Last week we shared a comprehensive guide on how we’ve invested our money to retire early (Read: How to Invest for Retirement – A Guide to the 4% Rule). Some of our readers have been reaching out to us asking how they can get started in the simplest way possible as they felt that managing their finances themselves was a pretty daunting and overwhelming task for them to take on.

Well, thanks to the right tools, achieving your financial goals becomes more attainable. In this post, I’ll be sharing our experiences and insights into a revolutionary financial platform that we are using that has transformed the way we approach wealth management: Wealthfront. Are you ready to put your money on auto-pilot?

Disclaimer: some links to the products/services mentioned below are affiliate links, meaning that if you click and make a purchase, we (Nomad Numbers) may receive a commission at no additional cost to you. For more information please review our disclaimer page.

What is Wealthfront

Wealthfront is not just an app; it’s a financial companion that offers a range of features designed to make your money work for you. From automated investing and robo-advisory services to tax-efficient strategies and a high-interest cash account, Wealthfront provides a comprehensive solution to navigate the complexities of personal finance. The user-friendly interface ensures that managing your finances is not only efficient but also accessible.

Note: Please be aware that Wealthfront is currently accessible only to residents in the United States. If you’re seeking alternatives, here are some ideas for other countries:

– Australia: Raiz Invest

– Canada: Wealth Simple

– France: Yomoni

– UK: Nutmeg

Please note that these alternatives may differ from Wealthfront and often have higher management fees.

Why Choose Wealthfront

Wealthfront stands out for its cost-effectiveness with low fees and economical investment options, a significant advantage for the long-term performance of your investments. (Wealthfront charges a mere 0.25% management fee, a stark contrast to the 1-2% typically levied by traditional financial advisors)

Our admiration for Wealthfront extends to its exceptional performance in:

- Crafting diversified investment portfolios.

- Tailoring portfolios based on your individual risk tolerance.

- Allowing portfolio customization (for those who prefer hands-on control).

- Implementing tax-loss harvesting, a tool to minimize you tax bill every year!

- Letting you simulate your retirement scenarios based on various life events

Who is Wealthfront for? We like to say that Wealthfront is best for someone who’s looking to make as few financial decisions as possible as well as someone who enjoy lots of features and messing around with graphs and charts 🙂

Getting Started With Wealthfront

In this section, we’ll walk you through the majority of Wealthfront’s features and guide you on getting started.

Creating your Wealthfront account is easy. Just sign up for the service, move money from your bank account, define your portfolio allocation and begin investing. It’s as straightforward as that!

If you want to get started by using this referral link to sign up, you will get your first $5,000 managed by Wealthfront for free! (while supporting our blog at not additional cost to you)

1 – Account Linking

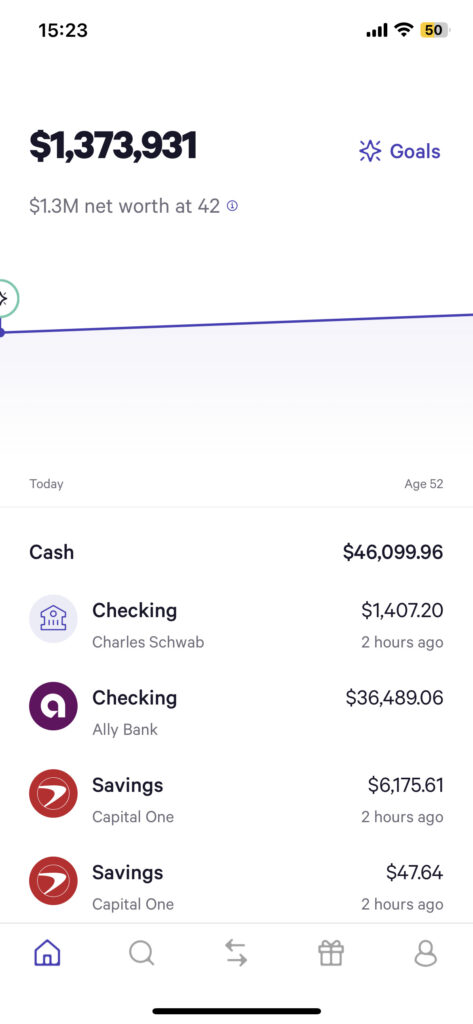

Once you log in to the app, you’ll find your dashboard. This dashboard displays your overall net worth, breaking down the balances of the various accounts you own by type (cash, investments, real estate, assets, liabilities).

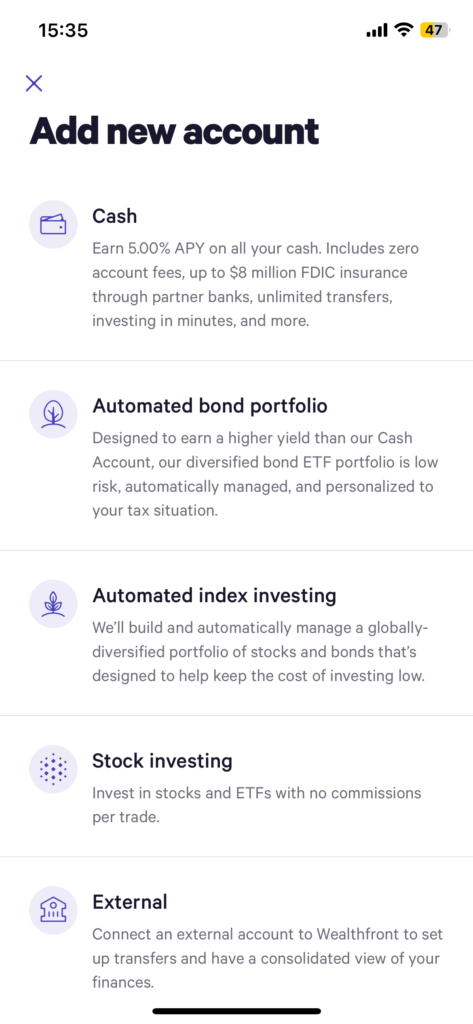

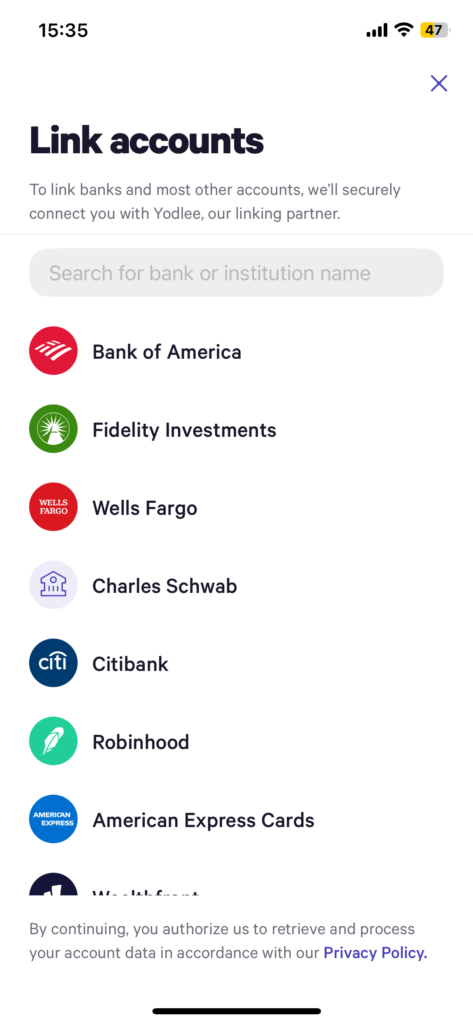

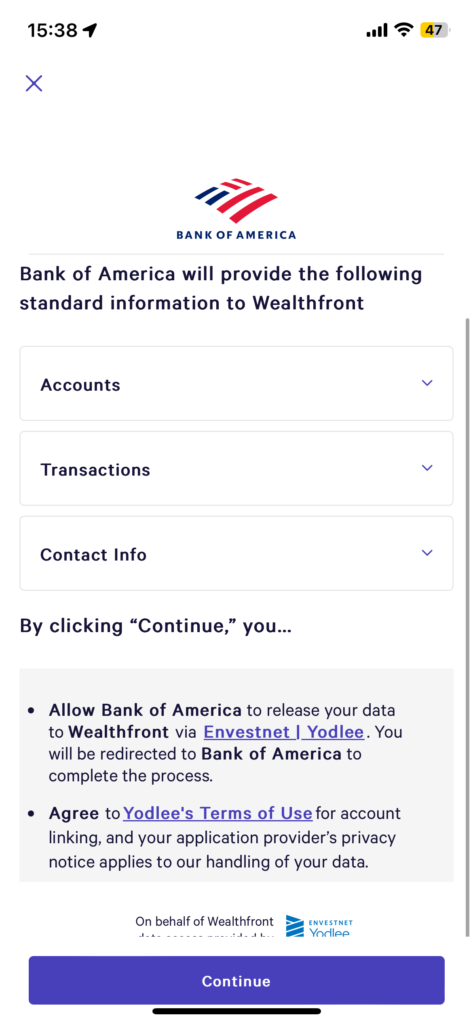

This initial step provides a comprehensive view of your finances, showing you how much money you have and where it’s distributed. Take a few minutes to enhance this overview by scrolling to the bottom of the page and selecting “Add new account.” Opt for “External” and add all your bank accounts.

After adding all your accounts, your dashboard will fill up with the total net worth and how it changes over time. This reflects your savings and earnings, giving you a snapshot of your financial progress.

Important: Please note that we’ve been using a demo account for the purpose of illustrating these features, so the numbers you are saying are not representative to our assets!

2 – Retirement Goals

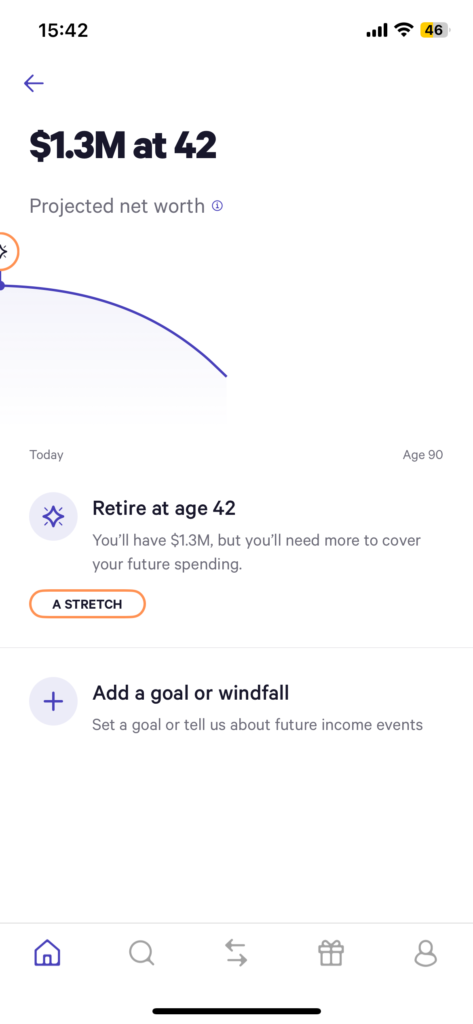

You can take it a step further by checking your eligibility for retirement. Click on the Goal button, answer a few questions, and Wealthfront will predict how your net worth will evolve and when you could retire. Wealthfront allows you to consider specific events such as expecting a windfall, social security benefits, selling real estate, planning a trip, preparing for a major expense, buying a house, or saving for college!

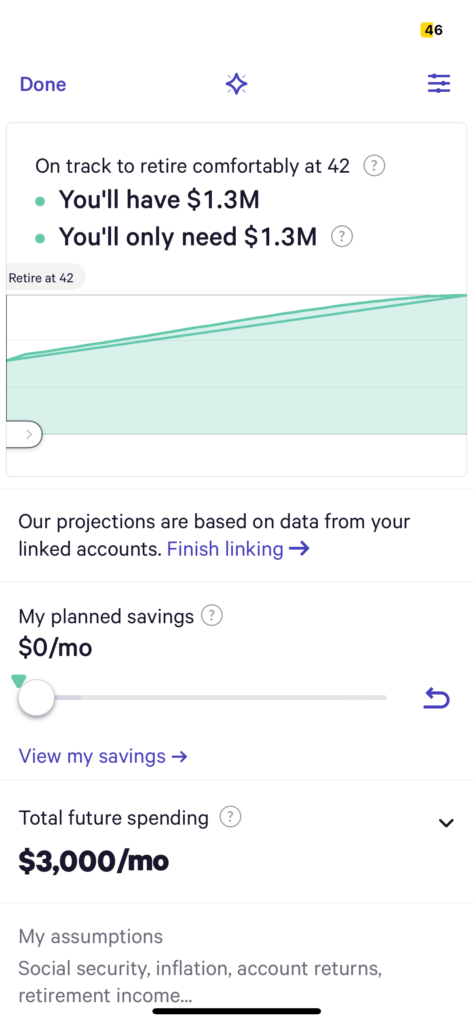

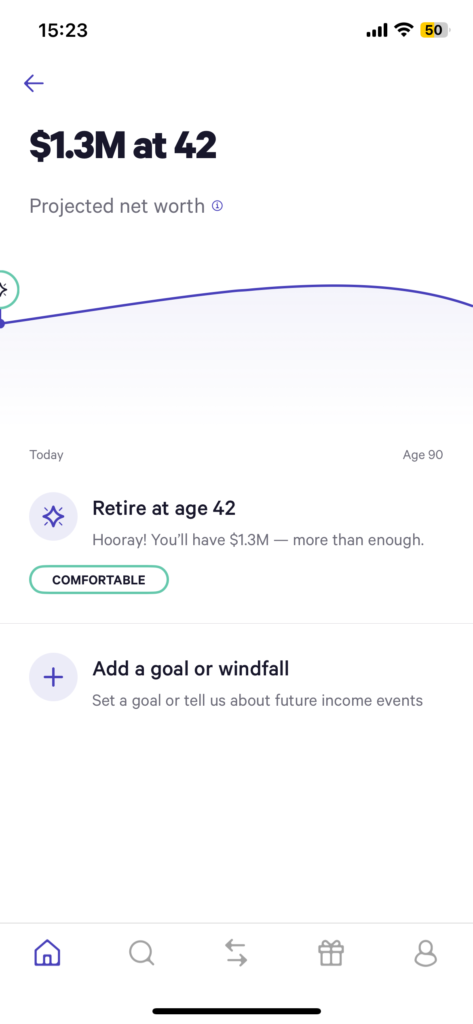

In the example below, we set a monthly spending of $3,000 (or $36,000 per year), and Wealthfront confirms that with $1.3 million, we can already retire! Woohoo!

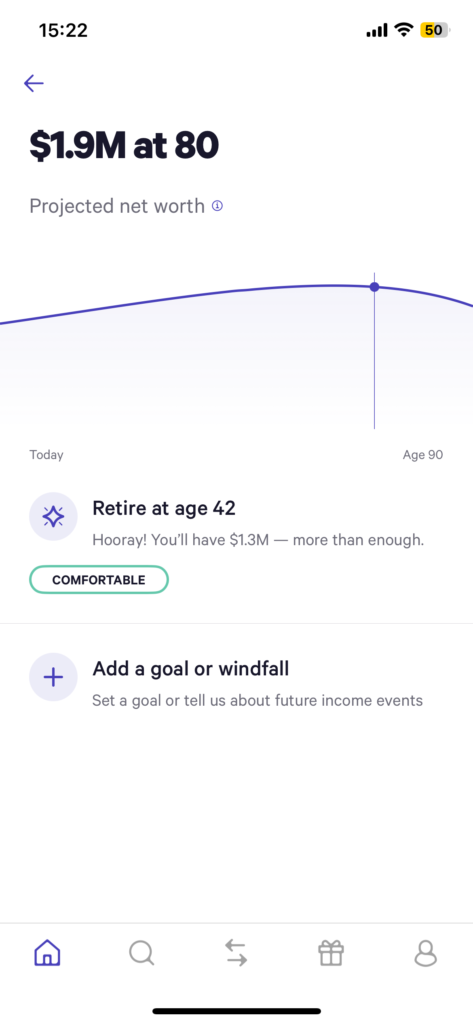

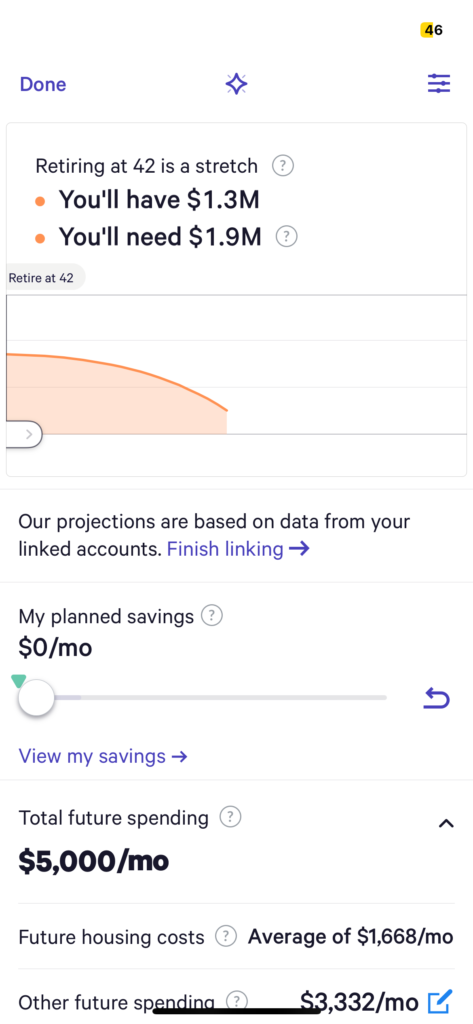

In this second example, we set a monthly spending of $5,000 (or $60,000 per year), and Wealthfront indicates that it’s not currently comfortable for us to retire with our existing net worth.

It looks like Wealthfront use a safe withdrawl rate of 3.15% for their retirement planning.

3 – Setting Up Investment Account

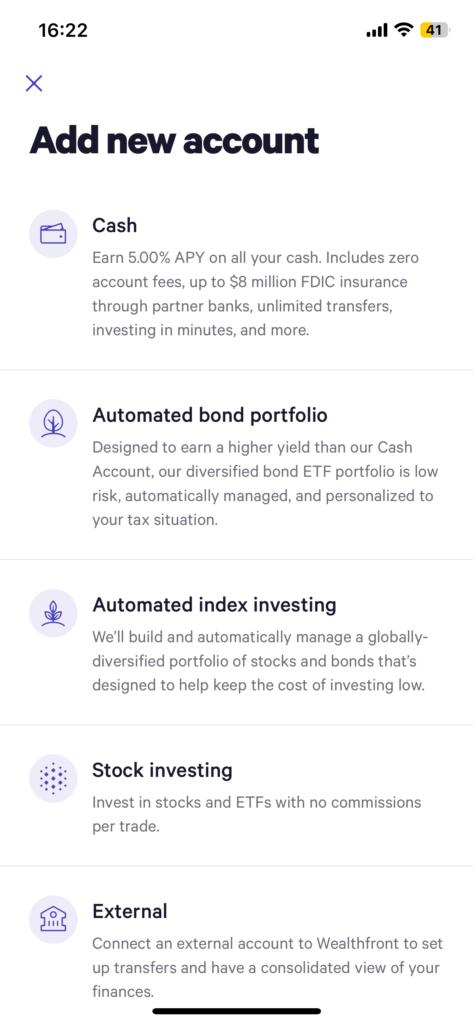

Now, it’s time to take control of your investments. Wealthfront offers you the option to open an investment account directly from the app.

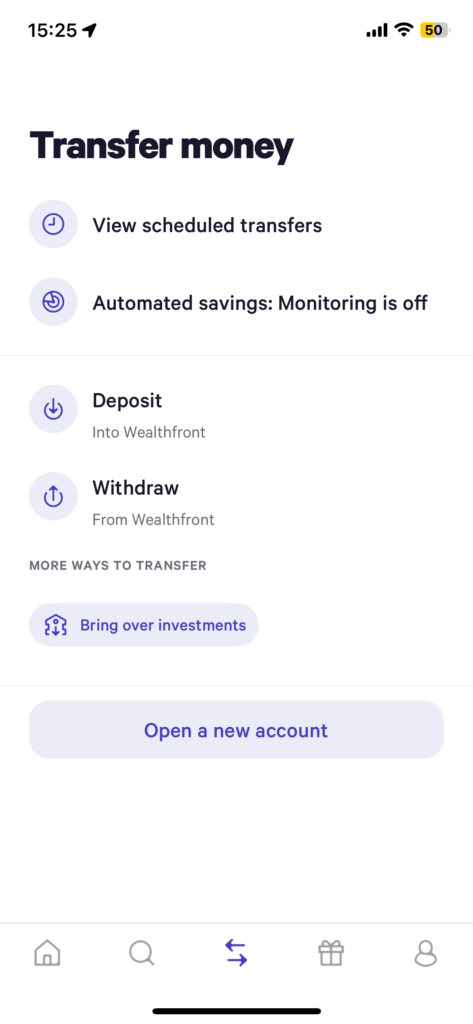

You can fund your account in two ways:

- Transfering money from your bank

- Transfering money from existing brokerarage of retirement accounts

Account Creation

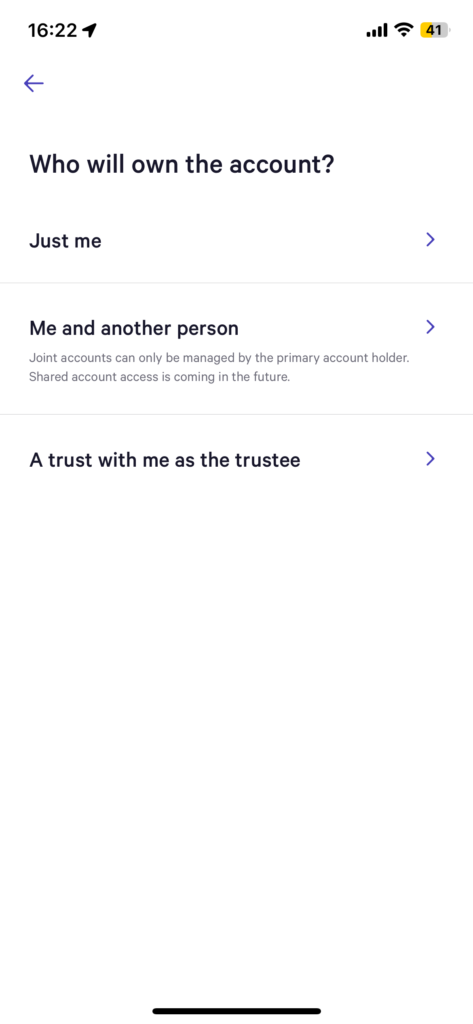

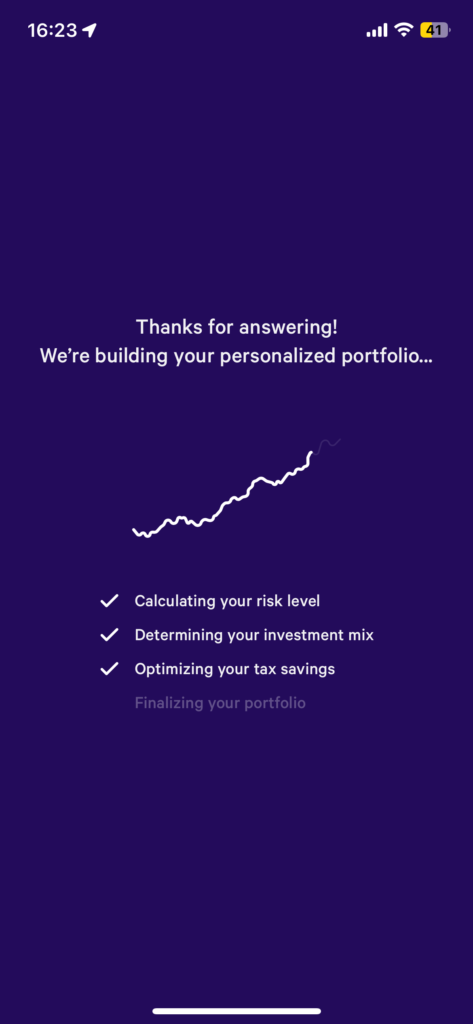

To initiate your Wealthfront account, choose “Automated Index Investing.” Next, specify whether the account is for you or you and your partner. Finally, select the type of portfolio you wish to open. Wealthfront will then craft a personalized portfolio tailored to your risk tolerance.

Portfolio Selection

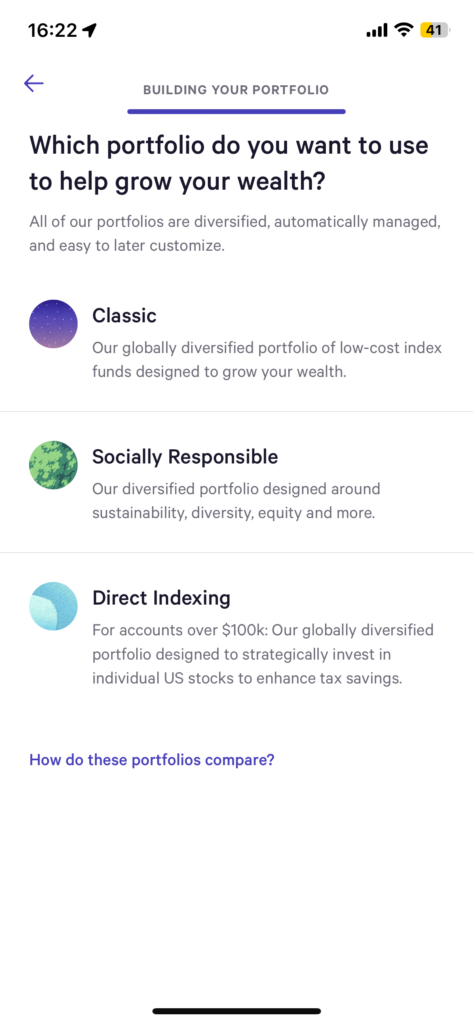

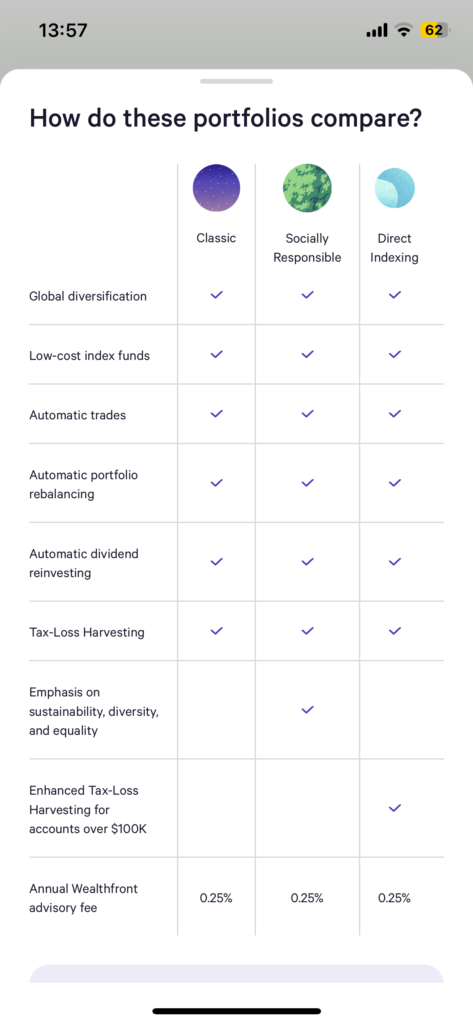

WealthFront offers 3 types of portfolio:

- Classic: A globally diversified portfolio of low-cost index funds designed to grow your wealth.

- Socially Responsible: A diversified portfolio designed around sustainability, diversity, equity, and more.

- Direct Indexing: A globally diversified portfolio designed to strategically invest in individual US stocks to enhance tax savings.

The first 2 options are probably the best to get your started with.

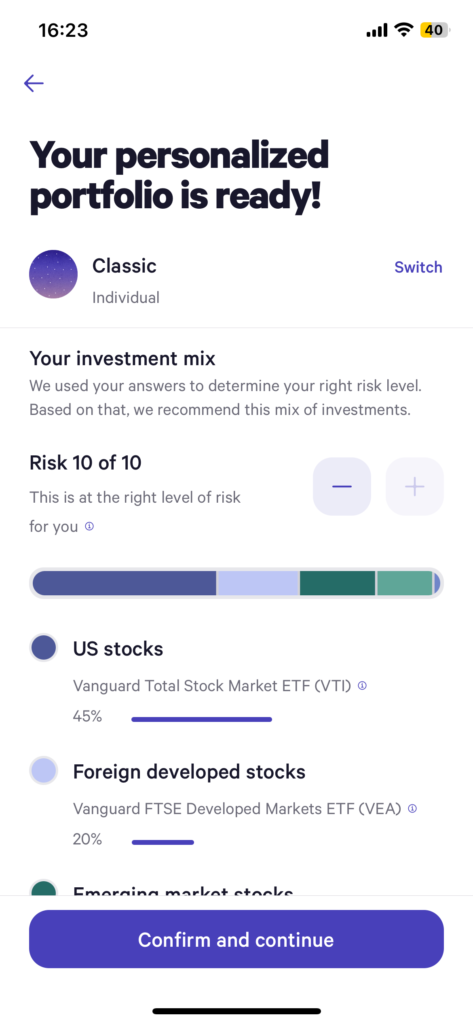

Portfolio Allocation

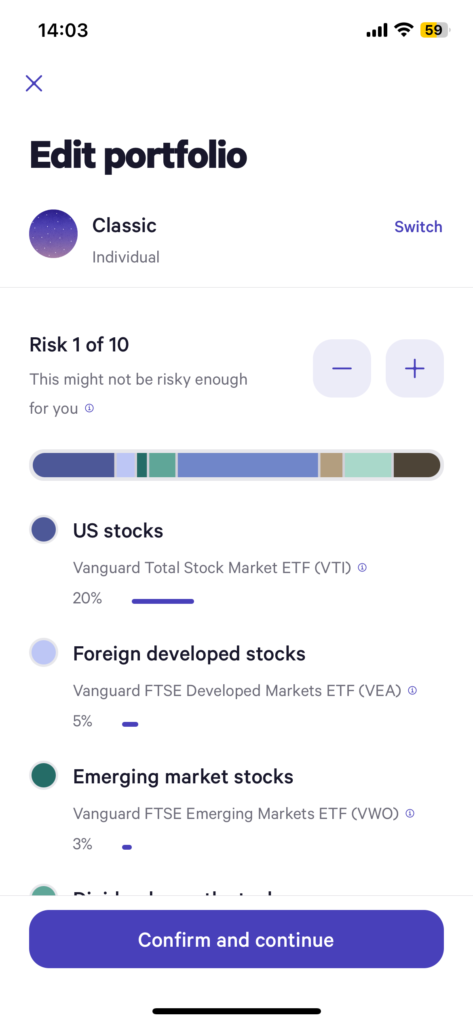

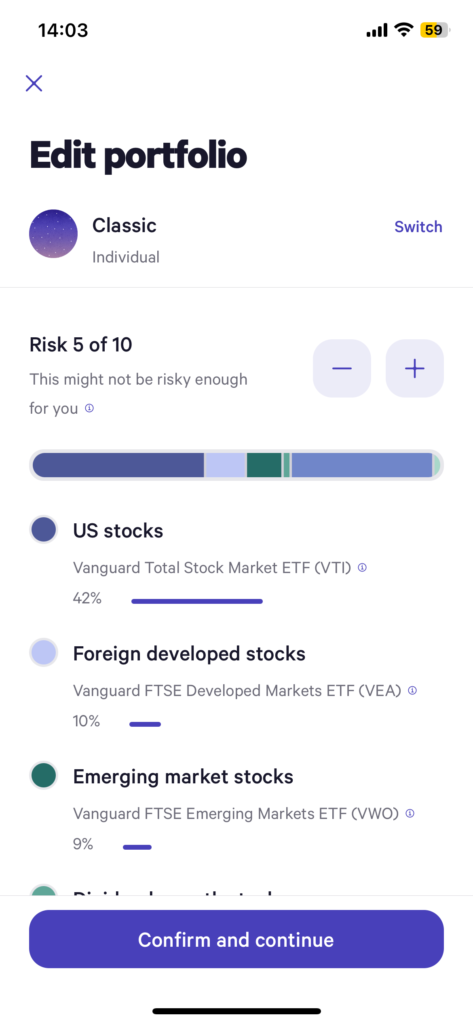

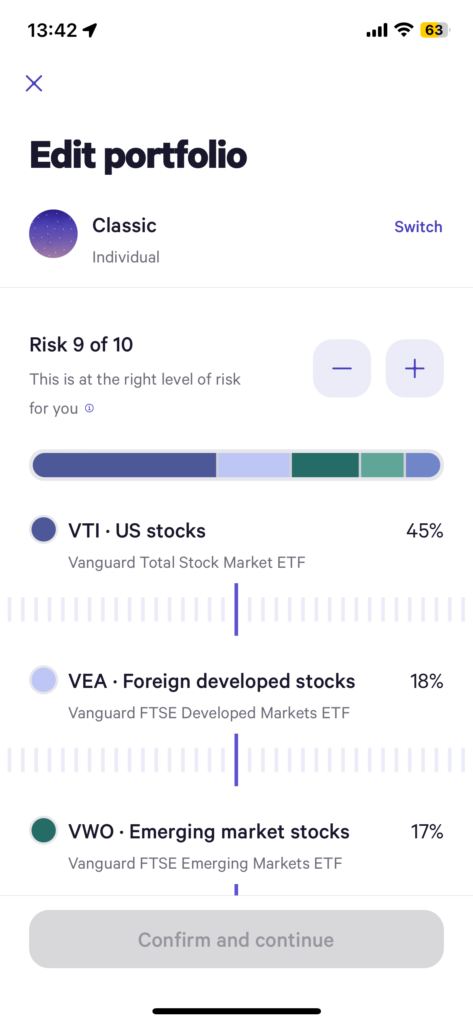

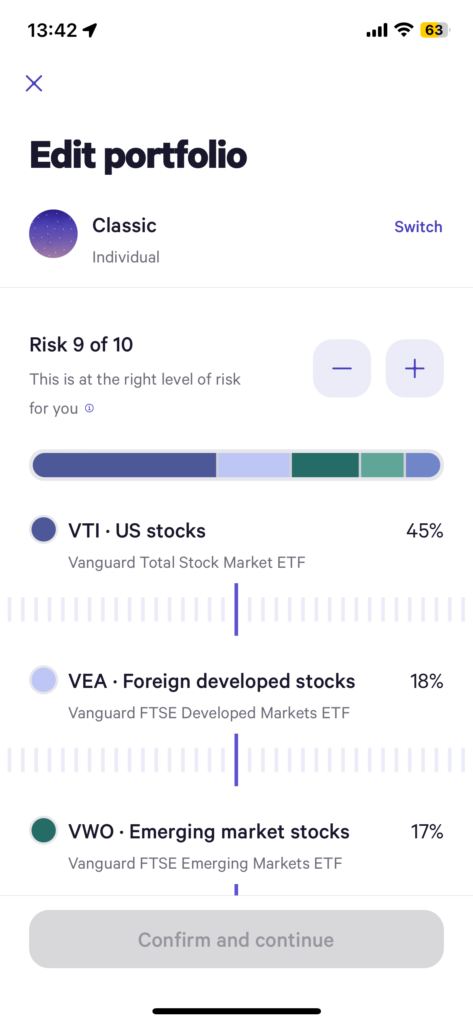

Once your portfolio is created, you have the flexibility to adjust its risk profile before confirming. The risk level is scored between 1 and 10. Higher risk corresponds to more equity in your portfolio, while lower risk introduces more bounds. It’s important to note that you can modify your risk tolerance at any time in the future, so feel free to keep this in mind as your financial goals evolve.

Here are 3 portfolios with different risk factors. Respectively with a risk for 1, 5 and 9.

What’s great is that you can use this as a baseline. If you desire, you can further customize your asset allocation by fine-tuning each of the assets that make up your portfolio.

ETF Selection

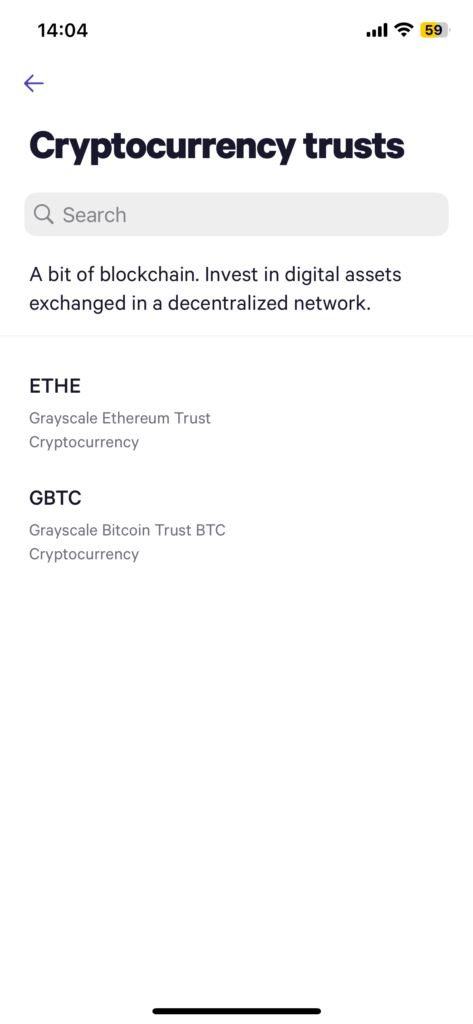

Seeking more customization? How about adding your own assets? As of this writing (Dec 2023), Wealthfront offers a selection of 250+ ETFs for you to choose from (check the full list here). This allows you to invest in the US stock market, the international stock market, sector-specific ETFs, and even cryptocurrencies (if you’re a fan of risks!).

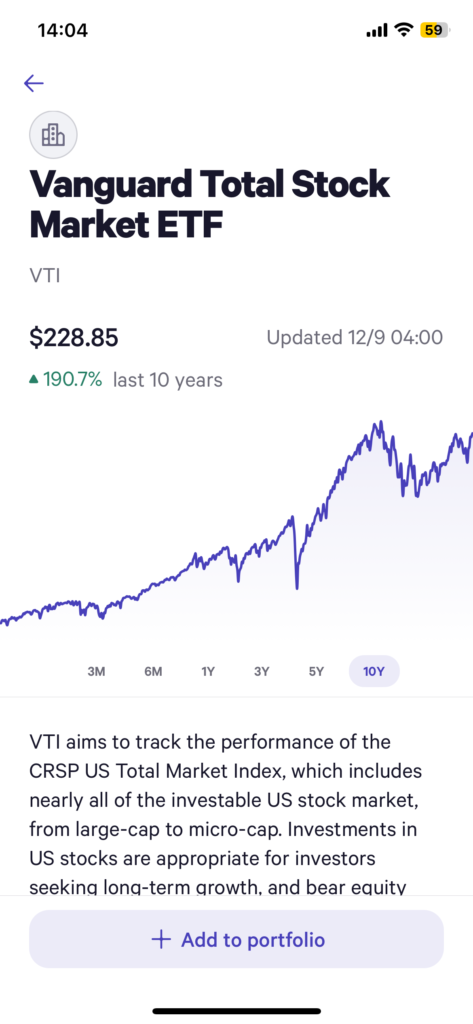

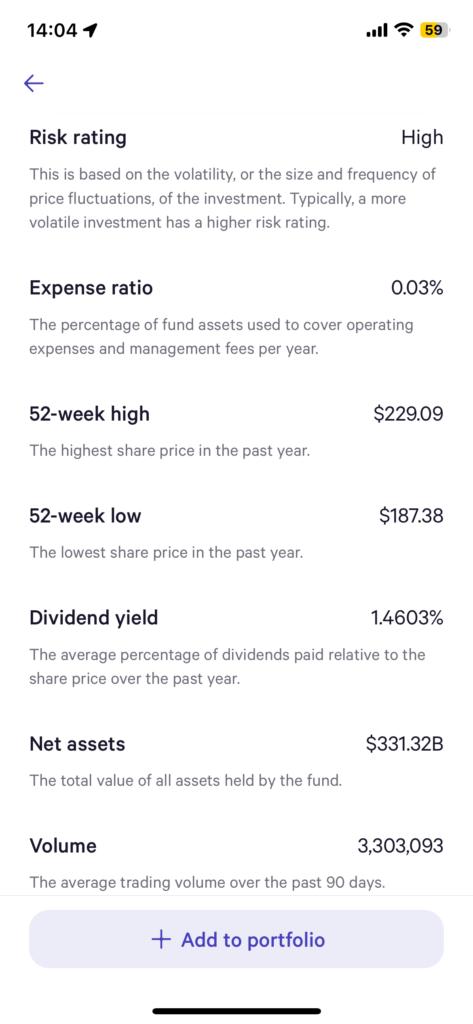

Wealthfront makes it incredibly easy to comprehend each ETF through a detailed page for each one. Take the Vanguard Total Stock Market ETF (VTI) as an example. The app simplifies the process of reviewing the asset’s performance, its expense ratio, and even provides insights into the current composition of the ETF.

4 – Tax Loss Harvesting

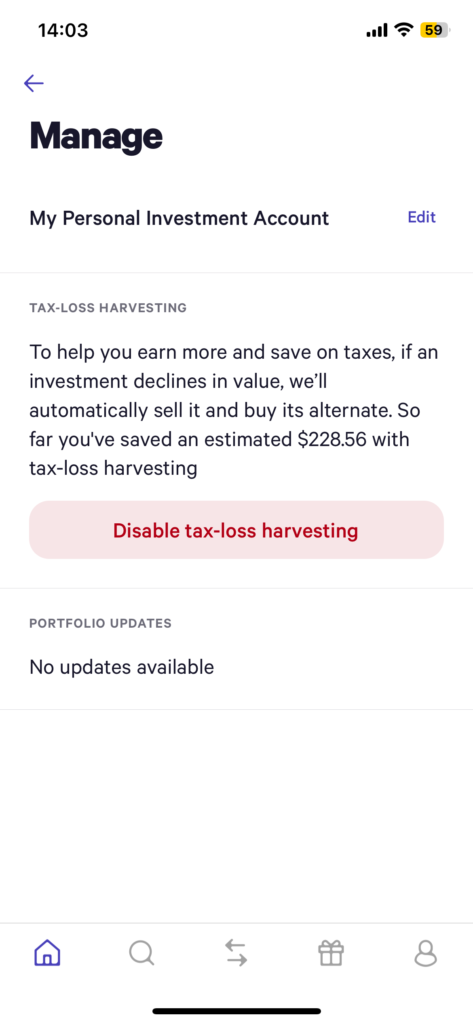

Wealthfront also provides you with the ability to engage in tax-loss harvesting, a method to claim a loss on your tax return and save on taxes. While it’s possible to do this manually, it requires buying and selling assets throughout the year, and careful avoidance of wash-trading (purchasing and selling the same asset type within a 30-day window). Thanks to its algorithm, Wealthfront actively seeks the best opportunities for tax harvesting, maximizing the amount you can claim each year. If you and your partner both have Wealthfront accounts and file your taxes jointly, the app can link your accounts so that tax-loss harvesting is done seamlessly.

How Do We Use Wealthfrton

Because we don’t mind having control over our own portfolio, most of our assets are held in our Vanguard account. Between Mrs. NN and myself, we have about $200,000 invested in robo-advisor companies like Wealthfront. This has been enough to perform capital loss harvesting each year so far.

We were a bit worried about how such services would act during a recession since they were created after the Financial Crisis of 2008, but they handled the pandemic crash quite well. So, we feel comfortable that our money will be safe with Wealthfront. And if you don’t trust robots, you can simply manage the portfolio yourself without tapping into all the cool automation, portfolio rebalancing, and tax loss harvesting that Wealthfront provides.

What About The Competition

The major competitors to Wealthfront are:

- Robinhood: While primarily known as a commission-free trading platform, Robinhood has expanded to offer more comprehensive financial services, including a robo-advisor feature.

- Betterment: Similar to Wealthfront, Betterment is a robo-advisor that offers automated investment services with a focus on goal-based investing and tax efficiency.

- SoFi: SoFi offers a range of financial services, including a robo-advisor, providing automated investment management along with other financial products.

Our Bottom Line

To sum up, Wealthfront is more than just an app; it’s a dedicated partner on your journey to financial success. Are you ready to take that crucial next step towards financial freedom with Wealthfront and experience the positive impact on your wealth journey.

If you’re ready to get started, don’t forget to use this referral link to sign up, allowing you to get your first $5,000 managed by Wealthfront for free! (while supporting our blog at not additional cost to you)

Which tools do you utilize to oversee your investments and track your financial status? Have you had the chance to explore Wealthfront?

1 Comment

How to Invest for Retirement (A Guide to the 4% Rule) — Nomad Numbers · December 10, 2023 at 2:32 pm

[…] their portfolio themselves.We are using Wealthfront and wrote a detailed review that you can read here.If you would like to sign-up you will get your first $5,000 managed for free by sign-up using our […]