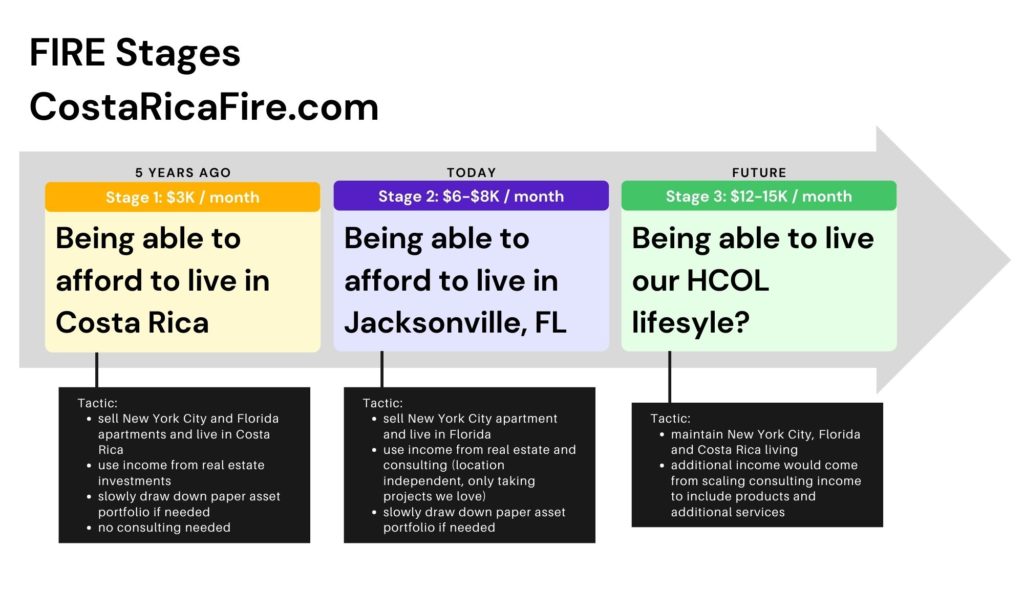

S&C: We have targeted FIRE in stages. Stage 1 is being able to live without working at all (consulting in our case) and just living off our portfolio – we hit a hypothetical Stage 1 by setting up a base in Costa Rica. We could move into one of our vacation rentals there, sell our apartments in New York and Florida, and be fine. Stage 2 is having our portfolio cover our life in Jacksonville, FL. We might already be at that stage, but the pandemic makes us wary about relying on our rental portfolio for being fully rented, and wary about our paper portfolio holding up in a potential economic downturn. So, we are currently focused on growing our consulting business, where we would have the most control. Finally, Stage 3, our ultimate FIRE goal, is to have a portfolio that covers having homes in Jacksonville and New York City and allows for lots of travel. At this time, our passive income doesn’t cover our ideal Stage 3, so we continue to consult and work to build other passive income streams.

8. What did the people around you (friends/family/colleagues…) think of your plan to take on this new life?

S&C: Most of our family and friends are not on the FIRE journey so we don’t discuss it. Unless they ask about what we’re doing, we think it’s preachy to assume others want to hear about it. Our family and friends know we invest in real estate and run our own consulting business and think it’s interesting that we are able to travel as much as we do and have as much flexibility as we do.

Cost of living

9. How much yearly expense did you have before and after this change in lifestyle?

S&C: We track our expenses so we can project into the future what we need to earn. We don’t like to budget because that’s just a guess.

- Stage 1 of FIRE – living in Costa Rica exclusively – would cost ~$3,000 per month.

- Stage 2 of FIRE – living in Jacksonville exclusively and giving up our New York City apartment – would cost $6,000-$8,000 per month depending on how much we travel.

- Stage 3 of FIRE – our ultimate goal – would cost $12-15k per month, depending on how much we travel.

In the past year, we’ve had 2 travel experiences that have shown us how inexpensive it can be to live a travel lifestyle and gave us a better idea of what is possible.

First, last September we spent a full month in Costa Rica. We stayed in one of our short term rental apartments so our housing was paid for (by the income from renting it the rest of the year), and we were able to see how inexpensive it is to live there as compared to being in New York City or Jacksonville. We rarely cooked at home (besides leftovers), and still only spent $1400 in food over the month. Since we enjoy the beach, our activity costs were minimal. Caroline even had a great experience at a local dentist. We know we could easily live in Costa Rica with $3,000 per month.

Second, just before the start of the pandemic, we spent some time in the Philippines. While Manila is already pretty cheap, we spent a week in Cebu, a major city in a different region, and found it to be even more inexpensive. We rarely spent over $15 for a big meal for 2, and many of our meals were much cheaper. The spas in Cebu were half the price compared to Manila, which is already way cheaper than in the US. We can already envision a lifestyle of ‘slow travel’ that is not too expensive where, for example, we would spend 3 months traveling to different locations in Asia, or perhaps expanding our Costa Rica trip to 2-3 months. We believe we would need more than $3,000 per month to live in the Philippines as we would expect the cost for healthcare to be higher and we are looking to use the Philippines as a base and then travel around (which would increase our transportation cost). (alternate: We believe we would need more than $3,000 per month to live in the Philippines as we would expect the cost for healthcare to be higher, and a comparable level of housing to our place in Costa Rica would be more expensive. Also, we would be looking to use the Philippines as a base and then travel around the region, which would increase our transportation costs. )

10. What strategies have you used to reduce your expenses? And what strategies have you used to fund your lifestyle?

S&C: The most important strategy for us in cutting expenses is geo-arbitrage. We established clients and a professional network in New York City, but moving from Manhattan to a cheaper neighborhood saved 30% on housing. Moving from that cheaper New York City neighborhood to Jacksonville, FL saved 60% on housing. Moving from Jacksonville to Costa Rica would cut total costs by 50% (and 70% compared to New York City).

Lessons, tips & advice

11. If you had to do it again, what would you do differently?

S&C: We wish we had bought real estate consistently over the years, especially when we had regular corporate jobs. As small business owners with lumpy earnings, we now have a terrible time getting credit. Had we completed our real estate portfolio in our 20’s or even 30’s instead of ’40s, we would have paid off our rental mortgages by now and have an additional thousands of dollars per month in cash flow. Also, we spent the first 20 years as adults renting an apartment before we finally purchased one. We passed up opportunities to buy an apartment earlier in our life, and the appreciation over time would have gone a long way to expanding our real estate elsewhere or doing a better job of funding the travel lifestyle we now want to have.

12. What advice do you have for others who are considering going through a life design exercise?

S&C: Our life changed when we were burnt out and stopped to ask if there was a better way. We knew we wanted to slow down. How could we do it? Once we asked How it made us more curious and open for an answer. It seems so obvious now that we liked real estate so just do more of that, but at the time we were all about our jobs and business income.

13. Looking back at your experience, what advice do you have for parents that think they need to work more (to earn more) to raise a family. Can you imagine a path that young parents can follow that will provide them with more time for themselves and their family without living a life of deprivation?

S&C: The strategies we are using, investing in real estate and geo-arbitrage, can be done when kids are at any age. We didn’t get serious about real estate investing until later, but we wish we had done more sooner. We elected not to move our kids out of school in New York City and relocate to a cheaper area, but we know plenty of families who move their kids, and they thrive. We didn’t employ the strategies until our mid-30’s and 40’s, but they absolutely could have been applied earlier and with younger kids.

14. What is one resource (blog, podcast, book beside your own) you recommend for those that want to design their own life?

S&C: We use Bigger Pockets to connect to other real estate investors. We also like the Norada real estate podcast. For general financial advice, we like Financial Mentor and Daniel Amerman. For geo-arbitrage, travel, and retirement destinations, International Living magazine has been an invaluable resource.

Looking ahead

15. What is next for you?

S&C: We’re FIRE Stage 2 going to Stage 3. We have bigger goals for our business, and ideally, we’d like to own real estate in other countries, not just in the US and Costa Rica. We would also like to travel more, as well as continue to support our kids, family, and causes we care about. Because of the pandemic, we’re being very careful with our money and not making any big moves right now. We had a real estate scouting trip to Portugal and Spain canceled this spring due to the pandemic. But we’d like to start investing and traveling again hopefully sooner than later.

S&C: As part of our continued effort to expand what we do into things that we like and things that are financially sound, we recently started working on an Etsy shop, selling digital downloads related to the financial independence journey. We like the idea of selling items online, but don’t like the idea of having inventory or shipping. With printable digital downloads, we can design and build items one-time, and then hopefully sell them for a long time.

Rapid-fire questions

We like ending every interview asking some fun rapid-fire questions to our guests

| What is your superpower & why? | We were slow to FIRE, having not discovered the concept until our 40’s! But once it crossed our radar, we jumped in wholeheartedly. So decisiveness is the superpower that most helped us here. |

| What is your favorite travel destination & why? | We love the beach, and when we are in Tamarindo, Costa Rica, we can walk to the beach and enjoy picture-perfect sunsets every evening. |

| What’s something you can never live without? | Each other |

| What’s the best piece of advice you’ve received? | We want to enjoy every single day and not take it for granted, which is an approach beautifully encapsulated in this Paulo Coelho quote: “The money we receive in return for our eight hours of work each day can be spent any number of ways; the only thing we cannot buy is extra time. So, during the minutes we have, I believe it is better to live a dream rather than to simply dream it. The dream is the start of something greater, something that impels us to make daring decisions. And it’s true that the person who pursues a dream takes many risks. But the person who does not runs risks that are even greater.” |

Thank you so much Scott and Caroline for sharing your transformational life design journey with us. It is quite inspiring to see how far you have come and that you manage to reach a pretty good level of financial freedom while raising a family. Something that a lot of people think isn’t easy (or even possible) to achieve! As for now, we hope that you will get your last stage of FIRE and keep enjoying the journey along the way!

If you want to know more about Scott and Caroline, you can find them on the following platforms:

- Blog: Costa Rica FIRE

- Facebook: @CostaRicaFIRE

- Twitter: @costaricafire

- Instagram: @costaricafire

- Pinterest: @costaricafire

- Etsy: @prescopresco

Interview resources

Don’t forget to check these additional resources that are related to this interview:

Our Bottom Line

Here are the main lessons we took away from this interview with Scott and Caroline:

- Lesson 1 – “The most important strategy for us in cutting expenses is geo-arbitrage” – Scott and Caroline are other couples that is realizing the benefit of geo-arbitrage. By planning their “retirements” year outside of the USA they can achieve a similar (if not better) standard of living for much less since they could live in Costa Rica for $3,000 a month, while their lifestyle in New York would cost them well above $10,000 per month! Mrs. NN and I have been in so many countries that we are comfortable saying you could easily live outside of the USA for $2,000 a month (check our cost of living reports for some examples).

- Lesson 2 – “Our life changed when we were burnt out and stopped to ask if there was a better way” – Similar to Emily/Ryan or Stephanie/Gillian (that we recently interviewed), it is only when people face a major “crisis” in their lives that they are open to looking at alternatives.

- Lesson 3 – The destination is as important as the journey. – Rather than depriving themselves and their family to become financially free, Scott and Caroline have built their road to financial independence into stages that provided them incremental comfort and freedom through their lives without deprivation, hence making the journey as enjoyable as the destination.

- Lesson 4 – Raising kids and retiring early aren’t conflicting goals! – Scott and Caroline have been able to build their plan to travel the world while still raising kids. And while they decided not to move their kids away from New York, they have mentioned that they know plenty of families that have taken this approach. Showing that you can raise kids and still aim to retire early, even with younger kids.

Sometimes we need to hear about others making unconventional decisions before we can have the confidence to make our own. If you have (or are on a path to) an unconventional journey to improve your life that has a nomadic component to it and is interested to share it, please reach out to us as we would love to consider your story for our blog.

3 Comments

David @iretiredyoung · September 1, 2020 at 2:25 pm

This seemed to be a different type of story to most that you have interviewed previously, so it was nice to see the difference, for example, still working on the consulting business and some big numbers for stage 3 FIRE. I was also interested to read that they are interested in expanding their rental portfolio into more countries – I wondered if that sounds more complex in terms of managing the properties and also the tax implications.

Caroline at Costa Rica FIRE · September 2, 2020 at 12:02 pm

Hi David, thanks for the interest in our story! When looking at properties we do prioritize simple situations — in CR, for example, foreigners are able to buy, title is very clean, we were able to get referrals to a lawyer, re agent, prop mgt, accountant. For any other geo that we consider, we would look for a similar set-up. We firmly believe you need prop mgt on the ground. I know some US re investors who manage out of state, but still you’re dealing with the same country’s laws and tax regulations, and we don’t manage our US rentals — we believe that prop mgt is a skill and a job in itself, and we elect to do what we love and our good at (in my case, HR and in Scott’s case, IT).

David @iretiredyoung · September 2, 2020 at 12:51 pm

Hi Caroline, thanks for the feedback. We also have a number of rental properties and, like you, we use an agent. Other than it making things simpler, I feel that as we charging the tenant a market related rent and expect them to pay on time and respect the tenancy agreement and our property, we in turn should provide a good quality/professional level of service. A professional property agent lets us do that.

Good luck getting to your Stage 3 FIRE