This interview is part of our interview series, where we curate stories of regular people that decided to design a life they love. (click here to learn more).

Pete from Captain FI

Some links to the products mentioned below are affiliate links, meaning that if you click and make a purchase, we (Nomad Numbers) may receive a commission at no additional cost to you. For more information please review our disclaimer page.

1. Can you introduce yourself?

My name is Pete, I go by CaptainFI and I am 32. I recently moved to Adelaide, South Australia after retiring from a full time flying job as a cargo pilot. I wasn’t always a pilot and began my career as an aeronautical engineer, and have worked many jobs and side hustles both in and out of the aviation industry. In 2019 I began blogging and podcasting on CaptainFI.com about my journey to Financial Independence and interviewing people from the personal finance community.

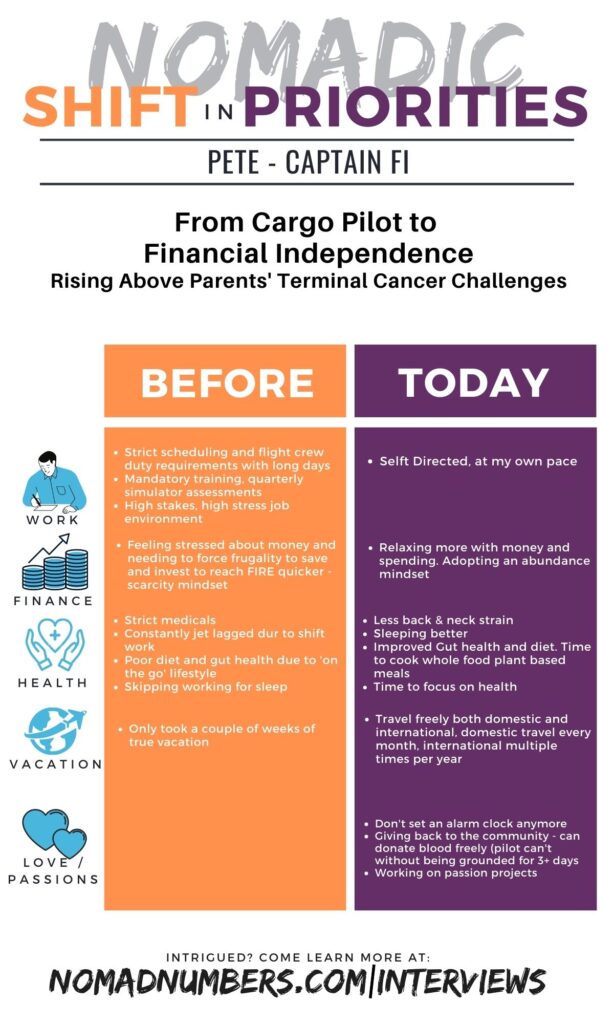

2. What does a typical day in your life look like for you today? How does it differ from your life before?

Since retiring from flying, my days are much quieter and less stressful. I call it ‘semi-retirement’ or perhaps some would just call it working part time on my business. It’s a lot of fun, I get to be self directed and work on my passion projects according to my life’s needs.

Life design journey

3. What inflection point led you to decide to change your life trajectory?

Both of my parents being diagnosed with terminal cancer, dealing with the ‘Black Summer’ bushfires in NSW, the loss of several colleagues in a plane accident, the loss of an unborn child and the COVID-19 pandemic. Sometimes the universe really does beat you over the head until you realize where it is directing you, and for me these big events came in quick succession and really made a profound impact on my life.

4. What were some of the limiting beliefs that held you back initially?

I didn’t think I had ‘enough’ to retire from flying, and needed more investments and passive income to cover my future cost of living. I also subscribed to the ‘sunk cost’ fallacy in that I had invested so much time, money and effort to become a pilot that I shouldn’t just walk away. I kept pushing an unsustainable lifestyle and eventually the universe pushed back on me.

5. What did you do to prepare the transition to this new destination and how did you do it?

To be honest I didn’t really prepare much at all. I spoke to my GP and got a mental health care plan sorted out, and talked to a psychologist which helped with the transition. My close friends and family were also a source of help to talk to. I pretty much swapped my high stakes flying job for an equally stressful (and unpaid) role as a carer for my mum during her final six months of life, and after she passed it definitely left me feeling lost and floating without purpose. I went traveling for a few months through SE Asia with my partner, and when we got back I moped around for a few months, and now I am getting back to work with my websites and podcasts.

6. Once on the journey, what were some of the biggest wins you realized? What were the challenges you had to face along the way?

I think the biggest take-away is that you generally always think and plan for the worst case, so, in most cases ‘ semi-retirement’ or switching to part time work whether that be in a job or business is not as bad financially as it first seems. Actually, everything is going pretty well for me and I realize I could have made this transition probably a year or more earlier if I really think about it. The second big take-away is that you do need some kind of work or purpose, you can’t really just mope about all day, watching movies or playing games. Even consistent travel becomes tiresome, so don’t be afraid of having a job or some kind or creative outlet you can work on in “retirement”. A few big challenges have been time management – it’s easy to just waste time away, which feels inefficient in comparison to my previous ‘highly productive’ lifestyle, but I realize in hindsight that I was being overworked and on the path to burnout. You don’t ALWAYS have to be productive – it’s OK to just exist, and naturally you will gravitate towards some level of sustainable productivity in the areas that interest you.

7. How long did/will it take to reach the destination? Any advice to make the journey as enjoyable as possible?

I worked for 14 years, and was on a deliberate ‘FIRE / investing’ path for the final 7 of those 14, although the final few years was where I really saw the exponential / compounding growth of assets and passive income. This was when I was also starting to see healthy income coming from running a portfolio of websites which now produce a comfortable level of semi-passive income (I started building and running content websites in 2019).

8. What did the people around you (friends/family/colleagues…) think of your plan to take on this new life?

I didn’t really talk to anyone in my personal life about it. The very few that I did speak to in confidence all told me it was a terrible idea, including several close friends and family members – pretty much everyone thought I was crazy for throwing away this dream job I had been working so hard to get for over a decade.

Cost of living

9. How much yearly expense did you have before and after this change in lifestyle?

My cost of living has always been incredibly low, due to the fact I received rent subsidy through my employer, as well as traveling for work which was paid for by the company, including meals and travel allowances. I had a small, cheap apartment in Sydney which was packed to include internet, electricity, water etc which I used to pay $500 a week for

Currently, I live with my partner in the Adelaide foothills. I pay ⅔ of the bills, and she pays ⅓ of the bills which we find is equitable and allows her to build up her investments and essentially will compensate her for her gap in the workforce when we decide to start a family.

| Category | Description | Daily budget |

|---|---|---|

| Accommodation | Anything you pay toward keeping a roof over your head (ie. rent, internet, water, utilities…) | My share: about $45 per day (my partner $22.5) |

| Alcohol | Anything related to alcohol you purchase | Negligible |

| Groceries | Anything related to the groceries you get to cook at home | $10 per day (we have massively increased our grocery budget recently to relax the purse strings). |

| Dining out / Take-out | Anything related to what you spend when dining outside of your home. | $10 per day – this covers weekend brunch and one date night a week |

| Activities / Entertainment | Anything you pay related to ‘fun money’ (ie. park fees, outdoor activity, AirBnB experience…) | $10 per day |

| Health Care | Any cost related to treatment you are receiving on a given location. | Negligible – occasional dental costs (under $500 a year?). My partner is still working and has private health insurance as which costs her approx $6 per day |

| International Health / Travel Insurance | This is health.travel insurance that your purchase to get you covered outside of your home country | $5 per day |

| Local Transportation | Anything related to transportation within the boundary of the location you are staying at. | Mostly walk and cycle, negligible spend on petrol so approx $2 per day (one tank every few months for driving) |

| International Transportation | Anything related to transportation to go from one location to another. | No routine costs – travel on an ad hoc basis. Spent about $4,000 on this in the past 12 months on flights, cruises etc |

| Visa | Any cost related to a visa to stay in a given country. | Not Applicable |

| Living expenses | Anything else that you are spending money on to live in a specific location that can’t fit anywhere else (ie. Haircut, Netflix, cell phone…) | $5 per day ( streaming services, drivers license renewals, car insurance etc) |

| TOTALS | Monthly total Yearly total | AUD $2,700 (USD 1,800) per month AUD $36,400 (USD $24,250) per year |

Lessons, tips & advices

10. If you had to do it again, what would you do differently?

We eat a predominantly whole food plant based diet and don’t use meal delivery services. We eat healthy and frequently buy in bulk, meal prep. I also do lots of gardening and grow a lot of our food including herbs, chillies, peas, lettuce, spinach and other greens, onions, tomatoes, capsicum, eggplant, pumpkins etc.

We live in much less house than we can afford, and currently rent. We furnished the house with pre owned furniture from gumtree and facebook marketplace. We don’t “buy stuff” – we consider ourselves to be somewhat minimalists, so we don’t really bring unneeded crap into the house. We also generally sell things when we want to get rid of them, and then we put that money toward the next ‘item’ we want to try (for example we recently sold some house plants and room dividers and have put that money towards an expensive rice cooker my partner has been wanting for six months). If we do need to buy something, we usually wait a few months to see if we really do actually want it. We are also sensible with our energy usage, for example heat the person not the space, and dress appropriately. We like to shop for new clothes when needed (obviously we buy new socks and undies!), and take good care of our clothes so they last a long time.

For entertainment, we like to read a lot, watch movies at home, garden, exercise with our home gym and go hiking, and learn our instruments (for me guitar, my partner piano). We cooked together, and spent a lot of time with our dog walking, grooming or even just snuggled up on the couch or bed. We don’t really feel the need to go out and spend money to have fun. Having said that, we do enjoy going to restaurants and trying new cuisine (morso my partner is the one driving this as I am not that fussed but go along with her as it’s important to her and makes her happy). We do brunch after a Saturday hike, and then usually also go out for dinner one night a week.

11. What advice do you have for others who are considering going through a life design exercise?

Meditate. Seriously meditate and have a deep introspection about what you actually want out of life. I ended up doing some serious journeying into my mind (including with the use of some psychedelics) which really helped me put some loss into perspective, heal from old wounds, and start to build a path forward for the life I really wanted. Consider what makes you happy, ask yourself what would you do if money was no obstacle, where would you want to go, what would you want to do. The key is to figure out how you can sustainably do this whilst helping others.

Looking ahead

12. What is next for you?

The next big thing I suppose will be purchasing a small hobby farm on a block of land and starting a family. I do want to get another dog, and would like to be able to grow some of my websites and would like to sell some of them and put this money towards the purchase of the farm. But I am not putting any pressure or timelines on myself – Ideally it will be over the next few years, but I am focusing on mindfulness and enjoying the present, rather than fixating on any potential destination.

Not everyone wants to retire early, but we all have to reach financial independence. Whilst we can save a limited amount of our income, there is no limit on how much we can earn, and high earners with the right attitude can find it almost effortless to save and invest. Hard work, learning and sacrifice are very important things to maintain our physical and mental health, and when we find the correct balance between working and living, well that right there is the dream!

Thank you so much Pete for sharing your life design journey with us. It is quite inspiring to see how much change in your priorities you made before/after you left your job. As for now, we hope that you will be able to start your family and get that small hobby farm and create what should looks like an amazing and flourishing garden

If you want to know more about Pete (Captain FI), you can find him on the following platforms:

- Blog:

- Facebook:

- Instagram:

- Podcast

- CaptainFI Financial Independence Podcast (can stream via CaptainFI.com or via Spotify, Apple Podcasts, Google Podcasts etc)

Rapid-fire questions

We like ending every interview by asking some fun rapid-fire questions to our guests

| What is your superpower & why? | My ADHD. I can hyperfixate on something and complete projects in record time. |

| What is your favorite travel destination & why? | Australia. We have literally everything in our continent, from snowy mountains, to deserts, to rich coral reefs, to tropical rainforests. We have a rich cultural history going back over 50,000 years, modern cities, and endless wilderness to explore! |

| What is the best Amazon (or online) purchase you made this past year? (Provide a link to Amazon or the product page) | Honestly, we bought a mandolin for slicing vegetables and it’s been a game changer for meal prep and significantly reduced our cooking times as the majority of time is spent chopping and prepping veggies. Annoyingly the one we bought only a few months ago we can’t find on amazon anymore (Edit from Mr.NN: here is a decent Mandolin Vegetable Slicer on Amazon), but pretty much any large mandolin around the $50 mark would probably hit the spot! |

| What is the best Airbnb (or similar) you ever lived in and why? | We recently booked a Villa in Tagaytay in the Philippines which was honestly just so beautiful and was really good value for money with a spa, pool, kitchen and lovely suites all with our own bathrooms |

| What’s something you can never live without? | Plants. (Literally we would all die without them). Gardening is life, and producing nourishing, wonderful home grown produce is very satisfying and I think a skill we all should have. |

| What’s the best piece of advice you’ve received? | This too shall pass. |

Our Bottom Line

Here are the main lessons we took away from this interview with Pete:

- Lesson 1 – Life of the people around us is often shorter than we think. We can never predict the amount of time we will have to spend with our colleagues, close friends, or family as Pete painfully went through during the pandemic. While both men and women are expected to live until at least the age of 70 or older, due to the prevalence of Cardiovascular Diseases, Cancer, Neurological diseases and type 2 diabetes in our present environment, our lives often end up cut shorter than the average expectancy. Pete took this devastating experience as a reminder to do more of what he loves.

- Lesson 2 – “Worrying about something won’t change the outcome, but it will guarantee you will suffer now“ . Focusing on potential negative outcomes or uncertainties, can contribute to increased stress, sleep difficulties, decreased productivity, and so on. Moreover, continuous worrying about future events that are beyond our control can consume valuable mental and emotional energy that could be better utilized in productive or enjoyable activities. Instead it’s beneficial to focus on the present moment, practice mindfulness, and develop coping strategies to manage worries effectively. This is the shift that Pete followed in his journey.

- Lesson 3 – “Not everyone wants to retire early, but we all have to reach financial independence”. Pete’s quote brings attention to an important concept. Many individuals may perceive early retirement as unattainable, but it becomes crucial for them to prioritize achieving a state of financial freedom by the time they are ready to stop working. Even in the United States, a significant number of people cannot retire at the conventional retirement age due to insufficient savings. This situation arises because they may not have invested or saved adequately, and government-sponsored aid programs may not suffice to support the desired lifestyle they envision.

Sometimes we need to hear about others making unconventional decisions before we can have the confidence to make our own. If you have (or are on a path to) an unconventional journey to improve your life that has a nomadic component to it and are interested to share it, please reach out to us as we would love to consider your story for our blog.

0 Comments